Update 1/22/25: Deal has been extended to 4/15/2025

The Offer

Direct link to offer | Another link for higher tiers

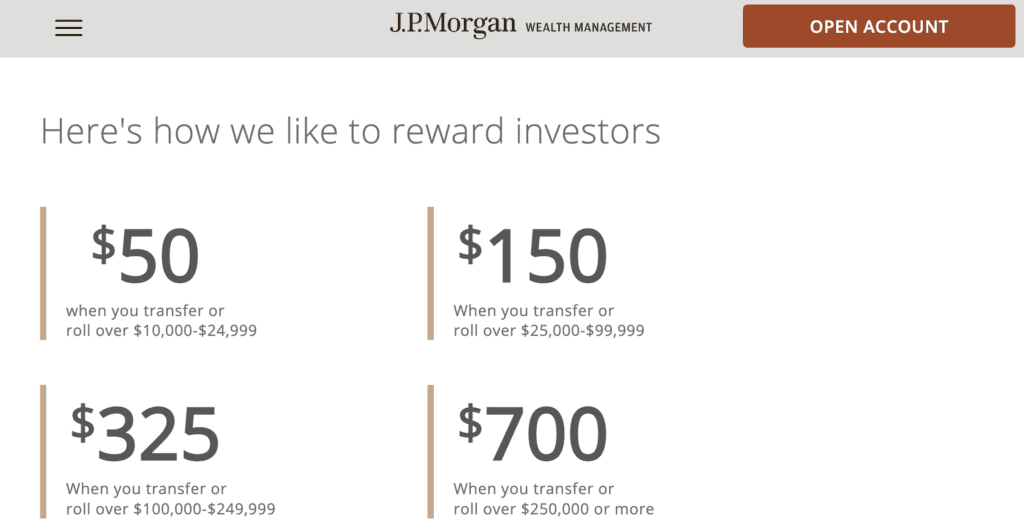

- Chase is offering a bonus on their You Invest investment product. This product offers free trades to some customers in addition to other benefits. The current sign up bonus is tiered and varies based on how much you fund the account with:

- Fund $5,000/$10,000-$24,999 and get a bonus of $50

- Fund $25,000-$99,999 and get a bonus of $150

- Fund $100,000-$249,999 and get a bonus of $325

- Fund $250,00+ and get a bonus of $700

- Fund $500,000+ and get a bonus of $1,200

- Fund $2,000,000+ and get a bonus of $2,500

- Account must be funded within 45 days and must be maintained for 90 days

The Fine Print

- Cash promotion is limited to one per customer and can only be applied to one new You Invest Trade account (Brokerage, Traditional IRA, or Roth IRA). To enroll in the up to $625 offer, you must open an account through this page.

- Customers must open and fund a new You Invest Trade account with new money of $25,000 or more in cash or securities from a non-Chase or non-J.P. Morgan account and cannot be funds or securities held by Chase or its affiliates. New money must be transferred within 45 days of account opening.

- At day 45, the bonus tier will be determined

- Cash bonus will be credited to the account within 10 business days of these requirements being met.

- You can participate in only one You Invest, Chase Private Client Checking, or Sapphire Checking new money bonus in a 12 month period.

- The new money balance must be maintained in the account for at least 90 days from the date of funding (losses due to trading or market fluctuation will not be taken into account).

Our Verdict

Previously only the lowest tier bonus has been offered. Keep in mind you can do this bonus and still do a Chase checking & Savings bonus as well, but doing this bonus prevents you from doing the Chase Private Client or Sapphire Checking bonus. If considering this bonus you have several options:

- You can just fund the account with $25,000-$250,000 and leave the funds in there without investing them for 90 days. For most people this won’t be worth doing.

- A better option would to put the funds into a money market fund such as VMMXX or VUSXX. These have been yielding 2%+ returns and are considered very safe, but they don’t have FDIC insurance like a traditional high yield savings account.

- You can invest funds as you normally would.

- Reader Ben points out that the Sapphire Banking offer does not allow IRA funds to count to the funding amount while this You Invest offer does allow that. So if you don’t have non-IRA funds to move over and thus can’t get the Sapphire bonus, this You Invest bonus can really be cost free by simply transferring over IRA funds (I’ve never actually transferred an IRA, personally, but I assume it’s not difficult). Another reader points out that there are often fees for transferring an IRA, check with your original institution and with Chase to find out if there are fees to transfer in or out.

We’ll add this to our List of Best Brokerage Bonuses.

Post history:

- Update 10/12/24: Deal has been extended to 01/23/2025

- Offer has been extended to 10/11/24

- Update 10/11/23: Extended until 01/22/2024. Bonus now $700.

- Update 7/15/23: Extended until 10/12/2023.

- Update 5/3/23: Offer is back at this link (incognito) through 7/13/23.

- Update 3/16/23: Here’s another link with similar tiers and which also includes a higher $1,200 and $2,500 tier. Updated below.

- Update 1/13/23: $700 bonus is back. Also added $150 tier. Valid now through 4/13/23. (ht David)

- $700 bonus has ended, $625 now available.

- Update 10/24/22: All tiers have been increased, maximum bonus now $700.

- Update 10/18/22: Deal is back and valid through 1/19/23.

- Update 7/28/22: Deal is back through October 10, 2022. New link. There’s also a targeted email being sent out with a couple of additional tiers. (ht 20201103)

- Update 5/25/22: Deal is back through July 14, 2022. New link. The lowest tier changed from $200 to $125, updated below. (ht BG)

- Update 10/26/20: Bonuses extend until 11/24/2020.

- Update 9/19/20: Bonuses have been reduced to $200/$300/$625. Bonus extended until October 25, 2020. Hat tip to reader SamL

- Update 5/1/20: $300 bonus has been increased to $350 and $625 bonus has been increased to $725. Hat tip to reader Chase-ing UR points

Email targeted to Sapphire card holders offers these tiers:

$5,000 – $24,999 $50

$25,000 – $99,999 $150

$100,000 – $249,999 $325

$250,000 or more $1,000

Is there a link or promo code for that?

I don’t think it’s just for Sapphire holders. I don’t have a Sapphire and it’s my Just For You offers.

Does opening an account and moving money internally from chase checking/savings count, or it’s only net-new to Chase/JP Morgan?

Must be net-new: “Assets from J.P. Morgan Chase & Co. or its affiliates are not eligible.”

JP Morgan Chase Self-Directed Investing $700 Bonus

opened and funded in early Dec. $700 bonus paid out yesterday. thanks doc!

“you can only participate in one J.P. Morgan Self-Directed Investing new money bonus in a 12 month period from the last bonus coupon enrollment date.: Is the coupon enrollment date the date you open your account?

ya

I closed previous self-direct account more than 1 years ago but it is still appear on my online chase account. Do I qualify this bonus?

Update for 01/22/25: Deal has been extended to 04/15/2025.

Thanks, I’ll update

woof. If you brought over your Roth IRA, heads up that chase requires a storming PDF with a wet signature to do a backdoor conversion. (at least they have a secure document portal). What a PITA.

https://www.chase.com/personal/investments/brokerage-forms

https://www.chase.com/content/dam/chase-ux/documents/personal/investments/roth-conversion.pdf

> Roth IRA Conversion Request – Request a one-time Roth IRA conversion from a Traditional IRA or SEP account. Please remember to indicate your withholding amount on page 6 and sign this form in pen rather than digitally, to ensure we can process it.

Looks like the bonus only applies to one type of account. So I can’t aggregate a ROTHwith a rollover IRA to meet a higher bonus threshold, right?

Correct

Pretty chintzy.

No one asked.

not bad for only requiring 90 days AND allowing retirement accounts