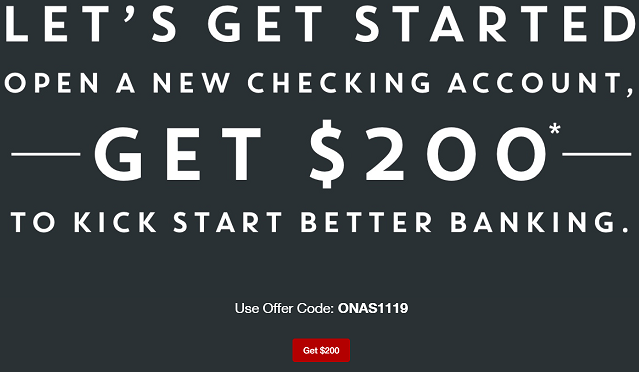

Update 8/17/23: Bonus now $200.

Update 6/26/22: Bonus has now been increased to $205.

Update 4/9/22: Deal now $175. Hat tip to mangorunner

Offer at a glance

- Maximum bonus amount: $205

- Availability: Must live or work in Baker, Brevard, Broward, Clay, Duval, Flagler, Indian River, Lake, Martin, Nassau, Orange, Palm Beach, Putnam, Seminole, St. Johns, St. Lucie, or Volusia counties in Florida

- Direct deposit required: Yes, $300+ required within 30 days

- Additional requirements: See below

- Hard/soft pull: Soft pull, reader via e-mail suggests it’s a hard pull but that is based on what a customer service rep said

- ChexSystems: Unknown

- Credit card funding: Up to $1,500

- Monthly fees:

- Early account termination fee: $10, six months

- Household limit: None listed

- Expiration date:

December 31, 2020December 31, 2021

Contents

The Offer

- Community First Credit Union is offering a bonus of up to a $200. Must use promo code CHK2022 Bonus is broken down as follows:

- $30 for your initial deposit

- $25 When you open a new debit card (Advantage Checking or Bonus Debit) and enroll in the Save My Change Program upon opening.

- $150 for starting a Direct Deposit (at least $1,000)

- You also get a $25 for every friend you refer

The Fine Print

- Membership is open to anyone who lives, works, or attends school in one of the following counties: Baker, Brevard, Broward, Clay, Duval, Flagler, Indian River, Lake, Martin, Nassau, Orange, Palm Beach, Putnam, Seminole, St. Johns, St. Lucie, or Volusia. Membership is also open to any relative of an existing or eligible Community First Credit Union of Florida member. We also offer membership to Select Employer Groups, including all employees of Brooks Rehabilitation and Web.com.

- When applying online use code CHK2019. Must mention this offer at time of account opening.

- Receive $25 upon account opening for opening a checking account and enrolling in the Save My Change Program, $125 for recurring Direct Deposit of at least $300 that posts within 30 days of account opening and we’ll post the credit within 6-8 weeks of account opening, and $50 for every friend you refer that opens a checking account.

- Credit provided when your friend opens a checking account and mentions you as the referrer.

- Credit and other restrictions apply.

- All bank account bonuses are treated as income/interest and as such you have to pay taxes on them

Avoiding Fees

Monthly Fees

Advantage checking has no monthly fees to worry about.

Early Account Termination Fee

You do need to keep the account open for six months otherwise an early account termination fee of $10 will be charged

Our Verdict

If it’s a soft pull to open then I do think it’s worth doing if you live in an eligible area. If anybody goes for the bonus, share your experiences in the comments below. We will likely add this to our best bank bonus page if we can confirm the soft pull.

Useful posts regarding bank bonuses:

- A Beginners Guide To Bank Account Bonuses

- Bank Account Quick Reference Table (Spreadsheet) (very useful for sorting bonuses by different parameters)

- PSA: Don’t Call The Bank

- Introduction To ChexSystems

- Banks & Credit Unions That Are ChexSystems Inquiry Sensitive

- What Banks & Credit Unions Do/Don’t Pull ChexSystems?

- How To Use Our Direct Deposit Page For Bank Bonuses Page

- Common Bank Bonus Misconceptions + Why You Should Give Them A Go

- How Many Bank Accounts Can I Safely Open Within A Year For Bank Bonus Purposes?

- Affiliate Links & Bank Bonuses – We Won’t Be Using Them

- Complete List Of Ways To Close Bank Accounts At Each Bank

- Banks That Allow/Don’t Allow Out Of State Checking Applications

- Bank Bonus Posting Times

Post history:

- Update 8/14/19: Bonus is back. Hat tip to reader newbie

- Update 8/2/19: Bonus is now cash instead of an Amazon gift card. In addition the $10 bonus for loading the debit card has been removed.

the direct link doesn’t seem to be working.

The $200 can be stacked with a referral bonus of $25. It’s not much but it doesn’t require direct deposit. Just needs 1k in deposits + 10 Debit Card purchases. If anyone wants to use my link, I would really appreciate it

[removed]

Thanks in advance

Two very similar posts exist on this C1CU bonus. Here’s the other one:

https://www.doctorofcredit.com/fl-only-community-first-credit-union-of-florida-100-checking-sign-up-bonus-no-bonus-requirements/

DP:

4/7/2023 – Applied and funded with $1,500 on Discover It card. Coded as a purchase.

4/10/2023 – Email received with documents to review and sign. Account approved.

4/10/2023 – $25 bonus posted in my main (old) checking account (not the new checking account).

8/10/2023 – $150 bonus posted in my savings account.

Note that $150 bonus took 120 days, not 90 days as described in Terms and Conditions. Also note that bonus posted in my savings account; not in my new checking account.

So sorry, but I don’t have that info – I haven’t pulled Chex in awhile – life has become very busy/complicated recently. ☹ Christopher Robin

Christopher Robin

Thinking some more about this… I have been a customer of C1CU for many years and already had two checking accounts and a saving account when I applied. I don’t know that my Chex score would have made a good DP. Christopher Robin

Christopher Robin

$200 bonus now. https://www.communityfirstfl.org/offers/get-$200-with-free-checking

It seems that the bonus is now $175 (150 for dd + 25 for initial deposit).

DP:

Community First Credit Union of Florida – funded with $1,500 on Discover It card. Coded as a purchase.

Can I join out-of-state? Do you have a referral?

send email to bluesky05460 -at- g.ma. i l

Does this work? I would like to signup for the CC spend, but I do not live in Florida

If you have a C1CU account and a related debit card, you can earn a $10 gift card for making 10 debit-card transactions:

https://info.communityfirstfl.org/debit-gift-card

“How to get your e-gift card:

You qualify for the chance to receive a $10 e-Gift Card (your choice of Target, Walmart or Amazon) on us!*

Simply make 10 purchases with an eligible Community First debit card in April, and we’ll send you a $10 e-Gift Card in May.”

Cash App loads/reloads are coding as:

“CASH APP … Merchant Category Code: 4829 Withdrawal Debit Card VISA CHECK CARD”

Merchant category code 4829 = “Money Orders – Wire Transfer”.

I’m going to switch to small payments to my health insurance and/or AT&T. Both allow $1 payments.

DP:

6/28: Accounts opened (soft pull)

6/28: $25 promo posted to checking (I think this was for the debit card save my change thing)

6/28: $5 promo posted to savings (opening deposit covered per the independence promo that was run, even though I funded $5 with credit card)

6/28: $25 promo posted to savings (new account promotion)

6/29: $1500 + $5 opening deposits posted as purchase with Chase United Explorer

7/14 & 7/28: $500 work DDs, so $1000 requirement met on 7/28

9/27: $150 posted to checking

Did anyone receive the bonus yet?

I just posted my data point.