Update 4/6/25: Back through 6/30/2025. Hat tip to reader Tikky

Update 1/1/25: Extended to March 28, 2025

Update 10/1/24: Extended to 12/31/24

Update 6/30/24: Deal is back through September 30, 2024. There is also a $300 and $1,500 tier now.

Update 4/3/24: Deal is back through June 28th. Hat tip to Frazz

Update 1/8/24: Deal is back and valid until 3/29. Hat tip to reader BD.

Update 10/2/23: Extended until 12/29.

Update 4/2/23: Extended until 6/30/2023

Update 1/15/23: Bonus is now $500 and doesn’t require merchant services.

Offer at a glance

- Maximum bonus amount: $500

- Availability: In branch only [Branch locator]. Branches are in CT, DE, D.C., MD, NJ, NY, PA, VA, WV

- Direct deposit required: No

- Additional requirements: Average daily balance of $5,000 for the 3rd full month after account opening

- Hard/soft pull: Soft

- ChexSystems:Yes

- Credit card funding: No

- Monthly fees: $20, avoidable

- Early account termination fee: $50 if closed within 180 days of date opened, bonus forfeit if closed within six months as well.

- Household limit: None

- Expiration date:

June 28th, 2019 September 30th, 2020November 30, 2020

Contents

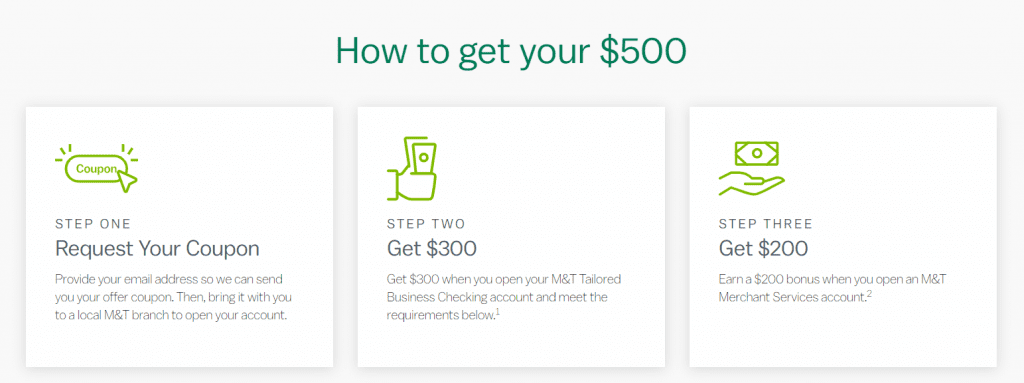

The Offer

- M&T Bank is offering a bonus of $500 when you open a new Tailored Business Checking account and complete the following requirements:

- Have an Average Ledger Balance in the account is at least $15,000 in the third full calendar month after the account was opened

- $300 bonus when you have an Average Ledger Balance in the account is at least $5,000+ in the third full calendar month after the account was opened

- $1,5000 bonus when you have an Average Ledger Balance in the account is at least $100,000+ in the third full calendar month after the account was opened

The Fine Print

- We will credit $500 bonus (the “Checking Bonus”) to a new M&T Tailored Business Checking account opened between 1/1/2023 and 3/31/2023 if the Average Ledger Balance in the account is at least $5,000 in the third full calendar month after the account was opened. If the requirements are met and the Account remains open, the Checking Bonus will be credited to the Account within 45 days after the end of the third full calendar month after the account was opened. The Checking Bonus is reportable for tax purposes and is not available to employees of M&T Bank or any of its affiliates. The Checking Bonus is not available to customers who have had a non-personal M&T checking account within the previous 90 days of opening an M&T Tailored Business Checking account. Only one Checking Bonus will be awarded per customer regardless of the number of new M&T Tailored Business Checking accounts opened. A $50 Account Closure Fee applies if the account is closed within the time period referenced in the Commercial Deposit Account Fee Schedule.

- All bank account bonuses are treated as income/interest and as such you have to pay taxes on them

Avoiding Fees

Monthly Fees

This account has a $20 monthly fee. This is waived if you:

- Maintain a $10,000 monthly average ledger balance

- Maintain $25,000 average ledger balance between checking & savings

- Make $2,000 in purchases on a linked M&T business credit card

- M&T bank merchant services account proceeds deposited

Early Account Termination Fee

$50 if closed within 180 days of date opened, bonus forfeit if closed within six months as well

Our Verdict

Update; You need $15,000 in the account to trigger the bonus, making the return even worse unfortunately.

You will need to keep $10,000 in this account to keep it fee free and to trigger the bonus (or you could put $5,000 into the account and just pay the monthly fees). Either way the deal is still worth doing as the bonus is for $500. Keep in mind M&T also offer personal bonuses of up to $300 as well. I will be adding this to our list of the best business bank account bonuses.

Hat tip to reader ChurningFast

Useful posts regarding bank bonuses:

- A Beginners Guide To Bank Account Bonuses

- Bank Account Quick Reference Table (Spreadsheet) (very useful for sorting bonuses by different parameters)

- PSA: Don’t Call The Bank

- Introduction To ChexSystems

- Banks & Credit Unions That Are ChexSystems Inquiry Sensitive

- What Banks & Credit Unions Do/Don’t Pull ChexSystems?

- How To Use Our Direct Deposit Page For Bank Bonuses Page

- Common Bank Bonus Misconceptions + Why You Should Give Them A Go

- How Many Bank Accounts Can I Safely Open Within A Year For Bank Bonus Purposes?

- Affiliate Links & Bank Bonuses – We Won’t Be Using Them

- Complete List Of Ways To Close Bank Accounts At Each Bank

- Banks That Allow/Don’t Allow Out Of State Checking Applications

- Bank Bonus Posting Times

Post history:

- Update 10/19/22: Extended through 12/31/2022.

- Update 7/3/22: Back and extended until Sept 30, 2022.

- Update 5/16/22: Deal is back and valid until 6/30/22.

- Update 1/15/22: Deal is back and valid until 3/11/22.

- Update 5/31/21: Extended until 6/30/21.

- Update 4/27/21: Deal is back and valid until May 30, 2021. Looks like it can be opened online now. Hat tip to IS250

- Update 10/4/20: Deal good through November 30, 2020.

- Update 8/10/20: Monthly fee is waived for the first three months. Hat tip to Lazy Travelers

- Update 8/2/20: Deal is back and valid until September, 30 2020. Hat tip to reader crystal

- Update 3/21/20: Deal has been extended until May 15th, 2020.

- Update 2/2/20: Deal is back until 3/20/20 but checking bonus has been reduced to $300. I’d recommend waiting until the $400/$100 bonus returns. Hat tip to reader Ryan

- Update 7/28/19: Deal is back and valid until September 26th, 2019. There is also a $200 bonus that we will post about shortly.

Anyone else having issues opening the account online?

It is giving me an error every time I click the last step of the process “Open account”. It says – “It’s not you, but something went wrong on our end.”

Thanks for the reply. I think it would be better to just go to the branch and do it all at once.

On a side note, do you know if it is easy to open a business checking account as a sole prop with SSN in a branch? What kind of details do they ask usually and any documents that we need to provide as a sole prop.

Business acct. may need a capable/willing banker to open your app. Make an appt. before heading to your local branch, tell them your a SP and just ask what docs are required based on the state you’re applying from. If they ask for too much, call a different branch. You won’t get the 3rd degree if someone competent is working with you. They ask about usual business type, expense, how long ago, income, mthly & foreign transfers, etc. Otherwise prepare a folder with the docs they recommend. Better to be comfortable and relaxed. HTH.

thank you

I just tried applying and got the same error message. Frustrating.

I got a referral link from someone who has an active account and when I fill out the info it gives me an error message and says “your request could not be completed. Please check your referral link and try again.”

Anyone else having a similar issue?

Maybe your referrer is at their cap and they don’t know it?

They may have turned off the spigot or RL form maybe broken/corrupted. Dan There maybe validity to this issue.

Dan There maybe validity to this issue.

“Your request could not be completed. Please check your referral link and try again.”

I encountered the same with the biz form not submitting but need another DP, can you or another reader verify? ntn

ntn

If this is the case then the M&T business referral page may indeed have invalid links as mentioned before even though the initiate splash page shows $150 the form is not working. Please delete if asking this breaks any rules. William Charles

William Charles  Chuck

Chuck

I think you’re right. Dead from my link, too. I tested another bank’s link and that one went through fine so it doesn’t appear to be a technical error.

Anyone has a working business checking account referral link?

I tried a couple from the referral page but they all give me an error.

Yup. Check a few of the peeps active here.

Go fish.

at least $15,000 in the third full calendar month after the account was opened

If the account is opened on 4/7 for example, do I need to have $15,000 for the month of June or the month of July?

July

When opened make sure you have some funds deposited into the acct. Not necessary, just good practice. Don’t want to give them any excuse to close it suddenly due to lack of funds or activities.

Does anybody have a referral for MTB business checkin account?

Maybe you can downgrade to simple checking? You can downgrade their personal account. Provided downgrading doesn’t void the bonus.

https://www.doctorofcredit.com/mt-bank-50-referral-bonus-for-each-party-stack-with-450-bonus-share-your-referrals/

I have available but can’t post it. I tend to use referrals from someone that’s helpful with an avatar link. Otherwise this page is useful and searchable by author/content. Only caution is some are invalid due to acct. closure and might not payout so you won’t know for sure.

https://www.doctorofcredit.com/mt-bank-50-referral-bonus-for-each-party-stack-with-450-bonus-share-your-referrals/

I tried to sign up using your link but got an error message.

They stipulate that the account must stay open for 6 months or entire bonus will be clawed back. That means you have to keep the account open for three months after receiving the bonus.

As I calculate, locking up $10k for three months would cost me about $111 if it would otherwise sit in a 4.5% APY account. That’s higher than the 3 * $20 = $60 in maintenance fees I’d pay. So better just to pull the money after month three and eat the fees right?

You only need to do the following:

“Maintain the average ledger balance requirement”

“Maintain an average ledger balance of at least $5,000 in the third full month after you open your account.”

Downgrading afterwards is also an option.

I was able to downgrade last year after receiving the bonus. Not sure if things have changed since then.

I remember someone mentioned that you wont be getting the Businees checking bonus if you open it with SSN and have got a personal bonus. Is that still true? How long do you need to wait? I got my personal bonus in June 2024 and closed the account in Oct 2024. Can I do this one now?

You referring to this? https://www.doctorofcredit.com/ct-de-d-c-md-nj-ny-pa-va-wv-in-branch-mt-bank-400-business-checking-bonus/#comment-1833382

Yep. Exactly that one

That is incorrect. Biz and Personal are separate bonus whether you Biz was using SSN/Sole prop or EIN based. I have done it multiple times. Even as recent as last month i got my Biz bonus and right away did my personal and got the bonus.

Did you use SSN for both business and personal? Someone did report the problem, as the comment link Tikky sent, but that was last year. Maybe they changed the system?

Can you confirm if you used SSN sole prop for business checking or EIN?

also it seems now it can be opened online, previously there is no open online buttom

Interesting, wonder if OOS can be done now, that being the case

DP for you: attempted to apply online from TX and when I input the business address in TX, got the error message “Sorry, we are not accepting online applications from your state at this time. We apologize for the inconvenience.”

Thanks, great DP! Was that hopefully before a chex pull got burned for you?

Never know unless you try. BankBonusIsMyReligion DP was successful https://www.doctorofcredit.com/ct-de-d-c-md-nj-ny-pa-va-wv-in-branch-mt-bank-400-business-checking-bonus/#comment-1925679 Reminder, there’s also a $150 referral to sweeten the deal if you can get it opened.

BankBonusIsMyReligion DP was successful https://www.doctorofcredit.com/ct-de-d-c-md-nj-ny-pa-va-wv-in-branch-mt-bank-400-business-checking-bonus/#comment-1925679 Reminder, there’s also a $150 referral to sweeten the deal if you can get it opened.

And from my experience, that ‘open online’ option sometimes disappears quickly, so folks need to act fast!

Online with sole-prop is definitely the way to go. The reason is because in branch M&T is really anal when it comes to Business Checking requirements needed to open the account. (You need to bring a lot of docs from what i remembered the past rep told me when i opened my personal acct )

Was able to churn 90 days from prior closure. Prev bonus was in Jun 2024 and closed ac in Aug 2024. New ac opened in Nov 2024. Kept 100K in 3rd full month (Feb 2025) and $1500 bonus posted 3/24/2025. Only thing is not able to churn the referral because that requires 6 months gap.

Yes

Had a really excruciating in branch opening a few years ago where the business manager flat out refused to hit the ‘submit button’ right at the end because I didn’t provide a DBA doc and cancelled my app. Even showed me a screen but where I had pointed out the statement that it wasn’t required by state, still denied, idiot! Whatever it was I sure gave him the jitters. Never encountered nor was ever asked about it with my past churn. Went to a different branch, applied, no questions or request for DBA and approved.