I decided to try something different and post some thoughts on taxes, revolving around upcoming changes to the tax code. Let us know if you find this kind of post useful. It goes without saying that all information below is for discussion purposes; consult your tax advisor before acting.

You can read up on the new tax law on the internet. Briefly, the laws which goes into effect on January 1, 2018 lowers tax rates across the board by a few percent. It also caps the state and local tax deduction to $10,000. There’s much discussion about what people should be doing before year-end to prepare. I’d recommend chatting with your accountant in the few remaining days if you haven’t already.

There are a few reasons to consider prepaying taxes and other payments/dues which are deductible. Note: this conversation only applies to those who plan to itemize their taxes in 2017, not for the majority of Americans who take the standard deduction.

- Since your tax bracket will be a few percent lower next year, you might as well maximize all deductions now (within the next few days), thus minimizing 2017 income and increasing 2018 income. Some people are making their next month’s mortgage payment, for example. Others are pushing through any charity donations they were going to make, or even paying out their entire next year’s charity contribution now. Likewise, if you can somehow defer income by a few days, it can be advantageous to do so.

- Since next year there’ll be a cap on state and local taxes, people who will blow past that cap are trying to pay up or even prepay their state and local taxes now by December 31. Every dollar paid now can potentially save you even 25% or more, depending on your tax bracket.

- On the state taxes front, the law is clear that you can NOT prepay 2018 state taxes and take the deduction. However, you can finish paying off any remaining dues for 2017 and get the unlimited deduction. If you wait until January or April to finish paying your 2017 state taxes, the payment will be subject to the $10k cap, despite the fact that it’s going toward 2017 dues. For that reason, those who plan on itemizing in 2018 and who will blow past the $10k limit can gain from paying off however much you think you’ll owe in state taxes before year’s end.

- On the local front, like property taxes, the IRS has not been clear whether prepaying 2018 taxes now will be deductible. A lot of towns are modifying their system to allow prepaying for the entire 2018 with the hopes that it’ll be deductible. Town executives across America are rejoicing in the float that’s coming their way from all the prepayments. It’s entirely possible all these 2018 prepayments will be for naught. [Update: apparently, the IRS finally came out with a guidance that only property taxes which were assessed in 2017 will count, not bonafide prepayments. “A prepayment of anticipated real property taxes that have not been assessed prior to 2018 are not deductible in 2017.” I assume that excludes most prepayments that people are doing, unless the towns quickly mobilize to officially assess the dues. It should – in a lot of cases – include local taxes paid for the beginning of 2018 since those bills have likely been sent out in December.]

- Some people won’t be itemizing in 2018 due to the higher standard deduction amount, but they are itemizing in 2017. For these people, there’s a major gain in maxing out their deductions now. As an example, someone in the 25% tax bracket who plans on giving $10k of charity will save $2,500 by giving now versus giving in the coming year or years. And someone in the 25% bracket who pays their January mortgage now can save hundreds of dollars, versus paying it in a few days/weeks when it’s due.

How do you make state and local tax payments? Mailing in a check is not the best idea since we have a January 1 deadline. Fortunately, most states and localities allow online payments. I’d guess ACH/e-check payments made online will post based on the date it was processed (even though it might take a few days until the funds clear), but I can’t say that for certain – it’ll depend how the state/city decides to treat it. Credit card payments should go by the date processed since there’s no funding delay. You don’t want to use a third-party processor like Plastiq since time is of the essence here.

Many cities and states allow paying taxes with a credit card on their website (the city/state might redirect you to a provider who processes the payment for them). There’s usually a fee for doing so. Luckily, the fee is often in the 2% area or less (I saw a 1.77% fee in one instance), and most of us have a credit card which earns rewards higher than that, meaning that it’s slightly profitable to be using this option, regardless.

- RELATED: A Complete Guide To Paying Your Federal Taxes With A Credit Card

- READ: End Of Year Deadline: Redeem FlexPoints, Double Discover Bonus & Much Much More

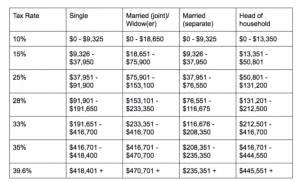

One final note, it’s worth comparing your tax bracket for 2017 and 2018 when evaluating whether to max out your deductions now since it might not always hold true that prepaying is better. For example, I noticed a donut hole where a single tax filer making between $$157,500 and $191,650 will actually be worse off prepaying. There are probably other such examples too (to be clear, their overall taxes will be lower, just prepaying isn’t necessarily a good idea). However, most income levels and statuses who itemize will gain by prepaying.

Let us know if you see any mistakes in this post – I’m no tax expert. Also, if we can please keep the comments non-political it’s greatly appreciated; the purpose of this post is only to discuss how we can save on taxes with planning.

Here’s the 2018 chart (courtesy of thebalance.com):

Here’s the 2017 chart (courtesy of studentloanhero.com):