After reading yet another disappointing Kristin Wong post (“All the Credit Card Companies That Offer Free Access to Your Credit Score“) over at Lifehacker’s Two Cents, I felt the need to tackle the subject in a more comprehensive manner. The goal of this post is to serve as an in-depth yet quick comparison of what each bank or credit union offers in terms of: type of score, credit bureau, and frequency of update. The focus is on FICO scores offered by having a credit card, but there will be some miscellaneous information included. There will be tables (I love tables), so you will likely want to view this on a desktop (leftmost column is abbreviated credit bureau, topmost row is the FICO scoring model). (This could be considered a companion to our excellent post “Complete List Of Places To Get Free FICO Scores“, though that post does need an update).

Data is compiled from the CFPB’s publication “Where to find access to a credit score” (specifically, the comments of “Notice of a Public List of Companies Offering Existing Customers Free Access to a Credit Score”), from FICO’s list of partners to the FICO Score Open Access Program, from personal experience, and from various places on the Internet.

You will likely want to refer to our omnibus reference “Credit Reports & Scoring Reference Pages” for more information about credit scores & what they mean. In particular, “How Many FICO Scores Are There?” lists the various scores and some of their differences.

This is as complete listing as I could make, but I’m sure there’s plenty of missing information. If you have questions, updates, or additions, please drop them in the comments below!

Contents

Banks

These banks offer free FICO scores updated monthly, for cardholders of consumer credit cards. Due to the way tables are displayed, I had to split FICO scores and FICO Bankcard scores into separate tables.

| 2 | 8 | 9 | ? | |

| EX | First Commonwealth1 | American Express4; Chase5; Discover6 | Wells Fargo9 | |

| EQ | HSBC | |||

| TU | Bank of America; Barclays3; Discover6; Synchrony8 | Commerce Bank2 | ||

| ? | Citizens; Merrick |

| Bankcard 2 | Bankcard 4 | Bankcard 8 | Bankcard 9 | |

| EX | Wells Fargo9 | Ally1,10; First National Bank of Omaha7 | MUFG Union Bank | |

| EQ | Huntington | Citibank; SunTrust | ||

| TU | First PREMIER1 |

Footnotes:

- Ally, First Commonwealth Bank, and First PREMIER Bank update and display your score quarterly, instead of monthly.

- Commerce may update and display your score quarterly or monthly.

- Barclays updates and displays your score bimonthly (every two months), or more frequently if something significant has changed on your credit report.

- American Express often updates more than once per month, but will only display the most recent score in its history. If you don’t log in and check, you will miss the extra scores.

- Chase only provides FICO scores to cardholders of the Chase Slate.

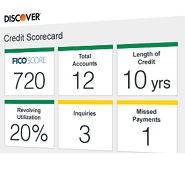

- Discover’s Credit Scorecard, which is available to everyone, provides Experian FICO 8. Note that Credit Scorecard updates every 30 days or when you log in again, whichever is later. Discover indicates that cardholders get TransUnion FICO 8 with their monthly statements. Note that this is updated monthly (and displayed on your statement) unless there’s been no activity for 180 days.

- FNBO provides a FICO Bankcard 8 score for credit card customers and FICO 8 for consumer loan customers; the latter is omitted in the table.

- Synchrony only provides FICO scores for the following cardholders: Amazon.com Store Card, Walmart Credit Card, Walmart MasterCard, Sam’s Club Credit Card, and Sam’s Club MasterCard.

- Wells Fargo displays the FICO score that is used to manage your account. For example, Wells Fargo also offers its consumer loan customers (including private, auto, student, mortage, HELOC, etc.) access to a free FICO score, but the bureau, frequency, and type of score is not indicated. (Nor is it indicated for credit card customers—I had to go digging on other sites to confirm). The expansion to deposit, investment, and retirement accounts led to access to a FICO 9.

- Ally provides a FICO Bankcard 8 score for credit card customers and a FICO Auto 8 for auto loan customers.

Credit Unions

These credit unions offer free FICO scores updated quarterly. In general, your FICO score is available if you have a consumer credit card with the (F)CU, but some (F)CUs offer it to all members or have other criteria (not indicated due to the general targeted nature of (F)CUs). Navy Federal plans to offer a free FICO score to consumers in 2017, but doesn’t make the table because I couldn’t find any information about it.

| 2 | NextGen 2 | 5 | 8 | 9 | ? | |

| EX | 1st United CU; America First CU; Community CU of Florida; Elevations CU; Mountain America FCU; NASA FCU; Pennsylvania State Employees CU1; Premier America CU; Stanford FCU; TrueCore FCU | Harvard University Employees CU; KeyPoint CU; Star One CU1; Polish & Slavic FCU; Whatcom Educational CU1 | MSU FCU | |||

| EQ | PenFed2 | Coulee Dam FCU; Digital FCU (DCU)1; DuPont Community CU; Fairfax County FCU; Langley FCU1; Listerhill CU; Robins Financial CU | Andrews FCU; General Electric CU; Healthcare Systems FCU; State Employees’ Credit Union (NC) | Fortera CU | ||

| TU | Interra CU | |||||

| ? | Franklin Mint FCU |

Unknown bureau and unknown scoring model: Affinity FCU; American Heritage FCU1; Chevron FCU; Elements Financial1; Firefighters First CU; Freedom CU; Maps CU; Montgomery County Employees FCU; Mutual Security CU; Redstone FCU; Redwood CU; Royal CU; Sharonview FCU; Space Coast CU.

Footnotes:

- Issuer updates and displays your score monthly, instead of quarterly.

- PenFed updates and displays your score when receive updated information in the “normal course of business”.