(See update here)

Chase is unofficially giving 115 days to meet signup bonus requirements, longer than the stated 3-months.

The standard language with Chase and most other banks to meet a signup bonus requirement is to spend $xx amount of money on the card within 3-months of approval.

The important date is the approval date, not the application date and not the date you activate the card.

I recently applied for the business version of the Southwest Premier credit card on 2/29/16 and got an approval email from Chase on 3/8/16. This week, I sent them a Secure Message, “Hi, I recently opened up a Southwest Airlines credit card. I recall that there was a bonus offer for signing up to the card. I think it was to get 50,000 Southwest points if I’d spend $2,000 within 3-months. Do I have the details correct? And, what date do I need to complete the $2,000 in spend by?” They replied that I need to spend $2,000 by 6/30/16 to get the 50k points.

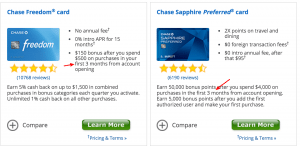

June 30 is 115 from the date of approval, and, apparently, Chase is unofficially giving 115 days to meet the signup bonus requirement. Moneymetagame also tweeted out that he got the exact same number of 115 days for his Chase INK Plus card. And reader T confirmed that the 115-day time frame applies to personal cards, like Chase Freedom, as well.

Note that both of us got this on business cards (INK and Southwest). It’s possible that Chase personal cards do not have this leeway. Let us know if you have information on this. The 115 time-frame has been confirmed for personal Chase cards as well.

Other Issuers

A while back we reported that Citi gives a 14-day grace period on the three months time-period. At the time, we reached out to Chase and Amex about their policy and we were told that they do NOT offer any grace period. Apparently, this extra ~25 days is an unofficial leeway. They don’t want to push people to the day and then have disgruntled customers.

Since the terms say three months, be sure to get the end-date in writing if you plan on pushing it to the end. And, of course, it’s always better not to push it to the last moment anyway in case something goes wrong with charges posting, returns, etc; we’ve heard many such stories.

- Chase – 115 days from approval

- Citi – 104 days (90 + 14) from approval

- Amex – 92 days from approval

- Bank of America – 3 months from card approval

Related posts:

- I Didn’t Complete My Minimum Spend Requirement, Is There Anything I Can Do?

- How Long Do I Have To Reach My Minimum Spend Requirement?

- Citi Offers 14-Day Grace Period for Signup Bonuses

2023 DP:

12/26/22 – Opened Ink Cash

04/17/23 (113 days later) – Finished MSR (wasn’t intentionally late, but my tracking for this card had been messed up)

04/20/23 – SUB showed as pending in UR portal

I opened my Ink card 12/31/22 (happy new year)

The tracker showed I had until 4/2 to spend the 6k for 90k bonus.

Unfortunately, I only had a 3k limit, meaning I had to spend and pay off in order to have room to meet the spend.

I was moving some money to pay off the balance on 3/27, which was a dumb move bc it didn’t post until 4/3.

In the meantime, I sent a secure message. The first person responded saying I had until 4/24! As soon as I could, I paid off the 3k, and spent another 3k. The last money was spent 4/6 (posted today). As of yesterday, 4/9 my account shows 105k points pending, congratulating me on meeting the spend bonus.

Contrary to this, I got another (day later) response to my secure message saying unfortunately I only had until 4/2 and missed the bonus period. So assuming all this posts, I’m a happy guy, and there still is some wiggle room up to 115 days. Not really worth the stress and bad planning for me, but lucky day

I think this may no longer be true, unfortunately – I sent a secure message on a new card yesterday asking for the date charges need to be made by for the SUB, and the answer I got was the date exactly 3 months after approval date.

Any idea if the grace period is still going? The Chase app was showing a date 90 days after approval along with a tracker for the bonus. Now the bonus tracking is gone after the 90 days, and no bonus. Naturally there was one late transaction, so I’m hoping the grace period is still Chase policy.

I would like to know this as well, if anyone has a DP.

My transaction that put me over the SUB threshold wasn’t charged until day 91 and didn’t hit the account until day 93. Can confirm that my points are on the way. Not sure if it goes all the way to 115 but it does go past 90.

Can confirm Chase stills gives 115 days as of today.

I know this is an old post, but does anyone know the answer for how many days we’re given for the United MileagePlus Explorer card?

Think all Chase cards are the same. Simply message Chase and you’ll get the exact date in writing within a few hours.

When you get a response via PM on the site with the due date, is that the 90-days from application or the deadline including the grace period? Asking because I ordered something to hit my spend two days before the end, and I’m afraid it might stay pending until it ships which could be after the deadline…..

Date on SM should be the true date, I’d think

Adding another data point: Signed up for the Chase Ink Business Preferred on Jan 19th this year, got secure message confirming that I have until May 14th to complete the spend. This is 115 days as others have reported.

Does it depend on the statement closing and payment due dates. I know some people have written about being able to get a longer time to complete the minimum spend by quickly requesting a change to their statement closing date .

I was approved for the Chase Sapphire Reserve on 8/10/17 and checked by SM when the last day was to meet the minimum spend. I was told 12/3/17 which makes it 115 days.

I applied (and was approved) for the Chase Sapphire Preferred on 19/Aug/17.

Got my card on 22/Aug/17.

Called to check the spend by date and was told 19/Nov/17, so that would make it 92 days 🙁

Anyone else has had this experience? I’m wondering if they maybe got more strict recently, or if it’s because the card I got. . . dunno.