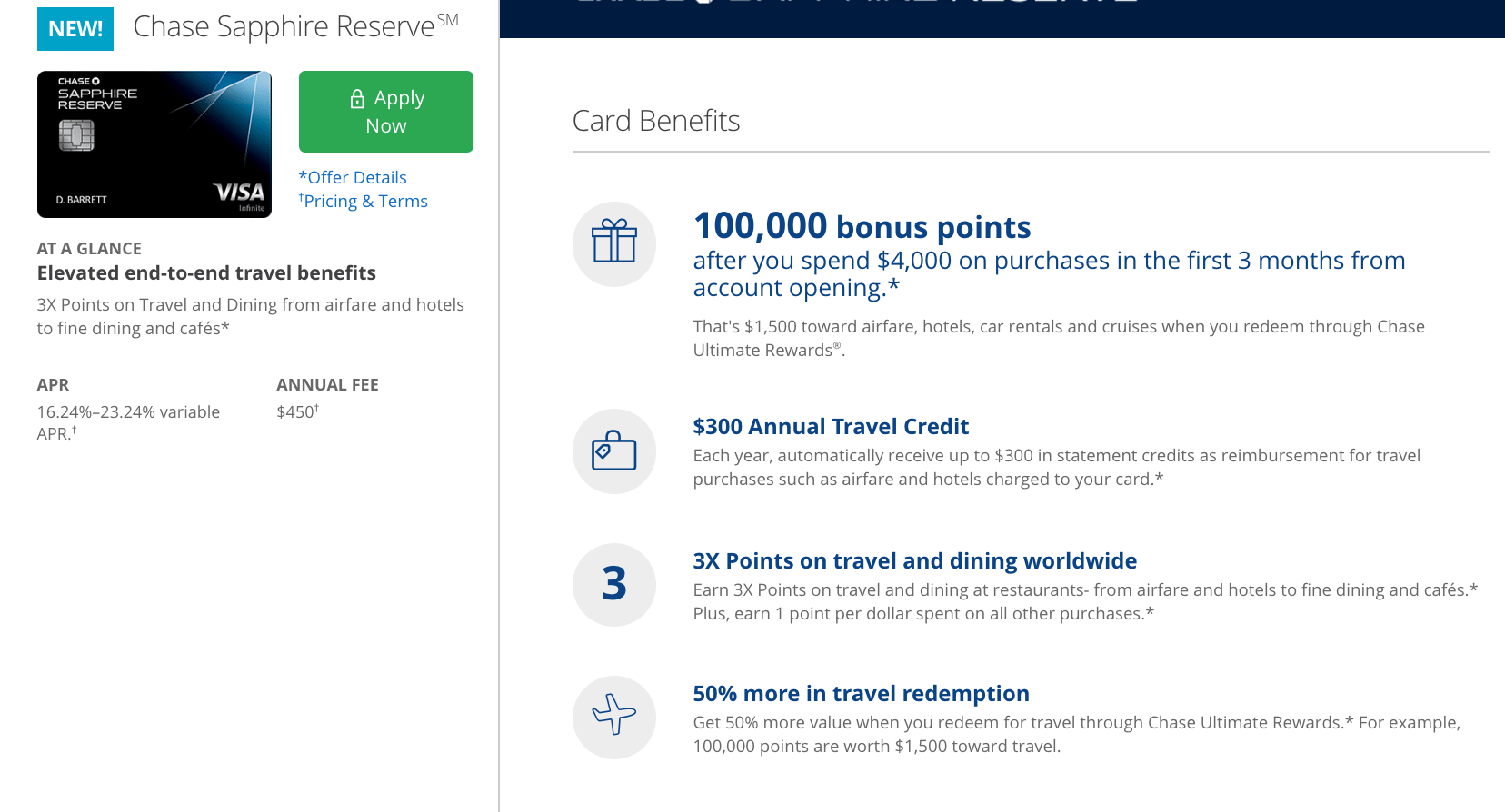

With all the hype of the release of the Sapphire Reserve card from Chase, it…well…was never officially released on the Chase site until just a few moments ago.

Direct Link to Sapphire Reserve on Chase Site

It now shows up with the signup bonus showing. Some people were a bit apprehensive that the old link everyone was using didn’t clearly mention the bonus.

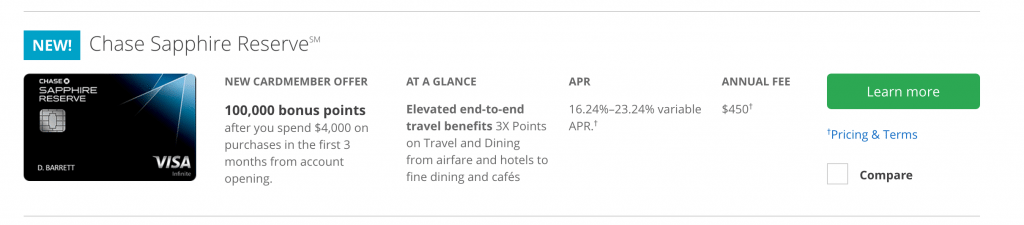

Here’s a list of all Chase cards, with the Sapphire Reserve showing up among them, pegged as NEW.

Hat tip to reader Jayesh Patel

I applied twice once at a branch (without pre-approval) and after denial once more online on the same day. I called recon line today after recv the denial letter. I’m right at 5/24 but 1 is AU. They told me they now count AU and they are not able to override the denial for too many credit cards opened in the last 24 months.

total income is 225k, credit score 768

They said they dont have a hard number to go by…. Can be less than 5 and still denial…

will try one more by getting preapproval in branch!

HUCA, some reps won’t discount AU

What’s the reconsideration number? I went to branch and was told to wait a few days. I would like to call and see if it would help

Applied online this morning and went pending so i called recon line (don’t have branch in my city). Was told I was denied due to too many cards in 24 months (4 my own and 4 as AU). The women was very firm about not overriding the decision so i hang up. I called again and was another female with similar voice so i hang up without answering. Called again and this time was a guy. First he said he couldn’t do anything but when i nicely explained to him about the AU cards, he agreed to remove the AU cards with a condition that i agree to allocate $10k credit from one of my existing chase cards. Of course I was more than happy to do that. Then i saw someone here mention Chase combines the HP in same day so i applied the IHG card a few hours later and was instantly approved for $36k! That was shocking to me as they only gave me $5k on my Ink Plus card a few months ago even though i have near perfect credit score and high income.

I’m surprised they had you reallocate credit and then gave you a new credit limit of 36k…

I know! I guess it was just my lucky day because when i logged in to my IHG account to apply for the IHG card i noticed all my points were gone ( expired due to no activity in 4 years). Before i go crazy, the nice rep quickly agreed to reinstate those points for another year. 🙂

Phew, that’s lucky

What is the difference if any when applying online or at branch?

I was checking if im pre-approved in branch earlier and when they’ve showed me the card benefits those $300 annual travel credit was not stated anywhere. Wonder why…

QUESTION: Im in doubt now… since i’d like to apply for this card, I might as well apply for another one since the hard inquiry will be combined.

My stats:

Im at 1/24 Freedom opened Apr 20 2016 limit 12.5k and balance as of last statement 2.7k. Total credit available 52.5k, income ~65k, credit score per credit carma: TransU:784, Equifax789; per credit.com: 798, VantageScore 3.0: 780, Discover FICO 759.

Basicly i only have balance on the freedom since its on promotional apr of 0%. Total credit usage is 6%. I have 10k on my chase savings acc, I have buisiness checking and credit acc with them as well.

What are your thoughts folks? Which CC’s should I apply with chase aside from this one?

I really appreciate your advice!

THANK YOU!

Depends on your travel goals, no clear goal no clear card.

Thank You for Your response William. Well, I dont travel that often since im trying to save, but i go to Europe once in couple of years, and maybe one few days getaway in state… i think this card is covering the flight part, so wouldn’t some hotel card be a good choice? Is it worth chasing that at all?

I just went in branch just to check if im pre-approved: i am :). What do you think about my stats, are they good enough for this card?

If you’re pre-approved, you should be fine approval wise. In terms of second cards, a hotel card could be useful if you have upcoming trips planned. Or you could just get another Chase branded card like the Freedom or Freedom Unlimited for another $150 + 1.5x or 5x rotating categories.

I alreday have the Freedom 5%, now if i get freedom 1.5% will i be able to downgrade the CSR in a year?

Thank You.

Should work fine

Applied online. Got approved for 25k. Income 130k. Below 5/24.

Not surprisingly I got rejected for being over 5/24 but on the recon line, she did go through every card I was an authorized user on and made sure I was not liable for those cards. Then she told me when one of the cards would fall off my report. Super nice! And she even apologized that I had to wait so long on hold. She said they’d been swamped since yesterday.

So for auto approvals, it will reject you based on authorized users accounts too, but for call ins-it looks like they will actually look at the accounts.

Just another confirmation that a solid income and a fantastic credit score (thanks to travel hacking) count for nothing!

After being denied online yesterday, just stopped into a Chase branch in Manhattan this morning. Was not pre-approved in their system, and after going thru the application process with the rep, I got the dreaded “you’ll find out by mail in 7-10 days” answer. So this is hardly a guaranteed workaround folks.

My stats: 7/24, 820 FICO, 400k annual household income, 3 other Chase cards but no banking accounts.

Because I’m way over 5/24, I won’t apply. But I applied online last night for my 18 year old daughter who just left for college 2 days ago, has no income, and got her first college-student credit card in June. She was approved instantly with a 29K credit line. Crazy.

Do Chase branch bankers receive an incentive or credit for credit card applications?

Not sure.