Update 7/16/20: Chase is now sending out e-mails advertising this feature to some cardholders.

Update 3/28/20: This option is now showing up for some people under ‘things you can do > credit options & tools’

Hat tip to

Last week we shared news that Chase had made a number of changes for current credit cardholders. This included notice that Chase will be launching two new products/features: My Chase Loan & My Chase Plan. We now know that these new products will launch on August 10th, 2019. Let’s take a look at each one in some more detail

My Chase Plan

My Chase Plan gives you the option to pay for eligible charges over a period of time. During this time you’ll pay a rate of 1.72% per month until the full balance is paid off.

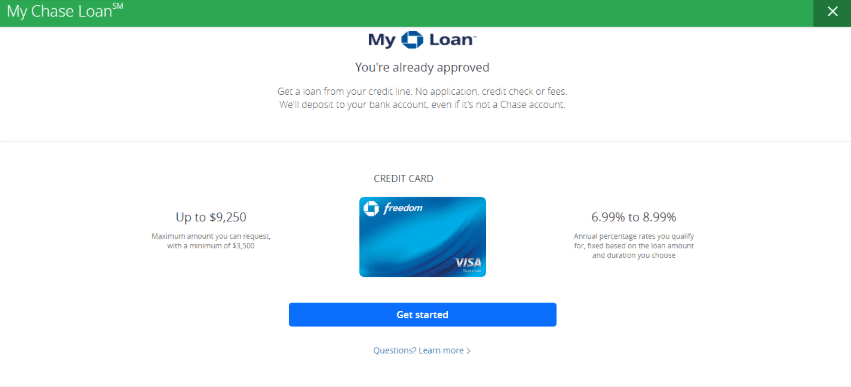

My Chase Loan

My Chase Loan lets you get a loan based on your credit card with Chase, the loan is deposited into your checking account (doesn’t have to be a Chase account). The interest rate you receive will depend on your relationship with Chase but will range from 18-25%.

Our Verdict

Both of these products come with incredibly high interest rates, so I’d be avoiding these as much as possible. My Chase Plan seems to similar to American Express’ Plan it feature and Chase offered something similar called Blueprint in the past as well.

This is straight up subprime. ‘member what happened the last time big banks went subprime? Anyone?

There has been a lot of talk about banks tightening up due to covid. And many have. But history says they eventually and usually go the opposite direction. They get whatever they can upfront with loose lending and down the road pass the loses on to the taxpayer.

it depends on who they offer it to. if they offer it to people with good credit scores only, its not really subprime.

My Amex Plan It seems to be working well with their 0 fee offer a couple months back. I have $5000+ on two cards with 24 months to pay them off. Just hoping no shut down or financial review happens, but I haven’t signed up for an Amex cards since October so it should be ok I think.

I have an interesting DP of approval despite 5/24. I’m currently 13/24, 7/12, 2/6. Initially, I’m guessing Chase might decrease the standard for credit card approval given the current virus outbreak, so I decided to take a shot to apply for World of Hyatt today. After submitting the app, then…. BOOM! Instant approval of 12,000 CL.

Perhaps my DP is just an exception.. if anyone else has similar DP. Plz feel free to share.

this is very interesting indeed. now im tempted to go for an INK

Did you use the standard link on the Chase website? Also, is your 5/24 count strictly personal cards?

I hope you are counting 5/24 correctly. It’s the number of revolving credit accounts on your credit report. Biz cards do not count unless they are from specific issuers that do report them.

…or counting inquiries instead. which I see lots of people who misunderstand X/24 always do.

Chase, just get rid of 5/24.

Here’s a question: What is the best way to borrow $30k cash?

Gofundme

such BS offers, but hopefully they offer UR points in order to entice people to use them. IF i can profit from it ill do it

Well 1.72% per month doesn’t sounds like much. After all that’s only 0.00000065% per second.

Lol! Wow, that’s a really low number. It must be a good deal!

Isn’t 1.7% per month even more than regular credit card interest rates? You’d better be paying off the card directly over a period of months instead?

1.72% x 12 = 20.64%. Yeah, higher than pretty much anything besides store/gas cards (and high-risk super-high-interest junk like payday loans, of course).

maybe they will give out 10,000 UR points for opting in.to compete with Amex

Can someone explain to me how these things are different than just a normal credit card or loan? Seems like My Chase Plan is offering us the option to buy now pay later like a CC while My Chase Loan sounds like a loan with CC level interest.

I see no value…

For the loan, say you want to pay a bill and it is ACH only, like car loan or mortgage. You have no immediate cash. In this case it could be useful. Not a problem for us after all. But not everyone knows the trick.

It seems like these banks are just trying to repackage their credit products to entice people to use it. Perhaps people on average are starting to get a little more savvy about revolving credit.

AMEX seems to try to hide the fact of interest with their “Plan It” by setting it up instead as a fixed fee. Citibank also keeps promoting to me their new “Flex Loan” offering, which seems to be a similar type of offering. I’m sure at least some other banks will follow.

I suppose seeing the costs of the borrowed money up front makes it *slightly* better than an open ended revolving loan. But yeah, not a good deal.

Exactly. But I really wonder how many people actually took up AmEx on their PlanIt option? It wouldn’t seem like something Chase should even bother with…

The CC company were expert at getting nearly everyone to apply for and receive a CC (hello experian boost). Now, the goal is to get those customers revolving a balance.. And if they have to re-brand it, that’s what they will do. Or so it seems.

Call me cynical.

>>Perhaps people on average are starting to get a little more savvy about revolving credit.

Yeah, right! Ever seen those big bank quarterly earnings reports?

Amex PlanIt used to have no fees and no interest, now that was a good deal, but now with the fee there’s no point to use anymore

The main draw here is that, since you aren’t *technically* paying interest, you can continue to use your card and keep your interest-free grace period for purchases not part of the loan or plan.

I don’t expect to use these because the rates are ridiculous, but Amex’s plan system has actually given me semi-reasonable rates. 11% APR isn’t too bad when you’ll have it all gone in three months, although it does obliterate the rewards from that particular purchase.