As Sirtheta points out these offers are not new. I think these might expire on March 31st, 2017 but they will possibly be extended.

These offers are back, so reposting. Hopefully some people can provide more datapoints due to having accounts for their checking account bonus.

Contents

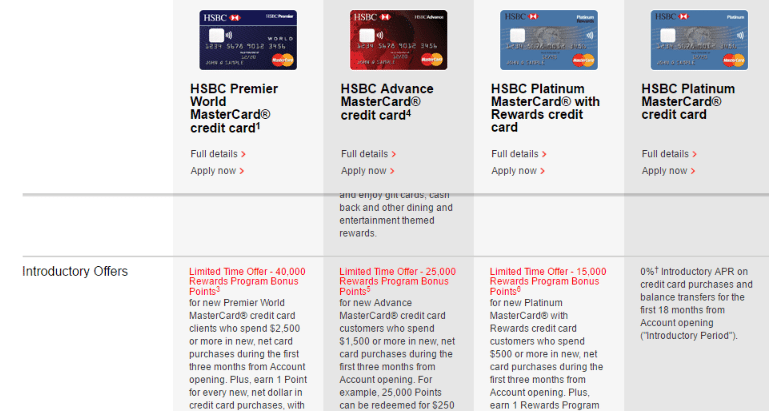

The Offers & Card Details

- HSBC has increased sign up bonuses on three of their cards, let’s take a look at each of them below

HSBC Premier World

- 40,000 points after $2,500 in spend within three months of account opening (standard is 25,000 points I believe)

- Card earns 1x points on all purchases

- Access to concierge service

- Must have a premier HSBC relationship to apply for this card. This requires $100,000 in deposit accounts with HSBC. Business owners can also use their commercial balances to qualify. If these monthly maintenance requirements are not met, a $50 fee per month is charged

HSBC Advance

- 25,000 points after $1,500 in spend within three months of account opening (not sure on the standard bonus unfortunately)

- No foreign transaction fees

- Card earns 1x points on all purchases

- Must have a premier or advance HSBC relationship (see premier requirements above).

HSBC Platinum Rewards

- 15,000 points after $500 in spend within three months of account opening (not sure on the standard bonus unfortunately)

- 0% Introductory APR for first twelve billing cycles on purchases

- No annual fee

- Card earns 1x points on all purchases

Our Verdict

Points are worth 1¢ a piece when redeeming for statement credit, Premier cardholders can get 1.5¢ when redeeming for travel (as statement credit). You can also transfer points to British Airways, Singapore Airlines & Cathay pacific (again I think this is premier cardholders only). They’ve had 30% transfer bonus when transferring to British Airways previously. I’m not that familiar with these cards, so if anybody has any personal experiences please share them in the comments and I’ll try to get some full reviews up soon.

https://www.us.hsbc.com/credit-cards/

Im seeing some different stats on their page compared to your assessment here. Maybe time for a small update.

Wanted to share data point: Was able to get approved for two hsbc cards on the same day. However, received two eq hard pulls (spaced the apps out a few hours apart, so not sure if that had anything to do with it). One was hsbc advance public offer (currently doing the advance checking bonus, so why not) and the other was a pre-approved mailer with code for their 1.5% cb card.

A few things about HSBC credit cards:

1. pulls EQ for NY

2. Churnable (my case is that I closed a card previously opened >2 year and applied again after >6 months of closeout of previous card)

3. Eligibility of card is determined by type of account/relationship with HSBC (I previously had 10K so applied for the advance card)

4. If not meeting account requirement, Advance and Premier cards will start to have annual fee on year two. You can downgrade Primer and Advance to one of the Platinum to avoid this.

5. In case annual fee posted due to account type has changed, you can call customer service to have fee manually waived by downgrading the card.

6. After downgrading the card, CL may decrease. (for example, $14500 for Advance at time of opening to $8000 for Platinum)

7. HSBC does not allow CA to be reduced, it’s a fixed % to CL

Not sure whether you can have more than 1 HSBC CC at one time. Probably not.

Reported highest CL at account opening: $14500

stay away from HSBC promotions. Lot of frustration and no bonus at the end even after meeting all the requirements.

Might need to adjust the wording here a little – these bonuses have been back for a while 🙂 (at least November-ish 2016 at the current amounts, wasn’t paying much attention prior to then.)

I forgot to consult the spreadsheet :(, silly Will! Thanks for info, I wasn’t actually sure if they went and came back or not.

Actually I think I posted because they might expire on March 31st, probably should add that to the post.

These are not necessarily meant for the general public but for their premier clients who are already holding balances. There are some fixed travel redemptions for the 1.5c (book any ticket and then redeem a statement credit using the points). If you want some screenshots let me know.

I got the premier world, but the travel credit is only $200 for 16k points, 400/32 or 600/48, which is 1.25c. would you mind tell me where to redeem it for 1.5c?

Got the HSBC Platinum Rewards along with the checking account (for the 350$ bonus)

They pulled EQ (I’m in Louisiana). Aside from the sign up bonus, the card is pretty useless, it’s basically a 1% cash back.

The 150$ bonus took about 3 weeks after 90 days period to post, and you can only redeem for statement credit or deposit to bank account in the amount of 25, 50,100, 200… I did not check travel option for redeem but other options (merchandise & gift card) are overpriced (much less than 1 cent per point)

Does anyone know if HSBC offers brokerage accounts, and what fees they charge? If I can open a no-fee brokerage account I wouldn’t mind parking 100k worth of ETFs at HSBC.

It looks like the has potential, but see this:

http://www.banking.us.hsbc.com/personal/cards/HBUS_Premier_CCAddendum.pdf

-If you don’t maintain a 100k checking balance, they charge you a $50 per month fee on the account

-If you don’t have 100k in your checking account after the first year, the most premium card comes with a $95 annual fee thereafter

-The hoops you have to go through to open up the initial checking account seems to not be worth it (no online application)

-They only have three transfer partners as of yet

-They don’t appear to have category point bonuses for spend

-Not sure about the rental car insurance (if it is primary or secondary)

-No sure all of this work for 40k points is worth it, as you are left with a paper weight after you earn the 40k points (no category bonuses, why keep it?)

If they want this card to be competitive, they need to: add more transfer partners (especially ones that are rare now – JAL and Alaska,) give a category spend bonus (rotating or whatever,) and not make it so difficult to apply for the card

It’s good to have more competition in this space.

$100k balance requirement should be waived or the fee reduced. An effective $600 AF does not match up to the card’s benefits.