On this blog we often talk about something called your average age of accounts (AAoA), we’ve had a few e-mail queries recently about how this is calculate and how it affects your credit score. Before we go any further it’s important to understand that there are lots of different credit scoring models. In this article we will mostly talk about two scoring models: VantageScore & the FICO Score.

- FICO Score: AAoA is part of your “length of credit history” which accounts for 15% of your total score.

- VantageScore: AAoA is part of your “depth of credit” which accounts for 9% of your total score.

In both cases AAoA isn’t the only scoring factor in these categories. They also look at your oldest account (which has more weight to it than your AAoA), when your newest account was opened (less weight) and how long since specific accounts have been used (almost no weight).

There is one key difference between FICO & Vantage scores at the moment. When calculating average age of accounts VantageScore does not include closed accounts, whereas FICO does. This might not seem like it would make a big difference, but it does. Closed accounts stay on your credit report for a period of up to ten years. Let’s look at how this would affect your average age of accounts when looking at the two different models.

It’s my opinion that when FICO9 is released (latest version of the FICO score) that they will no longer include closed accounts in your average age of accounts. This makes sense, because one of the reasons AAoA is looked at is because it shows how long you’ve displayed good or bad behavior. For example, if my AAoA is 15 years and I have no late payments then the chances of me making a late payment is extremely small. If my AAoA is 2 months and I have no late payments, then it’s much more likely that I’ll make a late payment as there isn’t a lot of history of me paying on time. By including closed accounts the FICO score increases your AAoA artificially. There is no chance you can make a late payment on a closed account, therefore it shouldn’t be included as it’s not a good gauge of calculating risk.

There are three important take aways to remember:

- When possible keep an account open as it’ll increase your credit score (both Vantage & FICO)

- Don’t fret about your AAoA too much. It makes up a small portion of your length of credit history/credit history depth. Much more important is your oldest account, make sure you keep this open.

- Your FICO score is more important than your VantageScore, this is becaused it’s used in 90%+ of lending decisions

This doesn’t mean you should pay annual fees on credit cards just to keep an account open. Instead what you should do is this:

- Call and see if they will waive the annual fee or offer a retention bonus

- If this is not possible, ask to downgrade to a no annual fee card. Make sure that this isn’t a new credit inquiry and that you’ll keep the account age.

[Read: Best Downgrade Options & Rules For Each Card Issuer]

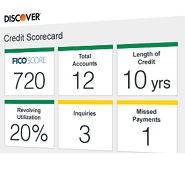

Any other questions about average age of accounts or how credit scores are calculated? Ask in the comments section. If you want access to your FICO score for free then click here to view different ways to get it. There are a number of different ways to get your VantageScore:

- Credit Karma provides a VantageScore based on your TransUnion credit report

- Quizzle provides a VantageScore based on your Equifax credit report

- Credit.com provides a VantageScore based on your Experian credit report

- WisePiggy provides a VantageScore based on your TransUnion credit report

My average age of credit is currently is 2 years and 5 months. How many tradelines and what specs of credit cards would I need for my average age of credit to be at 10-15 years of aged credit?

AAoA is the average age of all your cards, so it depends how many cards you have right now. If you only have one, then you would need to add a credit line that is about 18 years old to average out to 10 years. Increase by one for every additional card you have.

715 – 730 FICOs, 1 yr AAoa, spotless payment history, 0 negatives of any kind, 1% – 2% Utilization, 3 bank credit cards (Amex, Discover, Capitol Bank) and 1very small installment account. My question is: Will the 1 yr AAoa hurt the Credit Limit amount on a new card application and if so, will it be significant?

The guess that FICO 9 will not use closed accounts in calculating AAoA has been proven wrong. The analogy given for why closed accounts should not be given is lame, at best. Stick to what you do best — providing coupons to save money or news about sign-up bonuses. Leave credit scoring to people skilled in math and logic.

Before I knew all of this or started taking the travel 101 course I cancelled my oldest CC account….how much will it affect me?

I have a question about paying off a loan. My oldest account is a student loan from 17 years ago. I finally have the opportunity to pay it off and not have to worry about the interest always accruing. However, paying it off means that my oldest account would be just shy of five years and my AAoA would drop significantly since I take advantage of all the cc bonuses you keep us wonderfully informed of. So, I admit it is silly to keep paying the interest but I am hesitant because I finally have a score that is getting close to 800. Is dropping to an AAoA less than 5 years going to reduce my chances of opening new cc’s when great bonuses come around?

I want to increase my credit age. So I am planning to join as an authorized user in my sister’s CITI Double Cash Credit card. But CITI is not asking for my SSN, I doubt they will report to the credit bureau and it will increase my credit age?

Not sure if this thread is still active. I am a little confused. I have worked very hard over the past year or so after a short period of some late payments. One factor that I am looking at to help me increase my score is AAoA, which keeps getting hit by churning leased cars every 3 years for my wife. I have kept my current cards stable plus my mortgage, which I pay in full every month but I don’t see where past lines of credit are helping me here (as it seems some are saying here) or my number would be much higher. I know this isn’t a huge impact and I am around 5yr average which is smaller impact, just curious on what is accurate. Thanks!

5 years is a pretty solid AAoA. Are you opening any new accounts apart from the lease every 3 years? What’s your score currently?

Current score is 750, my AAoA is 4 yrs 7 months. I am not opening any cards but that lease restart every three years keeps bringing the avg down.

I wouldn’t worry about your AAOA too much.

You will be reported. They match names and addresses from data on hand. Trust me on this. I had AU on a Citi card under same circumstances and they were reported.

Late to the party, but my experian credit reporting site says under AAoA FICO Score Ingredients that AU accounts do not count towards AAoA. This may be a recent change, and my reports show different AAoA in different areas of this website, but here, the AAoA is only reflecting my primary accounts, not accounts that I’m an AU on.

Hi Doc,

I have a question that I’d like to clear up. Feel free to point me to a good link that explains if that is easier (or previous DoC post). This is all related to average age of account and the best way to manage card churning. I’ve read that a closed account stays on your credit report for 10 years, and I’ve read mixed things that say for instance on FICO, a closed account will continue to age and impact avg age of account (presumably to the point until 10 years after its closed and then it drops off your account)(ex, so an account thats closed at 6 months will continue to impact avg age of account and there’s nothing you can do, and then 10 years later that account will have an impact of 10.5 year, but will suddenly drop off). I’m asking this from the perspective of say Im churning citi AA cards, is it ever beneficial to close the card that’s 6 months old (if I’m not going to use it)? I would be closing in hopes that the closed account would not factor a low aged account into my avg age of account (and therefore hopefully boost my average age of account). But the way Im reading some things, it almost seems like it would be best to keep these accounts open (assuming they werent hindering the ability to get approved for more cards, which at some point that would be the case). Anyways, a lot of people throw around the turn of average age of account with a basic understanding of how it works, but Im interested in the specifics, particularly as it relates to closing accounts and how closed account continue to impact the avg age calculation over time. Thanks in advance for the reply

I reread the above post. It seems clear that for FICO, there is no benefit to closing, cause the account will continue to age and impact average age of account regardless. In fact, you could even say that it would be pointless to close, cause it means that in 10 years your aged account will drop off sooner (as opposed to being an account that stays open longer and stays on your FICO report longer). But what about for Experian, TU, and Equifax? Will closing these low aged accounts (say an account thats 6 months old) be beneficial for the average age of account for those scores? Meaning will the account age be immediately dropped for the AAoA calculation?

I have 3 Chase cards (Disney, Slate, and Freedom) All are paid off and at $0 balance. Freedom AAoA is 16 years, I’ll be keeping this open as it is my oldest account and transferring all the limit ($10,000) except $500 (so $9500) to my Disney card. Then from my Slate card also transfering all $3300 limit to my Disney card ($2300) and closing my Slate card. Bringing my Disney card to $15,100 limit total and $500 on the Freedom card. By doing this it keeps my utilization and my total limits exactly the same, no limits have changed and no balance has changed. I cancel the Slate card. How if at all since it does not effect my utilization, would the cancelation of my Slate card effect my AAoA?

Thanks,

Jason

Depends on the credit scoring model, some models do not count closed accounts, some do. FICO does count closed accounts, so you’re AAoA wouldn’t change in the short term. But when that account falls off your report (~7 years) it will stop counting towards your AAoA. I would probably just ask if you can product change the Slate to another Chase freedom, that way you keep the account age going forward AND get another $1,500 at 5% cash back each quarter.

I would really enjoy seeing a 2021 update to this article.

Nothing has really changed, most lenders are still using the older scoring models.

So when you close a card they continue to add age to that card? Or does it stop aging. When I think average I think the average of 5 years a card just opened is 2.5 years. But some posts seem to indicate that this calculates to 5 years plus the new card by just adding them together. So Im a little confused. By saying they continue to count it, doesn’t that mean you could have no cards open and still be aging and helping your credit with a card you closed last year? Thanks in advance.

Under your theory of AAoA and the prediction of late payments, then every closed account should be removed from one’s credit reports as irrelevant. You fail to remember that even if your account is 15 years old, late payments — as with most other derogatory data — do not remain for longer than 7.5 years. So when looking at negative history, every account, open or closed, is virtually irrelevant after 7.5 years. You also fail to see the value in, for example, 15 years of solid history on an account recently closed as predictive of future behavior.

You are simply wrong about how AAoA works. The value of AAoA is to predict risk based on how new your credit is, on average. AAoA goes down with new accounts and goes up with refraining from opening new accounts. The folks at FICO always tell you, only open accounts when you really need them. The risk factor calculated by AAoA pertains to new credit and late payments and not account age and late payments. This is why FICO tells you time and time again that the only negative consequence of closing an old account is your credit utilization ratio.

AAoA is looked at because it displays how long, on average, you have displayed behavior, whether good or bad. Late payments or lack thereof then drills down as to whether or not that behavior is good or bad. And since late payments drop after seven years, under your theory AAoA of over seven years is useless. Again, that’s why age is one factor and late payments are a different factor.

You should downgrade from Doctor of Credit to Nurse of Credit.

> You also fail to see the value in, for example, 15 years of solid history on an account recently closed as predictive of future behavior.

That’s not true at all. That account is indicative of future behavior, but it should be counted as 15 years of solid history, not 22.5 or 25 years. When an account closes, it makes no sense to let it continue to age as it’s no longer giving you an indication of risk as you can make neither on time payments or late payments.

> AAoA is looked at because it displays how long, on average, you have displayed behavior, whether good or bad.

Exactly, you’re not displaying any behavior when an account is closed because you’ve lost the ability to make on time payments or late payments.

> And since late payments drop after seven years, under your theory AAoA of over seven years is useless.

No it’s not. If your oldest account is 15 years and your AAoA is 10 years and you have no late payments on your credit report then your risk of becoming delinquent is lower than somebody who has an oldest account of 7.5 years and an AAoA of 7.5 years.

Who has more credit risk? Somebody who has an average age of accounts that is 15 years and no delinquencies and all of their accounts are still open? Or somebody who has an AAoA of 15 years and no delinquencies but closed all of their accounts 7.5 years ago? That’s the difference between letting closed accounts age and not.

> You should downgrade from Doctor of Credit to Nurse of Credit.

You make it sound like being a nurse instead of a doctor is an insult. I also don’t think you really understand what type of doctor I am.

How would we know what king of doctor you are?

You use a fake name.

I won’t trust credit advice from someone who won’t even disclose who he is or who he works for.

I use a pen name precisely because of my work, it’s part of my contract to not disclose my employer when doing hobby projects such as this. Not sure why you’re reading this blog if you don’t trust the advice given. Please troll elsewhere.

Williams Charles has a great blog going here.

There are plenty of other CC blogs controlled by affiliated links interests.

If you do not like it, go over to a different blog!!!

don’t feed the trolls