Virgin America & Comenity Bank have announced that due to Alaska’s acquisition of Virgin America their co-branded cards will be closed on 1/04/18. Cardmembers will continue to receive all the normal benefits through 12/31/17 and the cards will all be officially closed on 1/04/18. This means that Bank of America has not purchased the back book from Comenity and Comenity will also not product change existing cardholders to another product. The first point doesn’t surprise me, but the fact that Comenity isn’t giving cardholders another card is surprising.

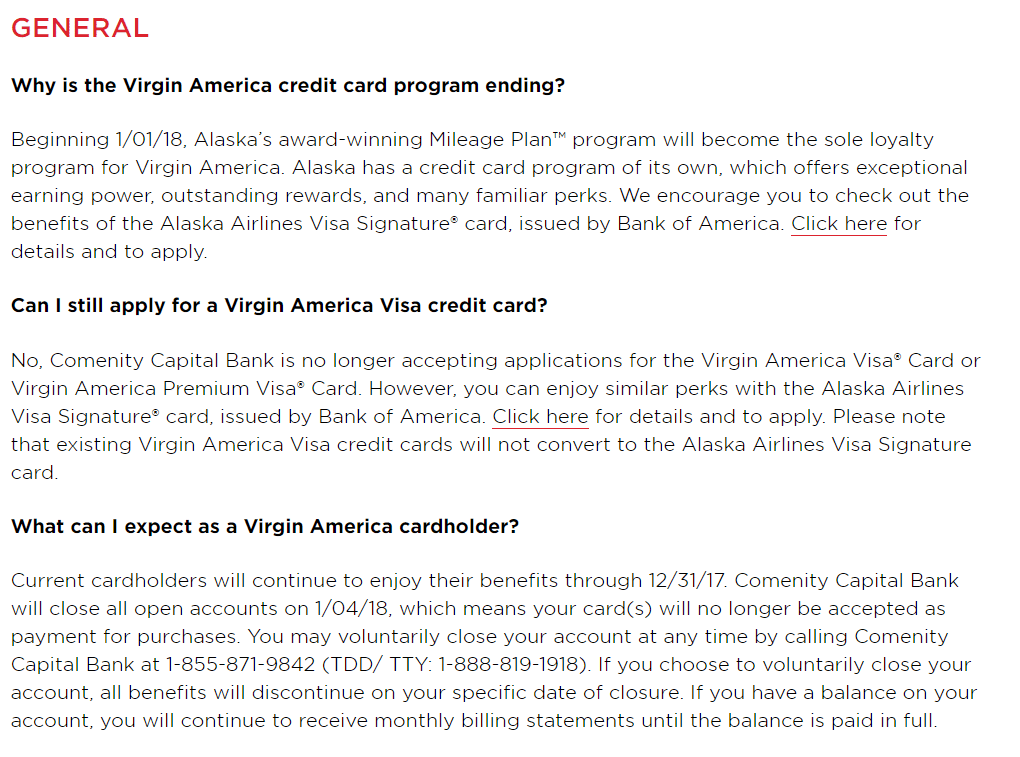

Comenity/Virgin America have put together a list of F.A.Q with answers here.