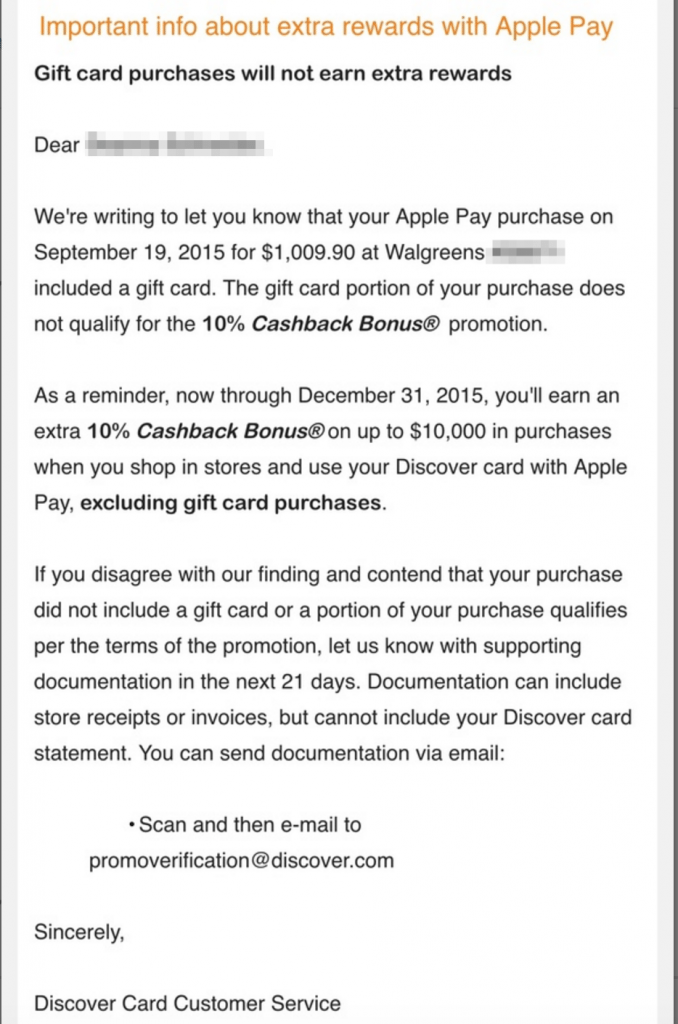

Discover announced a while back that the 10% Apple Pay promo won’t apply to gift card purchases.

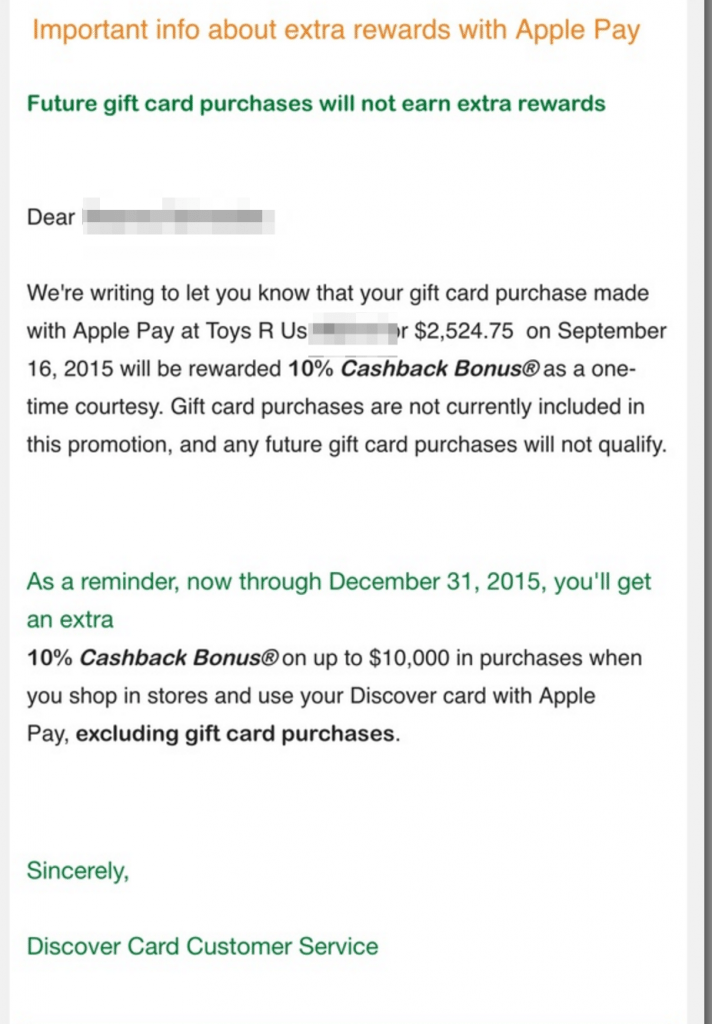

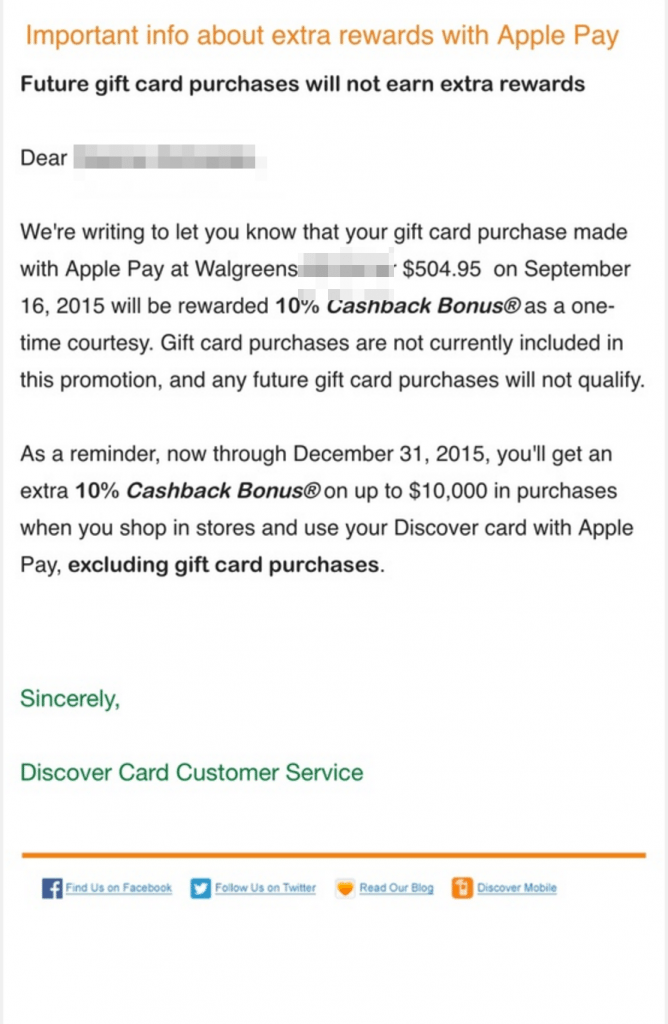

My friend Deanna made numerous Apple Pay purchases immediately when the 10% promo started on September 16. She got a few very intersting emails from Discover just now which I’m posting with her permission.

- They are enforcing the gift card exclusion.

- Some gift card purchases are getting a ‘one time courtesy’ and are being honored. There doesn’t seem to be much method to which purchases are being honored and which aren’t. Apparently, the earlier purchases are being honored, possibly since they happened before the exclusion was added. Some later purchases are being given this courtesy as well. Unclear if they’ll offer everyone this courtesy on their first purchase or if it’s just for the early purchases that they are offering this.

- As of September 18, the gift card exclusion was in there. It’s not clear if it got added on the 16th, 17th, or 18th.

- One report of a purchase on the 22nd being given this one-time courtesy, but another report of a purchase on the 20th that was not given the courtesy. Apparently, it’s not just the dates that matter.

- They’ll let you send in receipts to prove that the purchase was a non-gift card purchases.

- Orensmoneysaver got an email on an odd-dollar purchase at Staples, so it’s not just the $504.95 purchases being denied. In fact, his purchase wasn’t even a gift card purchase at all. Other people report the same. They are just assuming high-dollar purchases are gift cards. (Yes, this may become a customer service nightmare for Discover.)

- In the first email posted above, they mention that the 10% bonus is not earned on ‘the gift card portion of your purchase’. Can you get the 10% on the activation fees? 😉

Is Discover maybe checking if you bought a GC based on sales tax? My online transaction history has a “Complete Transaction details” tab, that I can pull down and it shows me “Sales Tax Amount”. They could easily write a program to check location, check sales tax, then calculate what should have been collected. Has anyone seen this discussed anywhere yet?

Whatever algorithm Discover is using, I assume they’re using one that “works” in all states.

There are states without sales tax, so I doubt your theory.

I made a purchase on Sept. 29 and on Sept. 30, on 2 accounts, and got the e-mail on 11/14/15 telling me they would honor the 10% but all future gift card purchases would not receive the 10%. I purchased some small items with each gift card purchase so it would not be an even 505.95.

If Discover is willing to follow up with the merchant on our behalf to obtain receipts, then we should flood them with requests to do so.

anthonyjh21,

I’m pretty certain that the majority of people that didn’t keep their receipts (or claim not to have them) were hoping to play ignorant and assumed that Discover would never have the “nerve” to have people prove they weren’t breaking the rules.

Depends on which version of this story you think is true. Right now, if you take FT posters at their word, it would seem to me they’re randomly flagging everything including random lower amount purchases that were 100% free of GCs including before. I don’t keep misc or grocery shopping receipts for anything lower than a $100 personally. I ALMOST switched to a grocery story that accepted AP just for this deal and I’d be pissed if that happened to me. Now, if you assume those many posters are simply piling on with lies to make discover look like they’re persecuting everyone, it’s more likely larger purchases only are being flagged. In which case, of course, who wouldn’t keep receipts? I believe Oren’s version of the story though in that I don’t think any GC’s were involved. The larger point though is the guilty until proven innocent approach of Apple/Discover is only okay if it’s fairly accurate and I feel on that front it is not. I think when they roll into October we’ll know more. Pretty sure this is a really poor knee jerk reaction when they saw the numbers rolling in and some detached corporate A-hole decided to just throw the baby out with the bath water. I’m not complaining because I knowingly only did VGC purchases and lost, but seems like a strong presence of others that are getting needlessly caught up in this mess.

I don’t read FT so I have no idea what’s been said over there. Has anyone that DID NOT purchase any gc using AP received that email? As I wrote above I bet Oren made gc purchases in OTHER transactions besides the Staples ones he wrote about. If so, that is a very good reason for them to flag all of his purchases. If he did not make any gc purchases at all I agree with your points.

Like other posters, I keep receipts because they provide other benefits such as purchase protection or the like.

With respect to FT, you have to separate the wheat from the chaff, and when it comes to MS — which is not totally legal nor illegal — you have to expect that many of the posters in that area aren’t the most ethical or trustworthy so you have to use extra caution.

After all, going to WM and claiming that your gift card is a debit card — even if technically accurate — is the first step down a slippery slope.

With respect to grocery receipts, I’ll just note that with one of my stores — ShopRite — you can now pull up your receipts online.

I would guess that this application is available to other stores, as well, so again, the sob stories are a but much, IMHO, especially when it comes to large ticket items. If they did not keep a receipt for an IPAD or phone purchase, it is their fault and they should improve their record keeping skills.

I spoke to them regarding the receipt problem.they said the merchant is the one handing out cashback bonus,and they can send letter asking the merchant 4 receipts .Most importantly,discover does not have access to lv3 data,and so it appear apple is the one flag the transaction,as they said apple also pay out the cashback bonus.i already maxed out the limit by paying my phone bill and every one i know lol

Lots of conflicting info coming out… sounds like CSR’s just making stuff up or repeating hearsay when they don’t officially know anything of what goes on behind the curtains either. Truth is no doubt somewhere in between, but highly doubt the merchants, of which there are many large and small, are footing this bill. More than likely it’s all Apple/Discover with one of them driving the automated review and flagging of transactions(most likely Apple but who knows). Point is it’s bad news all around for anyone that hit this deal legit or otherwise. If I had been all above board with transactions, I’d be infuriated with the crap they’re making people go through…. but I didn’t so… darn, oh well.

I think that when people have been told the “merchant” is footing the bill, that it is likely Apple Pay, and not the merchant who one bought the stuff from.

As others have noted, that is how most of these sorts of promotions are conducted, and if a CSR provides additional detail leading one to believe that is truly is the store that you bought it from, they are either misinformed or misconstruing what they were told or both — as others have noted with AMEX offers, it is the “merchant” in question that usually underwrites the majority of the cost of the program.

Good point and that makes sense. Although… you’d think Discover would, at some point, start pushing back on said merchant when it protests everything and ticks off its customers. Curious to see how this all ends up. Thinking of going for a round 2 and with the reselling angle.

Hi,I talked to the CSR about this 10% cash back promotion. Because I bought 2 iphones in 2 transactions on SEP-25 and SEP-26, but I just got only one 10% cash back in this month statement. So the CSR told me the whole process about this promotion. First,the apple pay system allowed them to get the whole transaction from the merchant,meanwhile,they would provide the whole information to APPLE(CSR said the whole infomation -this maybe the reason why they can get the detail for the gift card purchase and maybe for apple should also get the detail from apple pay). And Apple would match the transaction data they had and after that,APPLE would figure out how much they should give back to Discover. Especialy,CSR said that most of this 10% promotion was sponsored by APPLE. After getting the money,Discover would credit to the statement matching with the transaction #. This is the whole process so far I know. Thanks!

That’s very interesting if that is true. I figured they were each paying part of it but had no idea that Apple was footing most of the bill. I guess they have plenty of cash since they pay a fairly small dividend and charge obscene prices.

https://help.consumerfinance.gov/app/creditcard/ask

I got a one time exception email for a $475+fee GC purchase at WG on 9/22. None for later purchases. While I got the email, my 11/5 statement did NOT include the 10% back on this. I also did not receive 10% back on a $65 purchase on 9/27 at WG. No email on that though, just doing the math.

They reward the cash 2 cycle after the transaction

I saw it but didn’t want to comment much.

Sure, piggies get what’s coming to them, but Parker and others make some very good points about pushing the onus onto the consumer to demonstrate a legitimate charge — that seems to me unfair — if there was any verbiage about how one actually obtains the rebate/credit.

If there is language essentially stating that is is a pass through, then one should be upset.

However, if the language is silent — then they can enforce however they wish, I suppose.

I simply love the outrage of some — and probably many — who knowingly purchased gift cards in contravention of the rules and are now expressing their anger — it is misplaced and falls squarely on the shoulders of those looking in a mirror.

Parker is correct and honest with his thoughts re gift cards, and others should be as well.

If Discover is implementing such a procedure on all purchases and they are silent on proof, then they might prevail — this would be another instance of too good to be true and over-subscribed.

I sat at this Discover stuff because I don’t feel the need to have the latest electronic toy, or credit card with sign up bonus, etc.

Further, I don’t MS, so for me, sure 10% back is nice, but if I were to make all my online purchases with a card issuer/bank I have no experience with, it does mean cannibalizing my purchases with cards and issuers that I have experience with and which I also aim to meet minimum spends with and regular spend for bonus categories.

The 1 year 10% off was not enough of a draw to yours truly who does not MS, nor does any re-selling.

So, adding yet another credit card to my or my partner’s portfolio coupled with the above reasons caused me to sit this out — and for the foreseeable future, as well.

Sorry that others have gotten ensnared into this seeming debacle, but sometimes too good to be true, turns out that way.

In any event, good luck to those trying to streamline or extricate themselves from this matter as I do sympathize with the plight that most of you find yourselves.

Welcome to the circus Horace!

I might protest their request for receipt and escalate to have them produce proof. Someone on FT said they called, got a supervisor on the line, and said they could/would contact WAG to get original receipts on their behalf which would take up to 30 days. We’ll see how this shakes out, but if I get the feeling Discover is really just dumping this back on all consumers that made large purchases, I might pile it on them out of principle even though I likely won’t get anything in return.

Parker, like I said you make some valid points and also are the point of reason when it comes to MS activities — sometimes you win them and sometimes not.

Here is a case where the promoter changed the terms and gave notice of same and yet some people blithely went forward whatever the consequences.

As has been the case with MS activities and other “too good to last promotions,” a feeding frenzy was created and as with previous MS activities, it was too good to last.

Anyone getting into this thinking that it was a sure lock was an idiot, especially those who state that other credit card companies let things slide, so Discover should, as well!

That’s hilarious.

As usual, too many to the trough gets the entire thing shut down, because like it or not, these companies are not in the business of subsidizing one’s expected lifestyle, no matter how deluded some wish to think — they are in the business of making $$.

Some take a hit to increase market share — witness the attractive perks with the Citi Prestige card which many think will not last, and that is what Discover did, as well, however, they amended the rules at the start of the promotion — that should have been a red flag to others that they might just be serious about not paying out for these sorts of purchases and may make you jump through hoops to prove that this was not what you bought.

Again, some things that seem too good to be true, may be too good to be true, or at least in the context of the modus operandi that has governed such occasions in the past.

that is the whole point. it seams they are flagging all large purchases or all big spenders. that is wrong and should not be tolerated.

Hey doc can you contact discover about privacy issues and inconvenience this all will cause. maybe they have official response for you.

There is no privacy issue .

Really? So if bought a gift for my mistress that will be stored somewhere on discover computer or maybe discover rep knows my wife. Hm what then? Or maybe i dont want my grocery and medicine list and penis size (based on condom purchase) be stored and reviewed

Then use cash,you gave up ur privacy when u used plastic.there is no law against cc company knowing what u purchased,they even pay merchants for those data

Guys i know. I am just saying that if discover stated in terms that they want to look at our receipts everyone would go nuts on them. That is exactly what they are doing.

Absolutely on the $$.

As you have noted, the purchases of many are scrutinized and sold to various marketers because of one’s credit card, and the use thereof.

Well at least discover apple pay now work at tmobile,im gonna prepaying 3_4k ,my bill cost 700$ a month.so discover would save me 154$ per month.no complain here

How many people are on your plan?

6,but i have like 10 phones finance,buy and sell,maybe i should buy phone at tmobile and resell,lol.