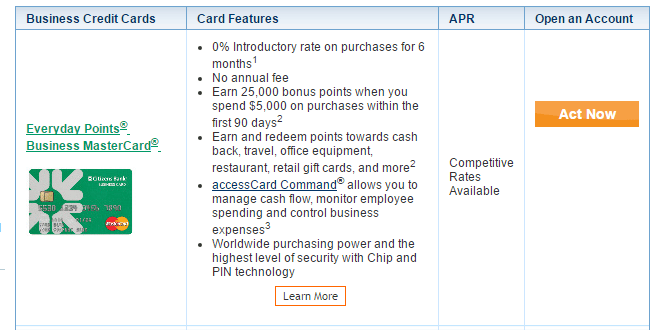

Citizens Bank offers the Citizens Bank Everyday Points Business Mastercard, it comes with a sign up bonus of 25,000 points so I thought I’d do a quick review of the card.

The Basics

- Sign up bonus of 25,000 points after $5,000 in spend within the first 90 days

- Card earns 2x points on all purchases

- No annual fee

- 0% Introductory APR for first six months

Details On Points Earned

- Points expire 36 months after the month in which they are earned

- Points can be redeemed for the following:

- Cash back deposited to your Citizens account

- Gift cards

- Travel rewards

- Business rewards

- Personal items

- Track, manage and redeem your points through our Everyday Points website

- No limit on the amount of points you can earn

Points aren’t very valuable at all, if you go to: https://www.citizensbankeverydaypoints.com/rewards/ and click browse catalog you can see the following redemption options:

- 6500 points for a $25 gift card

- 30,000 points for a $150 gift card

Basically best value is 0.5¢ per point (thanks to reader JB).

Our Verdict

This card is pretty terrible, sign up bonus is basically worth a maximum of $125 in gift cards and card earns a maximum of 1% back in gift cards on all purchase other cards earn at a higher rate on every day purchases. Definitely give this one a miss!

Citizens Bank branches in many areas have been acquired by other banks. One in fact, offers a checking account 5.01% APY on up to 5k after 10 debit swipes, can get 2 accounts per person, each account comes with $25 sign on bonus. Only weird thing is the accounts don’t deposit interest, they accrue in points which can be redeemed at 1 cent each no minimum, then deposited right back into the account. In addition to this magnificent find in a tiny town while driving to find family, I also discovered they have a 7.5%v credit card that earns score card rewards and tiered cash back up to 1% (after 3k spend). The 7.5% apr is variable but they are hoping to have it set to fixed very soon. Hopefully before the 0.25% increase, (doc surprised you have not posted about this). I guess they say for 0.25% increase that would be $25 extra per year in interest per $1000? Anyway, I managed to get 2 checking accounts and the credit card plus $50 free. Checking accounts are SP, but the credit card may also be a SP. No geographical requirements, but you have to go in branch in central Illinois. http://www.hometownbanks.com

They do charge 50 cents in fees for mobile check deposit, but they refund up to $10 a month in fees, or you can pay $2 and get $20 in fees refunded. All by points, which is weird, but totally worth it.

Thanks! (Also we will post about interest rate hike shortly)

I thought Citizens Bank is quite large?! They bought Charter One branches (midwest) several years ago. so maybe they are selling a few of those less profitable branches! otherwise, Citizens Bank is quite prevalent in northeast like RI, MA, CT, NH, and few parts of NY, PA, VT and other states. No branches are being sold.

Does Citizens report business cards to one’s personal credit reports?

Not sure, sorry!

FYI, if you browse their points store, you’ll find you can redeem 6500 points for a $25 gift card or 30,000 points for a $150 gift card. Pretty lousy. Not worth $5000 spend or a hard pull.

Go here: https://www.citizensbankeverydaypoints.com then to the bottom right to browse by category. Max value per point is 1/2 cent ($.005) like JB said.

Wow, too bad. A 2% cashback, no AF, business card (credit report considerations) mastercard (EasySavings) would have been great.

There is no other card out there like this right?

Thanks, updated post!