Unfortunately no more working links so marking this as expired.

Changed link to this, as it still works.

Update 3/11/19: Deal is set to end on March 18th, 2019.

Update 1/17/19: When we originally posted this bonus on 1/11/19 we said it might be worth waiting to see if they offered an extra $50 via dummy booking. Unfortunately that doesn’t seem to be happening, so if interested jump on this offer now.

The Offer

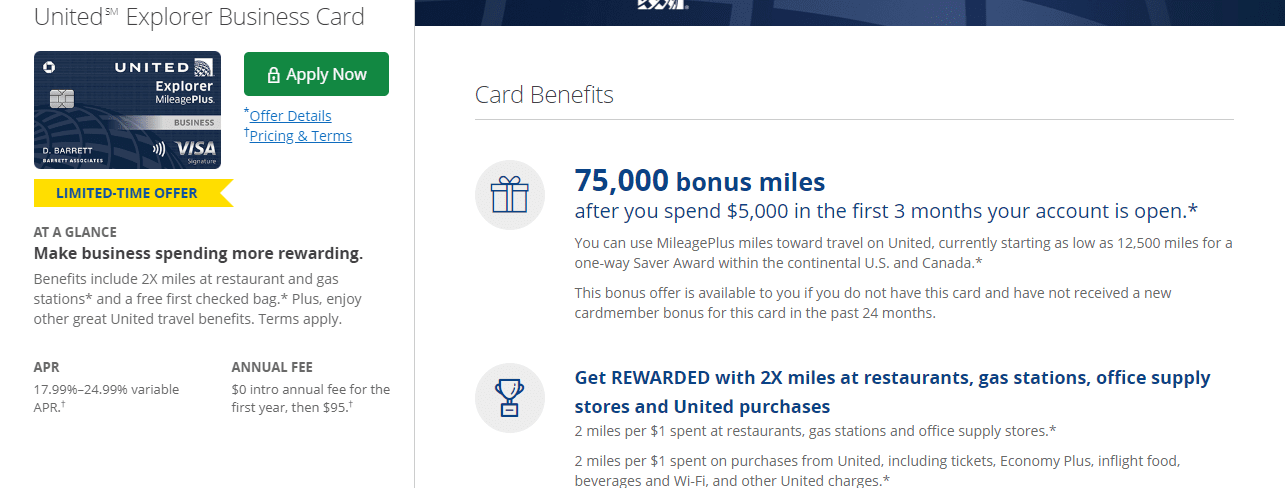

- Chase is offering up to 75,000 miles after $5,000 in spend within the first three months & annual fee waived first year on the United Explorer Business card.

Card Details

- Annual fee of $95 waived first year

- Card earns at the following rates:

- Earn 2 miles per $1 spent on purchases at restaurants, gas stations, and office supply stores.

- Earn 2 miles per $1 spent on tickets purchased from United.

- Earn 1 mile per $1 spent on all other purchases.

- Last seat availability

- Miles don’t expire

- Free checked bag when you pay with card (for 2 people)

- Priority boarding

- 2 Club passes per year

- No FX fees

- 10,000 bonus miles after $25,000 in spend within a calendar year

- 5/24 rule applies to this card

- Valid until March 18th, 2019

Our Verdict

This offer has been available for some time, but only select United members were eligible. It’s now publicly available so that’s great. Standard bonus on this card is 50,000 miles after $3,000 in spend. Sometimes it’s also possible to get an additional $50 by doing a dummy booking, I doubt this will be the case here but my recommendation is to wait a day or two just to confirm this is the case this time. The 5/24 rule does apply to this card, so most readers won’t be eligible for this card/bonus. The nice thing is thatChase business cards do not report to your personal credit report so this card won’t be added to your 5/24 total. Because of that I do strongly recommend picking up this card if you get the 75,000 offer and are under 5/24. As always if you have questions about Chase cards, please read this post first. I will be adding this to our list of the best business credit card bonuses.

Hat tip to reader Leslie