Deal has ended, view more bank account bonuses by clicking here.

Offer at a glance

- Maximum bonus amount: $3,500

- Availability: Nationwide

- Direct deposit required: None

- Additional requirements: Deposit $10,000 – $1M and maintain for 60 days

- Hard/soft pull: Soft pull

- ChexSystems: Yes

- Credit card funding: None

- Monthly fees: $25-$30, avoidable

- Early account termination fee: None

- Household limit: None listed

- Expiration date: October 3, 2022

Contents

The Offer

Direct Link to offer (‘Learn More’)

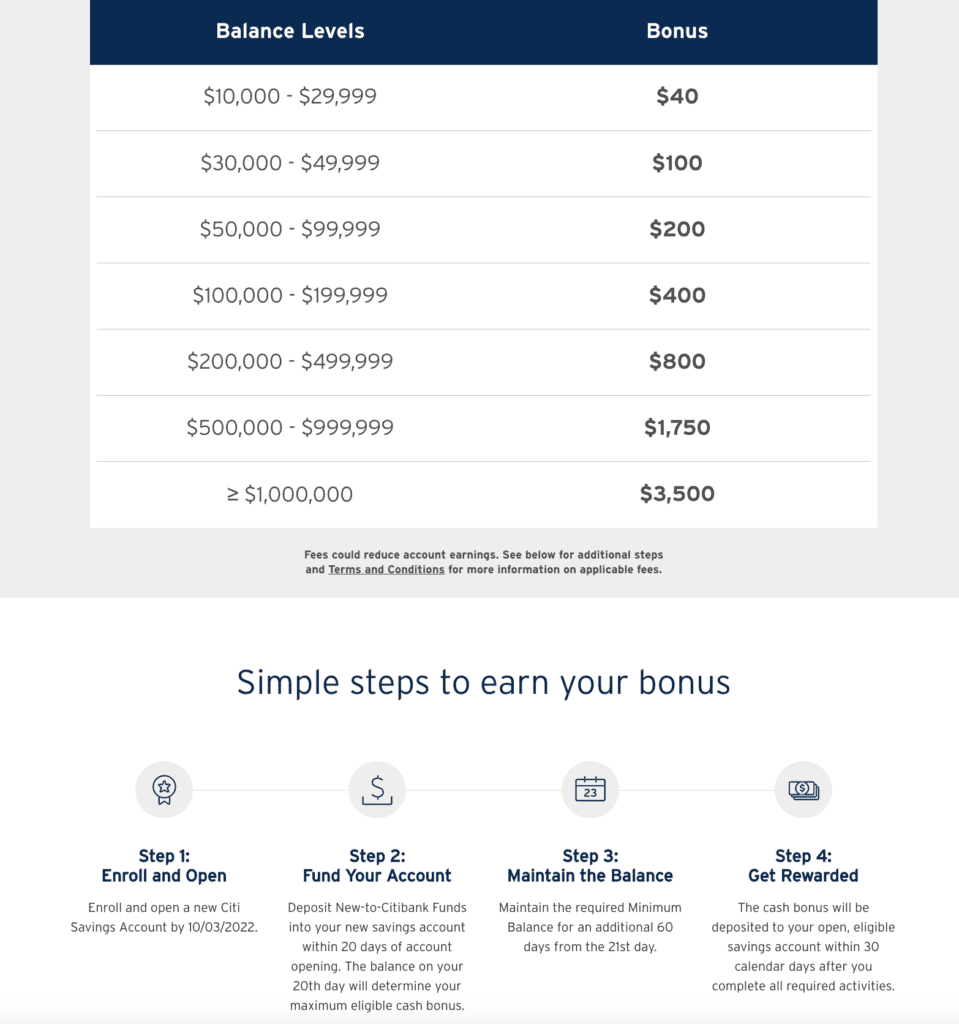

- Citibank is offering a savings account bonus when you open a new account, deposit funds within 20 days, and maintain the deposit for at least 60 days. Here are the bonus tiers:

- $10,000 – $40 bonus

- $30,000 – $100 bonus

- $50,000 – $200 bonus

- $100,000 – $400 bonus

- $200,000 – $800 bonus

- $500,000 – $1,750 bonus

- $1,000,000 – $3,500 bonus

The Fine Print

- All bank account bonuses are treated as income/interest and as such you have to pay taxes on them

Avoiding Fees

Monthly Fees

Citi Basic Account Package has a $12 monthly fee, this is waived if you do any of the following:

- Make one qualifying direct deposit per statement period and one qualifying bill payment per statement period or

- Maintain a $1,500+ combined average monthly balance in eligible linked accounts

- Fee also waived when first listed account owner is 62 or older.

Early Account Termination Fee

In the past, Citi has not charged any ETF, and none is mentioned for this offer.

Our Verdict

This bonus is almost entirely unexciting since you’d do better putting the funds in a high-yield savings account with no bonus rather than this Citi savings account with a bonus. What’s interesting here is that this offer would seem to stack with the Citi tiered checking bonus to spruce up earnings since that bonus allows holding funds in a linked savings account as well.

For example, if you’re doing the $75,000 checking bonus tier for $1,000 bonus, you might be able to get another $200 on top of that with the savings bonus, a nice sweetener.

The trick would be to open the checking account from the bonus landing page and not opening a savings account at that time. Then, open a savings account from the savings account bonus landing page. Then, deposit $75,000 into the savings account (or $50,000 into the savings and $25,000 into the checking). Hopefully that would yield both the $1,000 checking bonus – since it allows deposits into a linked savings account- and the $200 savings bonus.

The only part that’s not totally clear is whether you can open the savings account separately from opening the checking account and have it count for both. Here are the terms on the checking bonus:

If you also open and fund a new Citi® Savings Account, your balance can be held in your Checking Account or between your Checking Account AND your new Citi Savings Account to count toward the minimum requirement to earn a bonus.

On the 20th Day after you open your account, we will check your “On Deposit” balance in New-to-Citibank Funds which will determine the Maximum Bonus you can potentially earn (“Balance”). Your Balance can be held in your Checking Account or between your Checking Account AND a new Citi Savings Account if you open a new Citi Savings Account in the same package after opening your checking account and before your 20th day.

The Welcome Checking Cash Bonus Offer is a checking offer. Checking Accounts may only be used to fulfill the Welcome Checking Cash Bonus Offer once per Offer Period. If you enroll in multiple checking offers during an offer period and fulfill multiple checking offers in the same week, you will be awarded the offer with the highest bonus value. If you enroll in multiple checking offers during an offer period and fulfill multiple checking offers across different weeks, you will be awarded the bonus of the first checking offer to qualify. If you enroll in multiple checking account or savings account offers during an offer period, the requirements of each offer must be met separately.

The terms seem to allow for separate checking and savings bonus enrollments. My guess is this stack would ultimately work, but there is some risk involved.

Hat tip to reader EdwardD