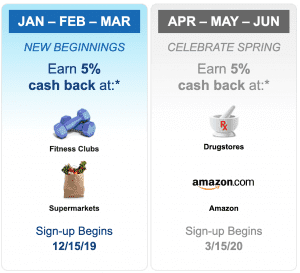

Citi has released the 5% categories for the first half of 2020 on their Dividend card:

- Q1: Supermarkets and Fitness Clubs

- Q2: Drug Stores and Amazon

Both quarters here will be useful for some. Remember that with the Citi Dividend there’s no $1,500 limit, it’s just an annual $300 cashback limit, so you can spend a full $6,000 in a single quarter on the 5% category and get $300 back. Drug stores is always a favorite, and for some things like supermarkets and Amazon can be interesting as well, depending what other cards you own.

Related: