Deal has ended, view more bank account bonuses by clicking here.

Offer at a glance

- Maximum bonus amount: $250 checking + $250 auto loan bonus

- Availability: Colorado only (can try to open out of state but doesn’t work according to this comment)

- Direct deposit required: No

- Additional requirements: None

- Hard/soft pull: Hard pull

- ChexSystems: Unknown

- Credit card funding: Yes, $500 checking & savings

- Monthly fees: $8, avoidable

- Early account termination fee: Unknown

- Household limit: None listed

- Expiration date: October 31, 2022

Contents

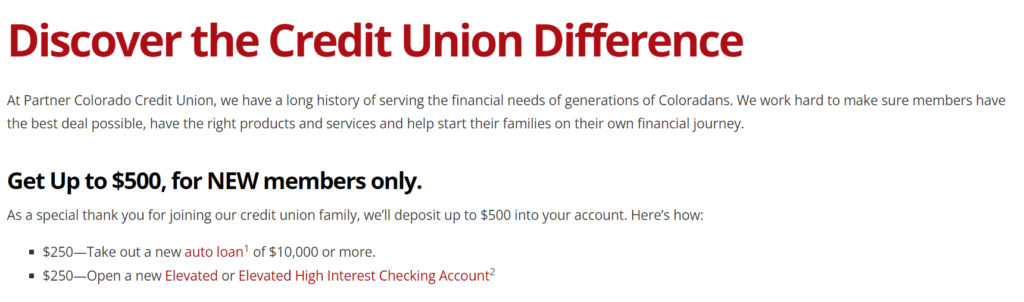

The Offer

- Partner Colorado Credit Union is offering a $500 bonus. Bonus is broken down as follows:

- $250 when you open a new elevated or elevated high interest checking account and complete the following requirements:

- Have an opening deposit of $500

- Activation of a Visa Debit Card and

- enrollment in online/mobile banking

- $250 when you take out a new auto loan of $10,000+

- $250 when you open a new elevated or elevated high interest checking account and complete the following requirements:

The Fine Print

- Subject to credit approval. Partner Colorado Credit Union membership required. 2Bonus is not available to existing Partner Colorado members. Bonus valid for new Elevated or Elevated High Interest checking accounts opened between July 15 – October 31, 2022.

- Limit one bonus per account.

- Opening deposit of $500, activation of a Visa Debit Card and enrollment in online/mobile banking are required to receive bonus. All requirements must be met within 30 days of account opening and the cash bonus will be deposited into the new checking account within 10 days of meeting qualifications. The $250 cash bonus is considered interest and is subject to IRS and other tax reporting. Other conditions and restrictions may apply. 3Subject to the terms and conditions detailed in the Guide to Benefits. Insurance products are: NOT A DEPOSIT. NOT FEDERALLY INSURED. NOT AN OBLIGATION OR GUARANTEED BY THE CREDIT UNION, ITS AFFILIATES, OR ANY GOVERNMENT AGENCY. 4Interest will continue to accrue.

- All bank account bonuses are treated as income/interest and as such you have to pay taxes on them

Avoiding Fees

Monthly Fees

Elevated High-Interest has a $8 monthly fee, this is waived with 20 debit card transactions per month and enroll in eStatements and online banking.

Early Account Termination Fee

I wasn’t able to find a fee schedule so unsure if there is any EATF.

Our Verdict

Shame it’s not available nationwide. Will be interesting to see how much you can actually fund with a credit card.

Hat tip to Bockrr

Useful posts regarding bank bonuses:

- A Beginners Guide To Bank Account Bonuses

- Bank Account Quick Reference Table (Spreadsheet) (very useful for sorting bonuses by different parameters)

- PSA: Don’t Call The Bank

- Introduction To ChexSystems

- Banks & Credit Unions That Are ChexSystems Inquiry Sensitive

- What Banks & Credit Unions Do/Don’t Pull ChexSystems?

- How To Use Our Direct Deposit Page For Bank Bonuses Page

- Common Bank Bonus Misconceptions + Why You Should Give Them A Go

- How Many Bank Accounts Can I Safely Open Within A Year For Bank Bonus Purposes?

- Affiliate Links & Bank Bonuses – We Won’t Be Using Them

- Complete List Of Ways To Close Bank Accounts At Each Bank

- Banks That Allow/Don’t Allow Out Of State Checking Applications

- Bank Bonus Posting Times

This credit union has a $250 business checking bonus… William Charles CO only, from what I recall.

William Charles CO only, from what I recall.

https://www.partnercoloradocu.org/announcement/business-checking-earn-250-bonus

Requirements are super easy and quick payout.

Bonus is not available to existing Partner Colorado business members. Bonus valid for new business checking accounts opened between January 1 and March 31, 2024. Limit one bonus per account. Activation of a Business Visa Debit Card and enrollment in online/mobile banking are required to receive bonus. All requirements must be met within 30 days of account opening and the cash bonus will be deposited into the new business checking account within 10 days of meeting qualifications. The $250 cash bonus is considered interest and is subject to IRS and other tax reporting. Other conditions and restrictions may apply.

There is a $25 early termination fee if the account is closed within 90 days.

9/4 – applied online (in state), used BoA Premium Rewards for $2,005 ($2k checking + $5 savings), charge went pending (CA limit set to $200)

9/7 – received call from bank to unlock Experian so they could do HP, was asked some casual questions about how I plan to use the account (“day to day banking”) and where I heard about them (“Facebook”)

9/8 – bank called again after pulling credit report, account approved, was provided account number over phone to set up online banking, enrolled and checking shows $2k posted/available (BoA still shows pending)

Darn. Did not realize it’s a hard pull. I might still do this deal but it’s a pity that it is a hard pull.

Follow up DP

9/23 – received $250 bonus despite not yet receiving/activating debit card (bank never mailed debit card so I had to call in and still waiting for it)

Will most likely close account soon to avoid monthly fee.

Max funding is $500 for savings and $500 for checking on a CC (so $1k total in MSR).

I live in Douglas County.

I funded with $5k on my Chase Hyatt card yesterday. My app was approved today and it shows the $5k in my checking.

Anybody join yet? If so, did they pull Chex or seem Chex sensitive?

I am in footprint and eligible … will try this in about a week and report back.

WHO IS ELIGIBLE TO JOIN?

“Membership in Partner Colorado is open to all active or retired Colorado Postal employees, active or retired Denver Water Employees and active or retired HealthONE employees.

In addition, any resident who is 55 or older and living within a 25-mile radius

of any Partner Colorado branch is eligible to join. Employees of approved Select Employer Groups (SEGs) are also eligible to join, as well as persons living or working within defined communities as specified in the Credit Union’s Bylaws. In addition, all individuals who live or work in the following counties are eligible for membership: Denver, Adams, Jefferson, Douglas and Arapahoe. Once you become a member, your entire family (related to you by blood, marriage or adoption) as well as individuals living in your residence are eligible to join, too.“

4.99% auto loan interest rate and they call themselves a credit union? what a joke!

Not saying it’s a great rate, but have you found many much better? used car/refinance?

One of the members of the Leasehackr Forum came up with a great auto updating spreadhseet of Credit Union rates for vehicles….check it out at: https://forum.leasehackr.com/t/the-best-finance-rates-hacks-submit-your-cu-recommendations/419036