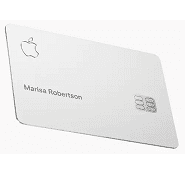

Yesterday saw Apple release details of the new co-branded credit card it’s launching with Goldman Sachs. As with most Apple products this card is getting a lot of hype and attention, I thought it would be worth pointing out several cards that are better than this card and the reasons why. Before we get started let’s take a look at the basics of the new Apple card:

- Card earns at the following rates:

- 3% cash back on Apple purchases and services (including the app store, Apple Music payments, etc.)

- 2% cash back on all Apple Pay purchases

- 1% cash back when using the physical card

- No annual fee

- No foreign transaction fees

- Will run on the Mastercard payment network

Contents

U.S. Bank Altitude Reserve

Read our full review of this card

One of the key selling points for the Apple card is that it earns 2% cash back on all Apple Pay purchases. The altitude Reserve earns 3x points on all mobile payment purchases (including Apple Pay). These points are worth 1.5¢ each when using the real-time mobile rewards future. This means this card effectively earns 4.5% cash back on all mobile payment purchases, more than double what Apple is offering.

The downside to this card is that the annual fee is $400. Keep in mind there are a few things that come with this annual fee:

- Sign up bonus of 50,000 points after $4,500 in spend within the first 90 days

- $325 in annual travel credits

- Priority Pass select membership

The second two benefits you receive on an annual basis and will at least partially offset the annual if not offset it entirely. If you don’t value those benefits at $400 or more then it’s a matter of working out how much you’d spend annually on the Apple card to determine if the Altitude Reserve card is better. For example let’s say I value the travel credits at $260 (80% of face value) and the Priority Pass select membership at $50, the annual fee I’d effectively be paying on this card is $90. This card earns 4.5% cash back vs the 2% on the Apple card. My break even point would be $3,600 in spend, if I spent more than that the Altitude Reserve card would be better than the Apple card. Keep in mind I’m not even factoring in the sign up bonus worth $750.

Fidelity 2% Cash Back Card

Fidelity offers a card that earns 2% cash back on all purchases, this card is issued by Elan services (subsidiary of U.S. Bank). The card also has no annual fee, but it does come with a 1% foreign transaction fee. The upside to this card over the Apple card is that it earns 2% on all purchases (rather than just Apple Pay purchases), comes with a sign up bonus of $100 and also has frequent targeted spending bonuses. You’ll need to ask yourself how many transactions you’ll actually be completing overseas using Apple Pay to determine what card is better.

Citi Double Cash Card

Similar to the Fidelity card listed above but without the sign up bonus. The real value of the Citi Double Cash card over the Apple card is the fact that the Citi DC offers price protection. This means if you make a purchase and then see the same identical item on sale for less within 60 days of purchase Citi will refund the difference. Citi also offers an extended warranty benefit on this card as well.

Alliant Cashback 3%/2.5% Cash Back

The Alliant cashback card earns 3% cash back on all purchases in your first year of being a card member and then 2.5% cash back on purchases from the second year onwards. The card does have a $59 annual fee that is waived the first year. This card also has no foreign transaction fees. From the second year onwards you’d need to spend more than $11,800 on this card to make up for the $59 annual fee compared to a flat 2% cash back card.

PayPal Cashback Card

This card earns 2% cash back on all purchases with no annual fee and no foreign transaction fee. Very similar to the Apple card but earns 2% back on all purchases rather than just Apple Pay purchases.

Our Verdict

For the vast majority of people the Apple credit card will not be the best option out there, there are obviously some fringe use cases but the majority of people that sign up for this card will be doing it due to the Apple branding. There is nothing wrong with that, but you should at least be aware that better options exist. If you’re thinking about getting this card I urge you to track how often Apple Pay is actually accepted before applying when it eventually launches.

For a lot of people none of the above cards will even be the best option. To get the most bang for your spend in general you’ll want to focus solely on using your credit card spend to meet minimum spend requirements. We list the best credit card bonuses here. Unlike other sites we do not use credit card affiliate links so we can remain unbiased and recommend the best cards/offers rather than the ones that pay us the most. The other thing worth remembering is that credit cards have very high APRs, so you’ll want to make sure you always pay your credit card in full. If that’s something you don’t feel like you’d be able to do comfortably then you’ll be better off with no credit card at all.

Under “Citi Double Cash Card,” you should strike the text:

“Citi also offers an extended warranty benefit on this card as well.”

since that benefit is going away on September 22, 2019:

https://www.doctorofcredit.com/citi-removing-most-benefits-from-all-cards-on-september-22-trip-cancellation-trip-delay-return-protection-car-rental-ticket-protection-etc/

as far as I can see, Alliant Visa Signature annual fee is $99, not $59 as claimed

https://www.alliantcreditunion.org/bank/visa-signature-card#fees

$99 annual fee, waived the first year83

it was $59 when this article was written.

Fantastic article and why I love this blog. Not because of the content (I knew most of it) but the simplicity with which you diss (point out that it’s nothing special) Apple or any other big company/bank. Confirms the ‘unbiased’ adjective for the blog for me which is really one of the hardest accolade for any content on the Internets to achieve and maintain.

One more thing, what will be the minimum redemption amount on the cashback for this Apple card?

$0, and it posts instantly, same day the purchase is made.

Now Apple would have truly changed the credit card game if they had made NO FEES completely true and didn’t charge any interest fees at all for the sheeple.

Is it the only NAF metal card?

I think it actually comes with an obligatory $1000 annual “fee” required to be spent at the Apple store on some unnecessary, overpriced Apple gadget.

Touche

Wells Fargo Propel

Not the WF Propel I’m looking at.

Not sure it’s a fair comparison against the Citi DoubleCash yet. From my understanding Apple has not released any of the card benefits yet from Goldman Sachs, it may very well offer price protection. We don’t have enough info yet to make that statement

I would agree with you that overall the Apple card isn’t at all favorable to Citi DC except for outside the US – which most people looking at this card likely travel outside the US at most once every 3-4 years.

It’s a Mastercard so it really should include price protection. It would be kind of extraordinary if it wasn’t offered. But Citi’s price protection is kind of unique in how easy it is to use.

Amex Blue Business Plus and Chase Freedom Unlimited are two other easily proven contenders.

The ironic part is that the Apple card gives you at most 3% for Apple Store purchases, where you can use the Altitude Reserve to earn 4.5%. So the Apple card isn’t even the best option to use at an Apple store.

The same goes for the Uber Visa Card – they just give 2% cash back for Uber, whereas you can get, for example, 5% by selecting the Ground Transportation 5% category on the US Bank Cash+ card.

Other higher % for Apple purchases:

5% year-round on US Bank Cash+ by selecting Electronics ($2K cap) every quarter as one of the categories. OR even 3% on BofA Cash Rewards by selecting Online Shopping ($2.5K) buying online from Apple or Costco for example & doing in-store pickup. These work fine under the caps for the typical person who is just buying a computer or phone.

Note that if you use a Citi Double Cash 2% to order Apple stuff (or other electronics or major appliances) from Costco, you get 2 yr warranty Costco + 2 yr through Citi = 4 yr total (hint: You don’t need a Citi Costco Visa to get ths feature)

The Apple card is perfect for folks who hate banking and want everything nicely integrated. The texting from cellphone is brilliant.

It has some nice, innovative features. If the lowest tier of cash back were 1.5% rather than 1%, I would consider making this my primary card in lieu of the Fidelity Visa. The features appeal to me enough to give up 0.5% on non-bonused categories, but not enough to give up 1%.

PNC offers cc with 4% gas,3% utilities.2% grocery stores,1% everything else. Statement credit after 12 months. Nice savings.