This is another post in our series on weird credit cards, this week we will be looking at the little known Chase United card with no annual fee.

Card Basics

- Not possible to apply for this card directly

- No annual fee

- Card earns at the following rates:

- 1x miles for every $2 spent

- 25% bonus on the MileagePlus shopping portal

- Increased award inventory (I originally listed this card as not receiving this benefit but lots of readers report that they do see increased award inventory)

This card does not give you access to the following benefits:

- Free bags

- Gives no benefits on United basic fares

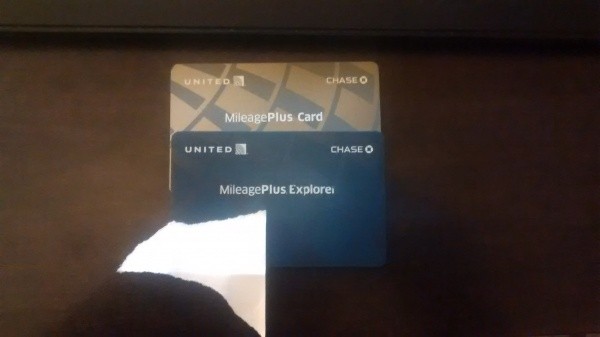

No annual fee card pictured at top, via krazykanuck on Flyertalk

Other United Credit Cards

There are actually other United credit cards that aren’t available for downgrades, United MileagePlus Awards Card (actually listed on the Chase website) that comes with a $60 annual fee and earns 1x miles on every $1 spent and the United Select card, with the following benefits:

- $140 annual fee

- 3 award miles per $1 spent on tickets purchased from United

- 2 miles per $1 spent on gas station, grocery, restaurant and home improvement store purchases

- 2 miles per $1 spent on tickets purchased from other Star AllianceTM member airlines

- 1 mile per $1 spent on all other purchases

- Up to 5,000 Premier® qualifying miles (PQM) each year on purchases made on united.com

- 5,000 bonus award miles each year on your account anniversary

Our Verdict

It doesn’t really make any sense to put any spend on this card with it only earning 1x mile per $2 spent, but it might be worth downgrading this card for three reasons:

- Chase only lets you product change to a card in the same family (e.g United). By downgrading to this card you’ll be able to keep your average age of accounts higher in the long term (if you cancel it’ll take 7 years to fall off your report anyway), this is a scoring factor for FICO.

- Holding a United credit card gives you a 25% bonus on their shopping portal & increased award inventory

- Miles expire after 18 months of no activity, putting a small charge on this card would be enough to keep them active

Thanks to this reddit thread & this Flyertalk thread

I just got a letter that the card will be converted to the United Gateway Card on July 1. Sadly, that’s probably end of the increased award inventory and early boarding for me.

Mine got converted too and I’m still seeing increased award inventory.

Haven’t flown since the conversion so can’t say anything about early boarding… in fact I’m not sure I got that with the old card.

Anyone know if this card has extended warranty protection if I downgrade from the Explorer? I can’t find any details about this card’s benefits.

Is this card still available to downgrade from the Explorer card?

I had to twist a CSR’s arm to get them to downgrade to this card. I’ve had 3 agents swear that it won’t provide expanded award chart availability. That being said, it was clear that they also had no idea what that actually means. Guess we’ll find out since I downgraded today. 🤷🏼♂️

PC’d to the no AF card a few weeks ago. Still have the enhanced award availability (for now).

Be careful with the Chase United Plus card . . . I’ve been with them since 2005, and (due to some circumstances) missed one payment.

As soon as I found out about it, I paid it immediately (had more than enough in my chase bank account, so just made an online transfer to pay the credit card).

They are taking four days to credit my account with the payment. In the mean time I’m incurring huge interest charges, I can’t use my card at all (and, suspect they’re making plenty for Chase investing my funds for four days).

So much for valuing customer loyalty! I’m going to be evaluating some other card options.

I used to get group 2 boarding with this card but as of 2 weeks ago I no longer am getting group to boarding.

Does anyone know if this card counts for the cc spend PQD wavier?

I didn’t receive the letter because I have the Explorer, not the no-fee card. I read about the letter in the other comments, and found it of interest because my $95 annual fee on the Explorer will be billed in a few days.

I’ve had this Chase United “no AF” card for several years, it’s the oldest card I have. I’ve done very light spend on it just to maintain it and keep my FICO up. Recently I got a notice from Chase that they are changing my account terms so that on 8/21 they will start charging me a $65 fee. Nothing about a PC. Does this make any sense?

1) Is there anything I can do before the deadline?

2) Could they be forcibly PC’ing me to the Explorer card?

3) Is there anything worthwhile I can PC it to?

That blows chunks. I’ve had the no-AF Chase United Mileage Plus since 2003 and I haven’t received any such threats.

If push comes to shove, I would threaten to cancel and see what happens. Chase would much rather have your business as a no-AF cardholder than none at all.

I’ve had my card since 2003. Just got the AF letter in the mail. I’ve called about 5 times and emailed, they won’t waive the fee. They were actually quite nasty about it. The only you can do is cancel the card or downgrade to the no AF card. That’s it. Sux

Can you send me a copy of the letter? [email protected]

This is a huge issue for many of us who have to make a decision soon on whether or not to downgrade our Explorer cards to the Rewards card. The Doctor of Credit review says that the Rewards card is no-fee, but these last few posts indicate that Chase is now adding a $65 fee. What’s the current state of play?

Can you send me a copy of the letter? [email protected]