Discover has launched ‘Discover it Business card‘, the new card has the same earning structure as the Discover it Miles personal card.

Contents

Card Basics

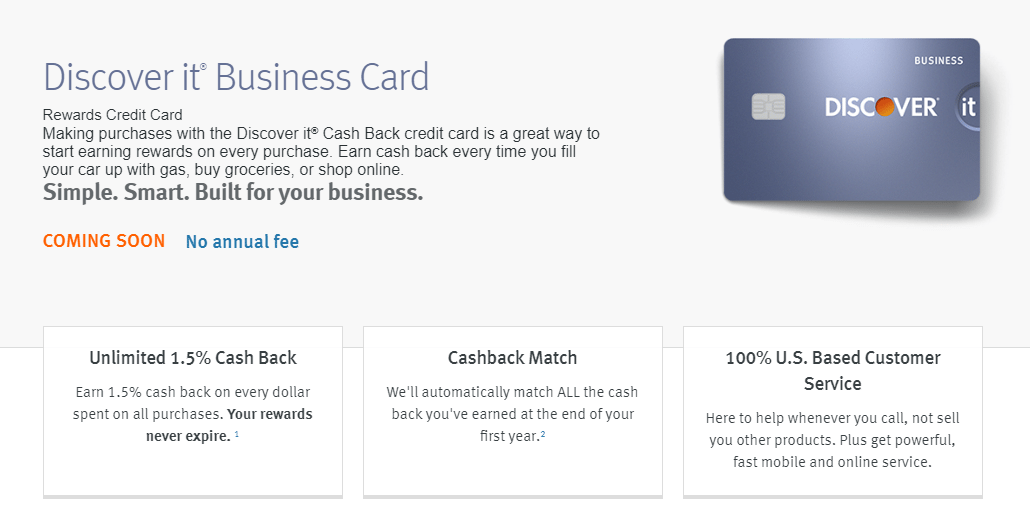

- Card earns 1.5% cash back on all purchases

- All the cash back you earn in the first year is doubled (making it 3% cash back the first year)

- No annual fee

- No sign up bonus

- 0% introductory APR for the first 12 months

Our Verdict

This card really isn’t that interesting, I can’t see any compelling reason to apply for it over the Discover it Miles card. That card also comes with a $75 sign up bonus and an annual $30 WiFi credit and has the same exact earning structure with no annual fee. Keep in mind Discover does report business cards to your personal credit report, so picking this card up wouldn’t even be useful for those trying to stay under Chase’s 5/24 rule.

Hey William Charles – If I have had (1) personal Discover Miles It card opened 2 months ago, will they let me get a business card using a business EIN for a sole-proprietorship or is it also tied to my personal SSN? I tried to get a second discover personal card but got denied 3 weeks ago. 🙁

William Charles – If I have had (1) personal Discover Miles It card opened 2 months ago, will they let me get a business card using a business EIN for a sole-proprietorship or is it also tied to my personal SSN? I tried to get a second discover personal card but got denied 3 weeks ago. 🙁

Not too sure sorry.

Is Discover sensitive to a lot of recent accounts or inquiries?

welp (i have 2 discover cards) and just tried to apply and got this declination : ANOTHER APPLICATION IS BEING PROCESSED OR WAS RECENTLY PROCESSED

Be aware that Discover (along with Cap One) is one of the two main credit card banks that reports its business cards to the main credit bureaus. So if you’re trying to get below Chase’s 5/24 (which counts cards on your credit report), the fact that this is a business card won’t help, because it’s from Discover.

Will I get my hard pulls combined if I apply for this card and a Discover It card on the same day?

Not sure if they even allow that

Discover has a restriction of only a maximum of two cards per user. Does this also apply to business cards or could i have two personal cards and one biz card?

Be the data point you seek. Apply and let us know…

This would be the reason for me

Not sure yet, try and let us know =)

No Foreign Transaction Fees I read in other blogs. If true it may be useful to some.

No Discover card has FTF. I’m currently getting 5% at restaurants in Europe (where they accept it).

Discover cards don’t have FTF’s, but the acceptance rate is so low it’s not really that useful IMO

I spent 2 months in Central and South America this summer and was shocked at how many merchants accepted Discover. There were very few who didn’t take it!

Free loan with 3% kicker for the first year sounds pretty good. After that, not so much.

Can you name a few Biz intro 0% Cards with 1.5% (or more) CashBack? The only one I know is Ink Unlimited but I’m over 5/24 (along with most people). The personal reporting is the only thing holding me up from going for the Discover Biz.

Honestly, who gives a crap about interest rates on credit cards? If you’re paying interest, you shouldn’t own a credit card…

“0% introductory APR for the first 12 months”

That’s the reason to apply for it over the Miles Card.

Also, Miles Card you can only redeem for Travel purchases my main (only) Travel Purchases I pay for with a CC are Flights (basically just the TSA Fee) and Rental cars. I pay for both with Ink Preffered because with car rentals it gets primary coverage, and with flights many travel delay benefits, etc. that It Miles wouldn’t have.

I’ve had about $200 worth of Travel Points banked with BofA for 6 months now, still haven’t used them. I will eventually, just hard to do.

Huh the Miles card by Discover is just a gimmick and it is cash back and doesn’t have to be redeemed for travel only purchases it is straight cash back as stated… Also the miles card has I believe a 14 month 0% apr as well.. I see no real benefit of this card unless Discover actually gives useable vs. their known small CL’s to make this a viable business card. I see no need in it since reports to personal credit, but others might. Basically the Miles card with a small sign-up bonus and a shorter 0% apr..

What do you consider a small limit? They gave me $14k to start on my Discover personal and reached $23k in about a year. For me, they seemed similar to other cashback cards except for Amex who has always given stellar limits.

Granted, small businesses have different needs and if you need $40k+ biz limits then yes, Discover will probably be too low.

Usually people with alot of credit and well established profiles 800+ scores and say a few hundred thousand in available credit and significant incomes usually get pretty bad starting limits with Discover, although there are some people that get decent limits. Discover likes people that carry balances, not transactors persay and more-so prefer people that are new or in the rebuilding phases of credit from a recent BK usually seem to get better SL than people with well established credit, incomes and scores. Just my 2 pennies. 14k SL for you isn’t bad for Discover, usually personal just takes along time to build up to a 20k+ limit. All depends on what a useable limit to the cardholder is considered as I consider 4k a toy limit personally which alot of people get with spotless profiles and high incomes

Yup, I laughed when I saw $4K limit. I called them and asked (seriously) if they didn’t really mean $40K. Once I saw they were serious, I knew MSers weren’t going to get much joy.

Can anyone confirm you can only redeem Personal It Miles towards travel purchases? I was under the impression it could also be used as cashback. I plan on applying for the Discover Miles in October and this would certainly change my plans.

You can get cash as a transfer to your bank account. To use it as a statement credit it has to be redeemed for a travel purchase made in the last 180 days. I have to imagine most people just take the deposit to a bank account.

You can use it for cash back

Extra year warranty and price protection always had me reaching for my Discover card. Now it’s used strictly for bonus categories. They really shredded most of their benefits.