Update 7/27/20: Ontime Netflix payments can now be added to Experian Boost.

Original post: Consumer reporting agency Experian has launched something called ‘Experian Boost‘. Experian boost allows consumers to add their utility and telecom bills to their credit report, to do so you need to give Experian access to your online bank account. If these bills have been paid on time then your score will increase. One nice thing about Experian Boost is that after adding access your FICO score is updated in real time.

Experian Boost will officially launch in early 2019, but you can register now for early access. You have to sign up for a free Experian membership to be eligible (credit card is not required). Experian states that according to their research 75% of consumers with a FICO score below 680 saw an immediate improvement and 10% of consumers who previously had a ‘thin credit file’ (unable to generate a credit score) became scoreable after using Experian boost.

The downside to Experian boost is that you need to provide Experian with additional data and access to your online accounts. It isn’t clear how that access is provided, is Experian handling that directly or are they using a known third party (similar to the access provided to Mint and other fintech companies). Given that competitor Equifax had data breached consumers have a right to be concerned over handling over this information. A better solution would be allow telecom and utility provides the ability to furnish this data, they would have an incentive to do so as it would mean consumers were more likely to pay bills on time.

I just signed up for Experian and find them slimy as hell. Constant barrage of sale pitches for their paid upgrade service and this boost business. Unfortunately I have more hard pulls with them than TransUnion and Equifax combined, and my score is significantly lower (at least per Credit Karma). But just on principle, I’m not going to be extorted into giving them my bank account info in return for the promise of an inflated score.

I’m curious to know if the “boost” even increases your credit score in any meaningful way. Does it actually change the fundamentals of your credit rating, or just the manipulated score they show you?

Anyone notice any new accounts added to the credit report?

Correct me if I’m wrong, but I thought Netflix is prepaid, not post like utility bills, CCs, etc. If so, why would that factor into credit?

I added utility bills a few months back and my score actually went down 30 points. Customer service told me this happens to about 10% of people. I just had to remove them and my score returned to normal.

i had this for a short while on a barely-used acct and eventually let it unlink the acct. once you no longer give them access to your acct, they remove the boost. pretty worthless (to you) unless you have a big even coming up and you want to increase your score. you also have to keep in mind that not all creditors even use that specific score, so.

What could possibly be the downside to providing Experian access to my bank account?

Right? What could possibly go wrong? They already have my address, SSN, DOB, employment info. It’s not like Equifax suffered a giant hack and everyone got their info leaked.

/s

I like your name. SoFi sucks.

I thought about it today… but a nap sounded better.

Lol I added mine, took a few months before i got enough bills to factor in and then finally my score went up a whopping….0 points. I was blown away it didn’t even go up a tiny bit. It might work amazing for people with no credit history, but it did diddly dink for me.

Is there a way to add my Amex card so that Experian can include my bill payments that get paid automatically from my credit card?

Yes, the option to add a variety of accounts is available.

it’s just like using plaid or a similar svc to link an external bank. they have lots of banks and cc companies. just search.

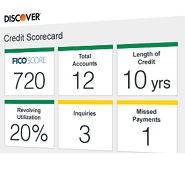

My score is high enough and my file is thick enough for this to be unlikely to make much difference anyway, and I didn’t want them to have access to my primary bank account’s transactions. But I decided to sign up using a dummy bank account with no meaningful transactions in it, just to get free access to my credit score there. We’ll see if it updates the score next month. Probably an unnecessary experiment since it was just 1 point different than the one on Discover CreditScorecard for me on the same day (they’re supposed to be the same score, EX FICO 8), but oh well, I was curious anyway.

I assume that it will only work if you’ve paid your utilities through that account. But, perhaps it is a good experiment to see how long it takes for new payments to affect the score.

So far so good – it gave me access to my Experian FICO 8 score last month on experian.com, and I got an updated score this month on the 1st when the Experian free report also updated. If only I’d started my Discover creditscorecard.com updates in the middle of the month instead of near the beginning of the month, I’d now have biweekly free access to that score. I still have not paid any bills from that linked bank account.

So, did you get a score boost?

have you tried canceling and then using a diff email to sign up? i’ve done that bc i was being greedy and was hoping to get 3 scores from discover lol. it just keeps your original acct closed and it will create a new acct for you.

yes, pretty unnecessary. unless it’s changed since i signed up about 6 months ago, you need to have at least 3 monthly payments from that creditor. read the messages that appear as it’s going through your bank acct. the messages tell you how everything works. you also can get your score w/o providing your bank acct. they’re known for letting ppl churn their weekly trial. i haven’t paid in a yr and get a score refresh every day.

It doesn’t specify if insurance bills count. I assume they don’t?

Nope, utilities only.