Contents

The Offer

Fidelity Investments is offering eight different bonuses in the form of cash, free trades, gift cards, or airline miles for new or existing customers who open and fund an individual retirement account (IRA) or nonretirement brokerage account, or add funds to an existing account.

The majority of these promotions employ a tiered bonus structure whereby deposits at the highest eligible tier of each offer will yield the maximum potential bonus value.

Due to the sizeable investments required to meet these bonus requirements, as well as the necessarily longer-term investment that a retirement vehicle like an IRA requires, it is wise for consumers to research brokers and account options and chase a quality broker in the long-term, versus a high bonus in the short-term. Fidelity is a well-regarded broker that won Kiplinger’s 2014 pick for best online broker for its combination of low commissions and fees, diversity of investment options, tools, and professional guidance.

Master List of Bonuses

| Bonus | Deposit | Receive | Return on Investment (pre-tax, shown for cash value bonuses only) |

| Deposit Bonus up to $2,500 | $50,000+ | $200 | .4% |

| $100,000+ | $300 | .3% | |

| $250,000+ | $600 | .24% | |

| $500,000+ | $1200 | .24% | |

| $1,000,000+ | $2500 | .25% | |

| One Year of Commission-Free Fidelity trades | $50,000+ | 60 commission-free trades for one year | |

| $100,000+ | maximum of 100 commission-free trades for one year | ||

| 200 Commission-Free Fidelity Trades with Active Trader Pro Platform | $50,000+ | 200 commission-free trades for 90 days, including access to the Fidelity Active Trader Pro Platform | |

| 200 Commission-Free Fidelity Trades | $50,000+ | 100 commission-free trades for 90 days | |

| $100,000+ | 200 commission-free trades for 90 days | ||

| Apple Gift Card up to $500

|

$75,000+ | $100 gift card | .13% |

| $150,000+ | $300 gift card | .2% | |

| $300,000+ | $500 gift card | .17% | |

| AAdvantage award up to 50,000 miles | $25,000+ | 15,000 miles | |

| $50,000+ | 25,000 miles | ||

| $100,000+ | 50,000 miles | ||

| Delta SkyMiles award up to 50,000 miles | $25,000+ | 15,000 miles | |

| $50,000+ | 25,000 miles | ||

| $100,000+ | 50,000 miles | ||

| United MileagePlus award up to 50,000 miles | $25,000+ | 15,000 miles | |

| $50,000+ | 25,000 miles | ||

| $100,000+ | 50,000 miles |

Bonuses for IRA and nonretirement brokerage accounts

| Bonus | Deposit | Receive | Return on Investment (pre-tax, shown for cash value bonuses only) |

| Deposit Bonus up to $2,500 | $50,000+ | $200 | .4% |

| $100,000+ | $300 | .3% | |

| $250,000+ | $600 | .24% | |

| $500,000+ | $1200 | .24% | |

| $1,000,000+ | $2500 | .25% | |

| One Year of Commission-Free Fidelity trades | $50,000+ | 60 commission-free trades for one year | |

| $100,000+ | maximum of 100 commission-free trades for one year | ||

| 200 Commission-Free Fidelity Trades with Active Trader Pro Platform | $50,000+ | 200 commission-free trades for 90 days, including access to the Fidelity Active Trader Pro Platform | |

| 200 Commission-Free Fidelity Trades | $50,000+ | 100 commission-free trades for 90 days | |

| $100,000+ | 200 commission-free trades for 90 days |

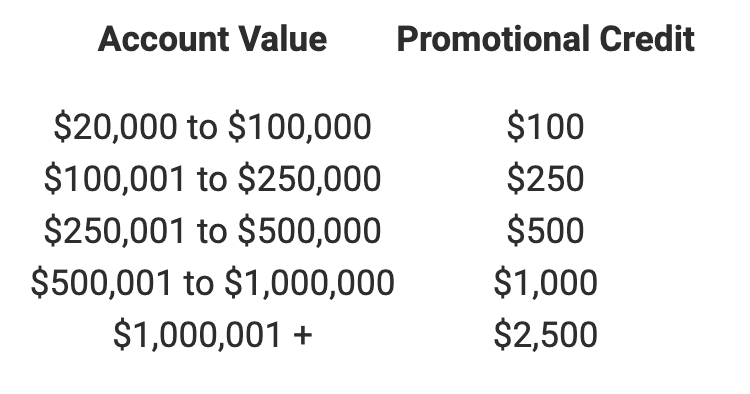

Deposit Bonus up to $2,500

To receive this bonus you must do the following:

- Be a new or existing Fidelity customer.

- Register at https://rewards.fidelity.com/offers/cashrewards.

- Designate an existing Fidelity IRA or brokerage account or open and fund a new Fidelity IRA or brokerage account within the qualifying period of 60 days.

Rules:

- Eligible accounts include Fidelity nonretirement (individual or joint) or IRA (rollover IRA, traditional IRA, Roth IRA, SEP-IRA) brokerage accounts.

- Funding must be from a non-Fidelity source. Rollovers from a former employer’s Fidelity-record kept savings plan do not qualify.

- You must maintain the minimum qualifying account balance for at least 9 months from the date on which the bonus is received, or Fidelity may charge you the cost of the bonus.

- You may not use qualifying deposits to purchase insurance or annuity products offered by Fidelity within 60 days of receiving the bonus, or Fidelity may charge you the cost of the bonus.

- You will need to pay any taxes resulting from this cash bonus.

- Offer only valid for U.S. residents

- Offer is not available for the following account types/products:

- mutual fund-only accounts

- business accounts

- trust accounts

- fiduciary accounts

- college investment trust accounts

- 529 college savings plan accounts

- Annuities

- Fidelity accounts managed by Strategic Advisers, Inc.

- Institutional Wealth Services (IWS) clients

- clients of registered investment advisors working with Fidelity Investments

- Stock Plan Services account

- Fidelity brokerage accounts and some IRA accounts require a minimum opening balance of $2,500.

- Offer is nontransferable

- Limit one per individual per rolling 12 months

- May not be combined with other offers

One Year of Commission-Free Fidelity trades

To receive this bonus you must do the following:

- Be a new or existing Fidelity customer.

- Register at fidelity.com/freetrades.

- Open and fund a new Fidelity IRA or brokerage account or add funds to an existing account within the qualifying period of 60 days.

Rules:

- Eligible accounts include Fidelity non-retirement (individual or joint) or IRA (Rollover IRA, Traditional IRA, Inherited IRA, Roth IRA, SEP-IRA) accounts.

- Funding must be net new assets from a non-Fidelity source, but rollovers from a former employer’s Fidelity-record kept savings plan are treated as an external source for this offer. Net new assets are defined as external new money in minus money out.

- Commission-free trades are limited to online domestic equity trades, and do not include options.

- You must maintain a minimum account balance of $50,000 of net new assets at least nine months from the date the trades are received, or you may be charged commission fees retroactively based on the commission rate under Fidelity’s Commission & Fee Schedule.

- Offer only valid for U.S. residents

- Offer is not available for the following account types/products:

- business accounts

- trust accounts

- fiduciary accounts

- college investment trust accounts

- 529 college savings plan accounts

- Annuities

- Fidelity accounts managed by Strategic Advisers, Inc.

- Institutional Wealth Services (IWS) clients

- clients of registered investment advisors working with Fidelity Investments

- Stock Plan Services account

- Fidelity brokerage accounts and some IRA accounts require a minimum opening balance of $2,500.

- Offer is nontransferable

- Limit one per individual per rolling 12 months

- May not be combined with other offers

200 Commission-Free Fidelity Trades with Active Trader Pro Platform

To receive this bonus you must do the following:

- Be a new or existing Fidelity customer.

- Register at https://rewards.fidelity.com/offers/ATP200free.

- Open and fund a new Fidelity IRA or brokerage account or add funds to an existing account within the qualifying period of 60 days.

Rules:

- Eligible accounts include Fidelity non-retirement (individual or joint) or IRA (Rollover IRA, Traditional IRA, Inherited IRA, Roth IRA, SEP-IRA) accounts.

- Funding must be net new assets from a non-Fidelity source, but rollovers from a former employer’s Fidelity-record kept savings plan are treated as an external source for this offer. Net new assets are defined as external new money in minus money out.

- Trades must be used within 90 calendar days of being received.

- Commission-free trades are limited to online domestic equities and options. Options trades are limited to 20 contracts or less per trade. Beyond these limits, standard commission rates apply.

- You must maintain a minimum account balance of $50,000 of net new assets at least nine months from the date the trades are received, or you may be charged commission fees retroactively based on the commission rate under Fidelity’s Commission & Fee Schedule.

- Offer only valid for U.S. residents

- Offer is not available for the following account types/products:

- business accounts

- trust accounts

- fiduciary accounts

- college investment trust accounts

- 529 college savings plan accounts

- Annuities

- Fidelity accounts managed by Strategic Advisers, Inc.

- Institutional Wealth Services (IWS) clients

- clients of registered investment advisors working with Fidelity Investments

- Stock Plan Services account

- Fidelity brokerage accounts and some IRA accounts require a minimum opening balance of $2,500.

- Offer is nontransferable

- Limit one per individual per rolling 12 months

- May not be combined with other offers

200 Commission-Free Fidelity Trades

To receive this bonus you must do the following:

- Be a new or existing Fidelity customer.

- Register at https://rewards.fidelity.com/offers/200free.

- Open and fund a new Fidelity IRA or brokerage account or add funds to an existing account within the qualifying period of 60 days.

Rules:

- Eligible accounts include Fidelity non-retirement (individual or joint) or IRA (Rollover IRA, Traditional IRA, Inherited IRA, Roth IRA, SEP-IRA) accounts.

- Funding must be net new assets from a non-Fidelity source, but rollovers from a former employer’s Fidelity-record kept savings plan are treated as an external source for this offer. Net new assets are defined as external new money in minus money out.

- Trades must be used within 90 calendar days of being received.

- Commission-free trades are limited to online domestic equities and options. Options trades are limited to 20 contracts or less per trade. Beyond these limits, standard commission rates apply.

- You must maintain a minimum account balance of $50,000 of net new assets at least nine months from the date the trades are received, or you may be charged commission fees retroactively based on the commission rate under Fidelity’s Commission & Fee Schedule.

- Offer only valid for U.S. residents

- Offer is not available for the following account types/products:

- business accounts

- trust accounts

- fiduciary accounts

- college investment trust accounts

- 529 college savings plan accounts

- Annuities

- Fidelity accounts managed by Strategic Advisers, Inc.

- Institutional Wealth Services (IWS) clients

- clients of registered investment advisors working with Fidelity Investments

- Stock Plan Services account

- Fidelity brokerage accounts and some IRA accounts require a minimum opening balance of $2,500.

- Offer is nontransferable

- Limit one per individual per rolling 12 months

- May not be combined with other offers

Bonuses for nonretirement brokerage accounts only

| Bonus | Deposit | Receive | Return on Investment (pre-tax, shown for cash value bonuses only) |

| Apple Gift Card up to $500

|

$75,000+ | $100 gift card | .13% |

| $150,000+ | $300 gift card | .2% | |

| $300,000+ | $500 gift card | .17% | |

| AAdvantage award up to 50,000 miles | $25,000+ | 15,000 miles | |

| $50,000+ | 25,000 miles | ||

| $100,000+ | 50,000 miles | ||

| Delta SkyMiles award up to 50,000 miles | $25,000+ | 15,000 miles | |

| $50,000+ | 25,000 miles | ||

| $100,000+ | 50,000 miles | ||

| United MileagePlus award up to 50,000 miles | $25,000+ | 15,000 miles | |

| $50,000+ | 25,000 miles | ||

| $100,000+ | 50,000 miles |

Apple Gift Card up to $500

To receive this bonus you must do the following:

- Be a new or existing Fidelity customer.

- Register at https://rewards.fidelity.com/offers/tieredapplegiftcard.

- Open and fund a nonretirement brokerage account or add funds to an existing account within the qualifying period of 60 days.

Rules:

- Offer expires 12/31/14

- Eligible accounts for this offer include Fidelity non-retirement (individual or joint) brokerage accounts.

- Funding must be from a non-Fidelity source.

- You must maintain the minimum qualifying account balance for at least nine months from the date the gift card is issued, or Fidelity may charge you the cost of the gift card.

- You may not use qualifying deposits to purchase insurance or annuity products offered by Fidelity within 60 days of receiving the bonus, or Fidelity may charge you the cost of the gift card.

- Gift card is redeemable at any Apple store.

- Offer only valid for U.S. residents

- Offer is not available for the following account types/products:

- mutual fund-only accounts

- business accounts

- trust accounts

- retirement accounts

- fiduciary accounts

- college investment trust accounts

- 529 college savings plan accounts

- Annuities

- Fidelity accounts managed by Strategic Advisers, Inc.

- Institutional Wealth Services (IWS) clients

- clients of registered investment advisors working with Fidelity Investments

- Stock Plan Services account

- Fidelity brokerage accounts require a minimum opening balance of $2,500.

- Offer is nontransferable

- Limit one per individual per rolling 12 months

- May not be combined with other offers

AAdvantage award up to 50,000 miles

To receive this bonus you must do the following:

- Be a new or existing Fidelity customer.

- Register at https://rewards.fidelity.com/offers/aa.

- Open and fund a nonretirement brokerage account or add funds to an existing account within the qualifying period of 60 days.

Rules:

- Offer expires 3/31/15

- Eligible accounts for this offer include Fidelity non-retirement (individual or joint) brokerage accounts.

- Funding must be net new assets from a non-Fidelity source. Net new assets are defined as external new money in minus money out.

- You must maintain the minimum qualifying account balance for at least nine months from the date the award is received.

- Offer only valid for U.S. residents

- Offer is not available for the following account types/products:

- mutual fund-only accounts

- business accounts

- trust accounts

- retirement accounts

- fiduciary accounts

- college investment trust accounts

- 529 college savings plan accounts

- Annuities

- Fidelity accounts managed by Strategic Advisers, Inc.

- Institutional Wealth Services (IWS) clients

- clients of registered investment advisors working with Fidelity Investments

- Stock Plan Services account

- Fidelity brokerage accounts require a minimum opening balance of $2,500.

- Offer is nontransferable

- Limit one per individual per rolling 12 months

- May not be combined with other offers

Delta SkyMiles award up to 50,000 miles

To receive this bonus you must do the following:

- Be a new or existing Fidelity customer.

- Register at https://rewards.fidelity.com/offers/delta.

- Open and fund a nonretirement brokerage account or add funds to an existing account within the qualifying period of 60 days.

Rules:

- Offer expires 12/31/15

- Eligible accounts for this offer include Fidelity non-retirement (individual or joint) brokerage accounts.

- Funding must be net new assets from a non-Fidelity source. Net new assets are defined as external new money in minus money out.

- You must maintain the minimum qualifying account balance for at least nine months from the date the award is received.

- Offer only valid for U.S. residents

- Offer is not available for the following account types/products:

- mutual fund-only accounts

- business accounts

- trust accounts

- retirement accounts

- fiduciary accounts

- college investment trust accounts

- 529 college savings plan accounts

- Annuities

- Fidelity accounts managed by Strategic Advisers, Inc.

- Institutional Wealth Services (IWS) clients

- clients of registered investment advisors working with Fidelity Investments

- Stock Plan Services account

- Fidelity brokerage accounts require a minimum opening balance of $2,500.

- Offer is nontransferable

- Limit one per individual per rolling 12 months

- May not be combined with other offers

United MileagePlus award up to 50,000 miles

To receive this bonus you must do the following:

- Be a new or existing Fidelity customer.

- Register at https://rewards.fidelity.com/offers/united.

- Open and fund a nonretirement brokerage account or add funds to an existing account within the qualifying period of 60 days.

Rules:

- Offer expires 4/30/15

- Eligible accounts for this offer include Fidelity non-retirement (individual or joint) brokerage accounts.

- Funding must be net new assets from a non-Fidelity source. Net new assets are defined as external new money in minus money out.

- You must maintain the minimum qualifying account balance for at least nine months from the date the award is received.

- Offer only valid for U.S. residents

- Offer is not available for the following account types/products:

- mutual fund-only accounts

- business accounts

- trust accounts

- retirement accounts

- fiduciary accounts

- college investment trust accounts

- 529 college savings plan accounts

- Annuities

- Fidelity accounts managed by Strategic Advisers, Inc.

- Institutional Wealth Services (IWS) clients

- clients of registered investment advisors working with Fidelity Investments

- Stock Plan Services account

- Fidelity brokerage accounts require a minimum opening balance of $2,500.

- Offer is nontransferable

- Limit one per individual per rolling 12 months

- May not be combined with other offers

The Verdict

Unlike with traditional checking and saving account bonuses that afford relative liquidity of assets in those accounts as convenient, IRA and brokerage bonuses attach you to these accounts for a longer term through investment of considerable assets. Across the eight Fidelity bonuses we covered here, $25,000 is the lowest minimum deposit amount that can earn you a mileage bonus, and many of the bonuses require the qualifying assets to be held for at least nine months.

This is why Fidelity IRA and brokerage bonuses are a fine incentive for new or existing customers who are prepared to commit their assets to Fidelity in the relative long-run, but not necessarily for customers who have significant assets (particularly retirement assets) committed to another broker and only feel compelled to transition brokers because of a short-term bonus. Market fluctuations and investment risks that lead to losses could quickly far exceed the value of any brokerage bonus, so when selecting an IRA or traditional brokerage account, your confidence in a broker, its resources, and investment options should be of foremost importance. If you do not already have an IRA, opening one is worth your consideration as these retirement accounts offer tax advantages.

If you are naturally inclined to choose Fidelity as your broker and want to pursue one of these bonuses simultaneously, keep in mind that deposits at the low to mid tiers of the bonus structure, while lower in perceived bonus value, may actually yield a higher percentage return on investment than the highest tier deposit would yield. The Deposit Bonus up to $2,500 and the Apple Gift Card up to $500 are examples where the highest tier deposit does not yield the highest ROI in the bonus structure.

As an existing Fidelity customer who already has plans to roll-over a 401k to Fidelity, this bonus would be an intuitive benefit to consider exercising. The key here is that benefits of an IRA or brokerage bonus are best derived when they accompany organic investment decisions.

The AA offer is still valid, the expiration date was extended to 9/30/2015

Back in the day you were able to reuse the deposited money. Say you only have $25,000 if you deposited and withdrew it and repeated it 4 times you were able to get $100k in.

These days this method does not work and the money needs to stay in the account a minimum of 6 months or you risk the miles being clawed back.

Excellent review…Of course the ROI is before taxes…IMAO the AA and UA are the best bonuses for several reasons: 1) Mileage points are not taxed 2) I value AA and UA at about 2 cents each (this is very user dependent 3) I value Skypesos at about 1 cent or less

Thanks for sharing, James!

Your analysis of the cash bonuses is flawed since the effective return is dependent on the taxes you’ll pay when the 1099 is filed. Apple gift card is an idiotic choice. If you have need of airline miles, the ROI is likely the highest for most people – AA and UA are.worth about 1.5c (DL less) and no 1099 is filed on the value of those miles.

Thanks for your input Paul! Indeed, the ROIs noted are pre-tax to provide a gauge only. We have noted pre-tax in the ROI column headings so folks are clear.