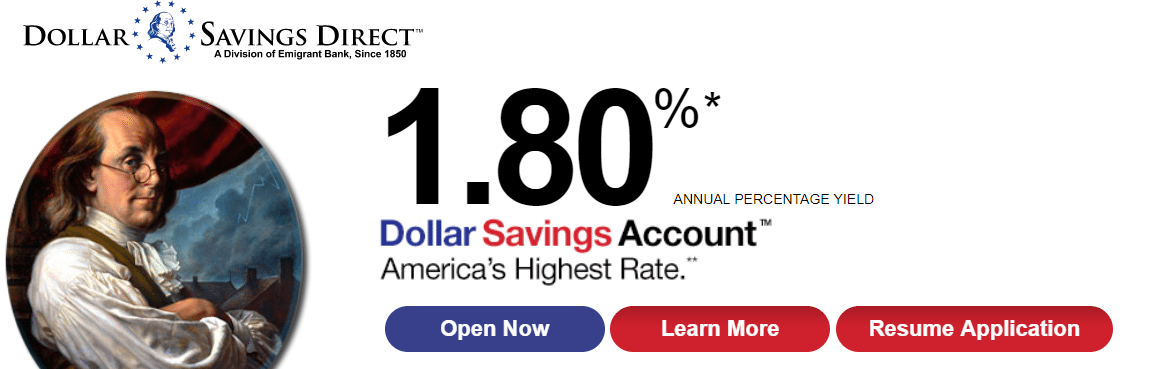

Update 02/27/18: Rate is now 1.8% APY, highest basic savings account rate.

Update: 01/03/18 rate is now 1.6%

Rate is now 1.5% APY

Offer at a glance

- Interest Rate: 1.8% APY

- Minimum Balance: None

- Maximum Balance: Unknown

- Availability: Nationwide

- Hard/soft pull: Unknown

- ChexSystems: Unknown

- Credit card funding: None

- Monthly fees: None

- Insured: FDIC

The Offer

- DollarSavingsDirect offers a 1.8% APY account, the account doesn’t have any requirements to receive this rate.

Avoiding Fees

This account has no monthly fees to worry about.

Our Verdict

DollarSavingsDirect is a division of Emigrant Bank, they have offered top rates in the past only to cut the rate dramatically at a later time. In terms of the rates DSD has offered, the previous high was 0.9% and they offered that for only four months according to deposit accounts. I personally don’t think there is a lot of value in chasing these basic savings account rates, if you don’t have the time for rewards accounts then pick one account that has offered a high APY for a long time and stick with that and instead focus on bank account bonuses.

That being said, this is the best basic savings rate currently and doesn’t have any minimum deposit required.

I love how they advertise that they have America’s highest rate when they haven’t for months.

Please put in the warning that this account does NOT allow ACH pull from external bank. The only way to withdraw is ACH push out.

^ This! I just lost out on the Northern’s 2.24% promo window because of this.

The interest rate is the only good thing about dollarsavings. Logging on to the online account is near imposable and it will not work with any auto aggregate programs. Why other online banks work fine but dollarsavings cannot is disturbing This makes dealing with dollar aggravating so if the rate drops there is absolutely no reason to have an account there unless they can hire some security people that have at least a small amount of intelligence and or skill.

Some due diligence to consider: DollarSavings Direct/ Emigrant Bank is ranked as one of the 20 riskiest banks with assets over $1 billion based on its “Texas Ratio” according to DepositAccounts.com. As of Q3 2017, the bank had a ratio of at risk loans (90+ days past due and not government backed) to total bank assets of 18.58%. That’s a total of $1.2 billion in at risk loans against bank assets of $6.58 billion. Though the bank is insured, I wouldn’t want to deal with filing an FDIC claim in the event the bank collapes. With plenty of healthy banks offering the same or better interest rates I’d take a pass on this!

There’s one bank offering the same rate and another offering a better rate. Not exactly a lot of banks. As you mentioned it’s insured.

This is now earning 1.80%, which is the highest rate among basic high-interest accounts as of today.

For anyone that has a Dollar Savings Direct account, please download the Prism app on your smart phone then link your Dollar Savings Direct account in order to monitor your balance. Thanks

Typo in your update today: 17 should say 18

Thanks, fixing now

a few months ago, they increased to 1.50 Am I missing some fine print?

Thanks,

Diane

a few months ago, they increased their rate to 1.50 no limits or requirements.

I like this one. Am I missing something? Diane

Awful. Had this account since 2008. Because my funding account has long been closed and they still want a mailed-in check or statement to link other external accounts, I opted to close it out. It took 5 biz days (contrary to the 1-3 biz days quoted in the account closing message) for them to just zero out my balance, a substantial sum. And given the 5-7 biz days they quoted to mail the check, I’d be losing at least half a month of interest on the five figure deposit. One forfeits all acrrued interest if closing the account during the month, and it’s really no different if closing the account on the 1st of the month either, given my first-hand experience.

Why couldn’t you just ACH out all the money and then close it?

They block ACH pull initiated from another bank. The only way to ACH out is a push from their end to your linkedin external account(s), for which you have to mail/fax in a voided check or statement. In this day and age, not worth the headache.

This is very helpful info! Thanks!