Offer at a glance

- Maximum bonus amount: $150

- Availability: All locations are in PA & MD, OH, WV & D.C. [Branch locator] [Previously this deal was available nationwide, this is no longer the case]

- Direct deposit required: Yes, total of $1,500+ within 90 days

- Additional requirements: None

- Hard/soft pull: Soft

- Credit card funding: Up to $499, all payment networks are accepted.

- Monthly fees: None with eStatements

- Early account termination fee: $50, 180 days

- Expiration date: September 16th, 2016

The Offer

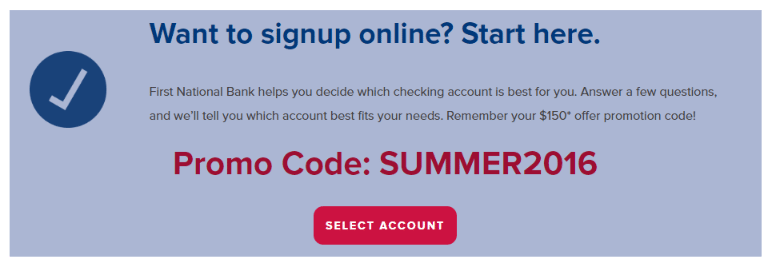

- Open a new FNB personal checking account (Freestyle, Mystyle, Lifestyle or Premierstyle) with the promotional code SUMMER2016 and receive a sign up bonus of $150 when you:

- Set up and receive qualifying direct deposits totalling at least $1,500 or more within the first 90 days of account open

- Account must be in good standing

The Fine Print

- Promotional offer only available to residents of Pennsylvania, Ohio, West Virginia, Maryland, Virginia and the District of Columbia

- Present the $150 promotional offer when opening a new FNB personal checking account online (Freestyle, Mystyle, Lifestyle or Premierstyle).

- A $50 minimum deposit is required when opening an account online. To receive the $150 reward, the following conditions must be satisfied: 1) set-up and have a qualifying direct deposit(s) totaling $1,500 or greater made to your new personal checking account within the first 90 days after account opening online; and 2) your account must be in good standing once the above conditions are satisfied.

- Then your $150 reward will be credited to this open account on the next business day following the 90 days after account opening.

- Your qualifying direct deposit(s) needs to be an electronic-type deposit, similar but not limited to, paycheck, pension or government benefits (such as Social Security) from your employer or other affiliated depositors.

- Offer valid for new personal checking accounts opened July 1, 2016 through September 16, 2016.

- Offer subject to change without prior notice and may be terminated or extended based on response.

- Offer does not apply to multiple checking accounts.

- Existing FNB checking accounts or accounts converting to another personal checking account are NOT eligible for this offer.

- You can receive only one new checking account reward related offer per household per calendar year

- Bank employees and members of their household are not eligible for this promotion.

- All bank account bonuses are treated as income/interest and as such you have to pay taxes on them

Avoiding Fees

The easiest account to keep fee free is Freestyle checking, there is no monthly fee as long as you have eStatements enabled. There is an early account termination fee of $50 if the account is closed within 180 days.

Our Verdict

Pretty good bonus with no requirements to keep the account fee free, the credit card funding is nice as well. The downside is that they seem to very inquiry sensitive when it comes to ChexSystems, so I wouldn’t bother if you’ve signed up with other financial institutions recently. Because of this, I doubt we’ll add it to our post on the best bank account bonuses. As mentioned people signed up outside the footprint previously had their accounts shut down (this was before they restricted it in the terms).

Big thanks to readers, daxihe who let us know. Please consider sharing bank bonuses with this site so we can make it even better.

Useful posts regarding bank bonuses:

- Bank account reference pages

- A Beginners Guide To Bank Account Bonuses

- PSA: Don’t Call The Bank

- Introduction To ChexSystems

- Banks & Credit Unions That Are ChexSystems Inquiry Sensitive

- How To Use Our Direct Deposit Page For Bank Bonuses Page

- Common Bank Bonus Misconceptions + Why You Should Give Them A Go

- How Many Bank Accounts Can I Safely Open Within A Year For Bank Bonus Purposes?

- Affiliate Links & Bank Bonuses – We Won’t Be Using Them

- Complete List Of Ways To Close Bank Accounts At Each Bank

for some reason I was only allowed to fund $50 with quicksilver, maybe they have cracked down on the cc funding.

Discover ACH does not count as DD. It shows P2P

Doesn’t necessarily mean it doesn’t count, often stuff that shows as P2P triggers the bonus still.

Anyone knows what counts as DD for this bank?

I tried Ally but shows up as “ALLY BANK P2P…” and I don’t think this will counts as DD.

I’ll try other methods and will report back.

Has anyone attempted a direct deposit from Capitol One 360? I know transfers from 360 typically show up as an ACH.

This is one of the method I’m trying to do at this point. I’ll report back if this works.

DP: approved with 5 other new accounts on chex in the past calendar year.

Oh, and one more thing, they were not chex inquiry sensitive for me. I have opened several other new checking/savings accounts within the last 3 months prior to this one. Applied Tuesday night and e-mail approval received Wednesday. Unless they change their mind later(which I have heard can happen), I will follow the rules to the T.

Approved. DP: Funded checking account opening, $375, w/ US Bank Cash+ Visa. Posted as purchase.

Denied. Their logic being that four years in DC is not long enough to be trusted.

lol it’s them again.