Update 9/10/25: Deal is back, there is another offer for $400-$1,000 but that contains mailer language so YMMV on using that. Requires the following:

- Receive a $600 cash bonus when you have a cumulative total of $10,000 in qualifying direct deposits post to your account within 90 days of account opening or

- Receive a $800 cash bonus when you have a cumulative total of $15,000 in qualifying direct deposits post to your account within 90 days of account opening or

- Receive a $1,000 cash bonus when you have a cumulative total of $20,000 in qualifying direct deposits post to your account within 90 days of account opening.

Update 5/7/25: Deal is back, now $400 instead of $350. There is also a $600 link, but that contains mailer language. If you’re using that link read this comment.

Update 2/4/25: Extended to May 2, 2025. Bonus now $350.

Update 11/3/24: Bonus has been reduced to a maximum of $300. Extended until February 3, 2025

Update 9/10/24: Extended through October 31, 2024. Can also get a $100 for meeting with a banker.

Offer at a glance

- Maximum bonus amount: $560

- Availability: Nationwide now

- Direct deposit required: Yes, direct deposits totaling $4,000+ or $7,500+

- Additional requirements: None

- Hard/soft pull: Soft

- ChexSystems: Yes

- Credit card funding: Cannot fund with a credit card

- Monthly fees: $25, avoidable

- Early account termination fee: $50 if closed within 90 days,

- Household limit: None listed

- Expiration date:

September 30th, 2020 October 31, 2020November 11, 2020January 29, 2021April 30, 2021June 3, 2022September 9, 2024

Contents

The Offer

- BMO Harris is offering a bonus of $600 when you open a checking account:

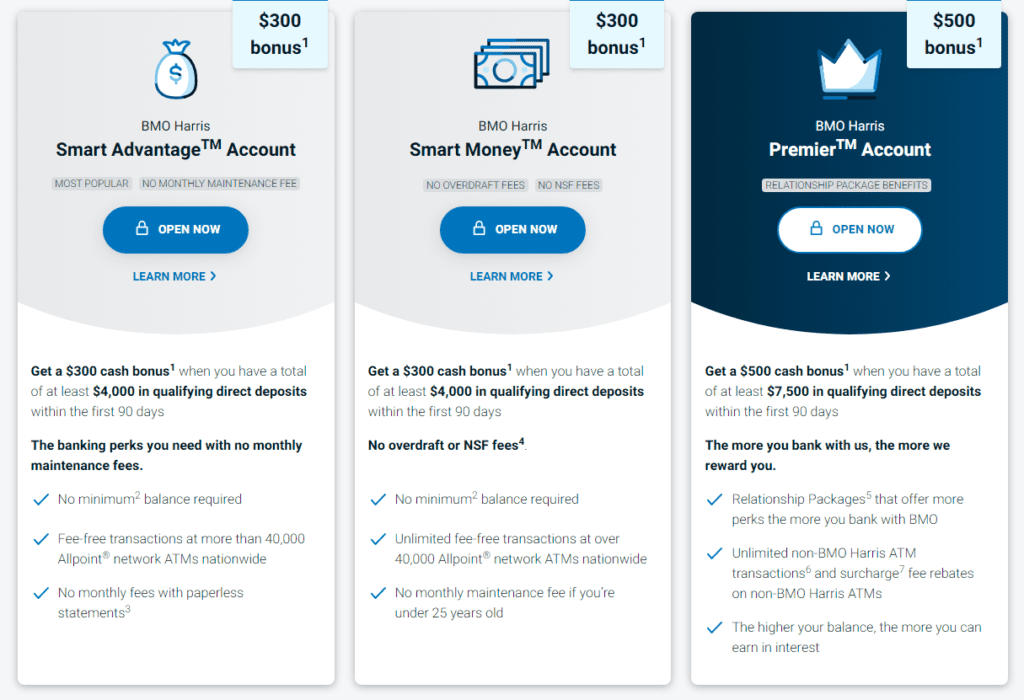

- Open a Smart Advantage Account and get a bonus of $300 when you have at least $4,000 in qualifying direct deposits within the first 90 days of account opening

Open a BMO Relationship Checking and get a bonus of $500 when you have at least $7,500 in qualifying direct deposits within the first 90 days of account opening

Plus, get a $100 digital gift card2 when you meet with a BMO banker to discuss your financial priorities after opening your account online- You can also open a savings account and get $5 monthly savings bonus for each month that you save $200 or more, for up to 12 months.

Open a Platinum Money Market account and get a bonus of up to $300:Get a $100 bonus when you deposit $10,000 or more in the first 30 days and then keep it in your account for at least an additional 90 daysGet a $200 bonus when you deposit $25,000 or more in the first 30 days and then keep it in your account for at least an additional 90 daysGet a $300 bonus when you deposit $50,000 or more in the first 30 days and then keep it in your account for at least an additional 90 days

The Fine Print

- You are only eligible for one checking account cash bonus; you cannot open multiple checking accounts and receive multiple cash bonuses.

- You can apply online or at a branch.

- To apply online, use the “open now” links above and we’ll automatically apply the promo code for you.

- Before you apply at a branch, enter your email and click “Send Me My Coupon Above” to receive the promo code you must use when opening your account. You must open your accounts between July 1, 2020 and September 30, 2020.

- Offers A & B can be combined but each are limited to one per customer.

- Offer A is not available for existing BMO Harris personal checking customers (including signers on joint accounts) or those who have closed a BMO Harris personal checking account within the past 12 months.

- Offer B is not available for existing BMO Harris personal money market or savings customers (including signers on joint accounts) or those who have closed a BMO Harris personal money market or savings account within the past 12 months.

- Offer B is available for existing BMO Harris personal CD or IRA customers (including signers on joint accounts) and those who have closed a BMO Harris personal CD or IRA in the past 12 months.

- Bonuses are not considered part of the opening deposit and will be reported to the IRS for tax purposes.

- You are responsible for any applicable taxes.

- Offers can be changed or cancelled without notice at any time, and cannot be combined with any other offer.

- Your accounts must be open, in good standing and must have a balance greater than zero when the bonuses are paid approximately 100 days (Offer A) and 130 days (Offer B) after opening.

- Offer A: Get up to a $350 bonus when you open a new BMO Harris Smart Advantage™ Account or BMO Harris Premier™ Account and have qualifying direct deposits of a paycheck, pension payment, Social Security payment, or other government benefits payment electronically deposited into the account from an employer or outside agency. We reserve the right to request documentation to confirm that the direct deposits qualify.

- 1) Get a $200 bonus when you open a new BMO Harris Smart Advantage™ Account and have a cumulative total of $4,000 in qualifying direct deposits within 90 days of opening. OR 2) Get a $350 bonus when you open a new BMO Harris Premier™ Account and have a cumulative total of $7,500 in qualifying direct deposits within 90 days of opening.

- You are only eligible for one bonus; you cannot open both checking accounts and receive both bonuses.

- Day 1 is the day you open your account and begins the tracking period.

- If you open your account on a day other than a Business Day, Day 1 is the next Business Day.

- The checking account type you have on Day 90 will determine which bonus you are eligible for. In order to receive the bonus, you must meet the associated criteria for that account.

- Offer B: Get up to a $300 bonus when you open a new Platinum Money Market account and make qualifying deposits of new money. New money is defined as funds not currently on deposit at BMO Harris Bank or its affiliates.

- 1) Get a $100 bonus when you deposit at least $10,000 in new money into your account by Day 30. Beginning Day 31, your balance must be $10,000 and it cannot drop below $10,000 for the next 90 days. OR 2) Get a $200 bonus when you deposit at least $25,000 in new money into your account by Day 30. Beginning Day 31, your balance must be $25,000 and it cannot drop below $25,000 for the next 90 days. OR 3) Get a $300 bonus when you deposit at least $50,000 in new money into your account by Day 30. Beginning Day 31, your balance must be $50,000 and it cannot drop below $50,000 for the next 90 days.

- You are only eligible for the bonus amount corresponding to your account balance on Day 30.

- If your account balance increases or decreases between Day 31 and the next 90 days, you will not be eligible for a different bonus amount. Day 1 is the day you open your account and begins the tracking period. If you open your account on a day other than a Business Day, Day 1 is the next Business Day.

- Deposits received on a day other than a Business Day will be posted the next Business Day.

- All bank account bonuses are treated as income/interest and as such you have to pay taxes on them

Avoiding Fees

Monthly Fees

Smart Advantage Checking Account ($350 Bonus)

This account has no monthly fees to worry about

BMO Harris Premier Account ($350 Bonus)

This account has a $25 monthly fee. This is waived with one of the following:

- $10,000 minimum daily balance,

- $25,000 in combined balances with Relationship Waiver,

- or a BMO Harris Financial Advisors, Inc. investment account

Early Account Termination Fee

There is an early account termination fee of $50 if the account is closed within 90 days.

Our Verdict

If you’re doing the savings bonus ($200 or $300) then you’ll have enough money in combined balances to keep the Premier account fee free as well. The savings account earns 0.05% APY for balances $25,000 or under and 0.1% APY for balances $25,000+. The most recent BMO Harris offer was for $200 for opening a checking account, but has been as high as $500 with the same requirements.

This bonus is up to an extra $150 compared to that $500 bonus, but the requirements are much higher. We obviously don’t have any idea if/when that bigger bonus will return so if you can do the full $650 bonus this might be worth considering. Because of that we will add it to our list of the best bank bonuses.

Hat tip to readers JohnnyBoyJr & raekwon

Useful posts regarding bank bonuses:

- A Beginners Guide To Bank Account Bonuses

- Bank Account Quick Reference Table (Spreadsheet) (very useful for sorting bonuses by different parameters)

- PSA: Don’t Call The Bank

- Introduction To ChexSystems

- Banks & Credit Unions That Are ChexSystems Inquiry Sensitive

- What Banks & Credit Unions Do/Don’t Pull ChexSystems?

- How To Use Our Direct Deposit Page For Bank Bonuses Page

- Common Bank Bonus Misconceptions + Why You Should Give Them A Go

- How Many Bank Accounts Can I Safely Open Within A Year For Bank Bonus Purposes?

- Affiliate Links & Bank Bonuses – We Won’t Be Using Them

- Complete List Of Ways To Close Bank Accounts At Each Bank

- Banks That Allow/Don’t Allow Out Of State Checking Applications

- Bank Bonus Posting Times

Post history:

- Update 5/6/24: Extended through 9/9/24

- Update 1/10/24: Extended until 5/3/24

- Update 12/11/23: Bonus is back but now only $250/$400.

- Update 10/9/23: There is now a savings bonus as well, not worth considering due to the current high interest rates.

- Update 9/19/23: Deal is back and valid until 12/8/23 and now officially $400/$600

- Update 9/10/23: Looks like people are actually getting $400/$600.

- Update 6/21/23: Looks to be nationwide now.

- Update 5/16/23: Extended through September 15, 2023.

- Update 1/9/23: Extended through June 2, 2023.

- Update 10/6/22: Bonus is now $350, valid through 12/30/22

- Update 7/11/22: Bonus has been increased to a maximum of $560. Hat tip to reader Matt J

- Update 2/7/22: Maximum bonus is now $350.

- Update 9/27/21: Extended until October 15.

- Update 6/10/21: Deal is back and has been increased from $200/$400 to $300/$500. Valid until September 30, 2021.

- Update 2/13/21: Deal is back and valid until

4/30.May 28, 2021June 4, 2021 - Update 1/5/21: Deal is back for $350. There is also a $5 savings bonus per month for 12 months. Hat tip to reader JohnnyBoyJr

- Update 10/14/20: Deal is back for the $350 checking bonus, savings bonus is not available this time. Deal is better when savings is also offered as that is enough to keep the Premier account fee free as well. Hat tip to reader Snowbird

- Update 8/3/20: Link for FL added. Hat tip to reader Zach