[Originally posted on 7/13/17. Reposting on 7/21/17 since the change goes into effect tomorrow. Let us know your experiences in the comments.]

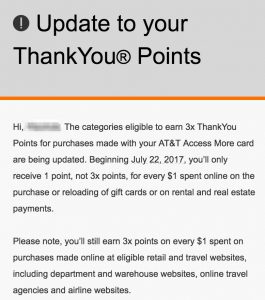

At&t Card Changes

Citi sent out an email today indicating that the Citi AT&T card which earns 3x for most online purchases will no longer earn 3x on the purchase or reload of gift cards, nor on rental and real estate payments.

Beginning July 22, 2017, gift cards and rent will only earn 1x with the AT&T card. The card will continue to earn 3x on ordinary online purchases.

The same changes hold true for the no-annual-fee ATT Access card (the non-More version) which earns 2x online purchases. Beginning July 22, gift cards and rent will only earn 1x.

Sample Changes

Here are some of the real-world ramifications for us; all of these will likely change on July 22:

- Some people were getting 3x on their Plastiq rent and mortgage payments. This will likely change.

- Radpad was getting 3x which will likely change.

- Some gift card sites like MXP, Giftcardmall, and Paypal Digital Gifts have been earning 3x which will likely change.

- Gift card sellers on eBay, such as SVM, PPDG, Giftcardmall, and Cardency have been earning 3x. This might change.

- Some second-hand gift card exchanges may have been earning 3x. These might change.

- If you have some sort of reloadable prepaid card which was earning 3x it might change.

Notes

It’s important to note that the change will only affect those sites coded correctly as gift card sites or rent/mortgage/HOA payments. Some sites might not come through as gift card or rent, and some sites might be part of a larger business. These won’t necessarily change.

I’d also assume, that buying or reloading Amazon gift cards will continue to earn 3x since it won’t be pegged as a gift card transaction. Similarly, if you buy a Macy’s gift card from macys.com it should still code at 3x.

The rent/mortgage payees are less likely to remain since those payments are so large Citi might be able to pick up on them and individually code those businesses not to earn 3x.

Regarding Plastiq specifically, it seems that most avenues are sealed shut: ATT probably won’t work anymore after this change, CSR stopped coding at 3x for rent/mortgage, CIP is a Visa card which won’t work in most cases for rent/mortgage, and PPBDC is being charged 2.5% now like a credit card. The only angles left that I’m aware of with Plastiq are:

- CIP on rent/mortgage if it’s coding for you at 3x and your payee is somehow going through despite being Visa (both of these things are YMMV)

- If you want to cash out the travel rewards on a Visa credit card with that kind of rewards program (BofA TR, Cap1), these things might still work

Final Word

While these changes mostly close the door on using the Citi AT&T card for purposes of manufactured spending, remember that it still earns 3x on ordinary online purchases which is quite generous. Further, there might still be some codings which fall through the cracks and continue to work. Personally, I intend to keep the card with it’s $95 annual fee for those reasons.

An easy rule of thumb is that if you think you’ll have $10k in annual purchases it’s worth keeping the card since it comes with a 10,000 points annual bonus for those who spent $10,000 over the course of the cardmember year. If you’ll be spending less than $10k, it might not be worth keeping. It’ll depend how much you plan on spending and how you value ThankYou points.

Remember to get your last Plastiq or whatnot charges in before July 22nd. Will also be interesting to see if the ATT Access More card becomes available for signup again now that they tweaked the rewards program.

Any more data points here on this card? still earning 3X on non-plastiq rent or mortgage payments.

what are you earning on online giftcard purchases.

Calling for a retention offer, not sure what to do here with this one.

Retention might be a reason to keep it if you can get one..

Anyone know if you can PC to the no AF AT&T card from a diamond Preferred?

I’d guess so, but not certain.

There is always hope for us miserable MS’ers. Some supplier of Gift Cards could code sales improperly, and the Garvey would continue to flow. But I’m not expecting that outcome. But, I will test it.

My rent payment was charged yesterday and since today is Friday so it’s probably not going to post until Monday. It was processed as misc government service and has been earning 3X gonna give it a month and see if Citi caught this one.

Should I convert my forward card to this? We rarely use forward anymore, except for occasional Amazon purchase. We do quite a bit of online shopping from other sources though.

Sounds like a plan. I believe some people are still having success doing product changes to the card. If you’ll spend $10k+ annually on the card (in bonus and non-bonused categories combined) it’s a no-brainer.

I would lose the 1200 points/year on forward though.

I’d heard that too, but since Oct 2016 I’ve tried to change an old card to AttAM a half dozen times and was told each time that the card didn’t come up as an available conversion option. One time I was flatly told “We no longer perform conversions to that card.”

I attempted from an AA Bronze, a DC, and a TY Preferred (all same old account, I kept PC’ing in hopes it would work from a different card).

I Approve of this message

Don’t forget that if you need to top up spend to $10000/year buying VGCs w/o fee would accomplish it and offset the annual fee.

In that case the card could be still kept for organic online spending bringing 3 TYP/$1.

With mortgage payment it’s easy to be greater $10K per year. But w/o it I would say I wouldn’t keep this card

I hope you’re right and the card becomes available again for new sign ups.

I imagine from now on what does still work with the card will be less openly discussed.

Ha! good one