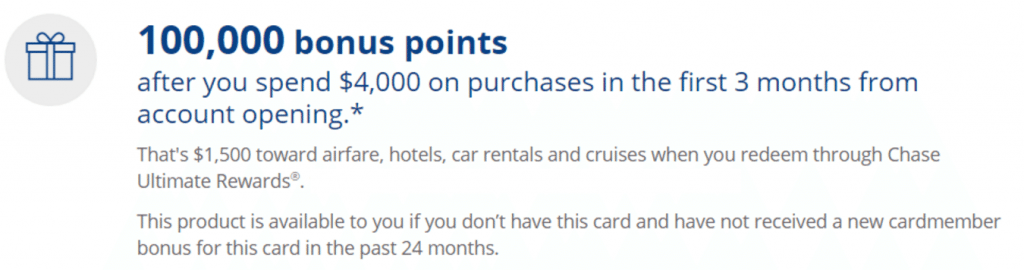

Saturday is the last day for the Chase Sapphire Reserve 100,000 point offer in branch offer. I don’t expect we will see this offer again in the near future, so if you haven’t already gotten the card then I’d recommend getting it now. Some things to note:

- Chase 5/24 rule does apply to this card

- Pre-approvals currently not available for this card

- Point Me To The Plane stated that they were at 6/24 and applied & was approved for the card. They said that they saw that the Chase Sapphire Reserve was still shaded in green like other card pre-approvals. Not sure what’s going on here, but I suspect it’s most likely that they are actually under 5/24 for whatever reason as others don’t seem able to replicate this.

- Also a good idea to familiarize yourself with other changes happening on/around March 12th.

I am 6/24, CPC status, appled in branch, denied offer. Rascals at chase have no value of their high end customers, loyal customers who bank with them for 10 years. F ’em

Moving My $400k to another bank who are giving me $1500 account opening bonus for 1) Getting me their customer from chase 2) Matching the bonus i would have got from getting the CSR card.

Glad to get rid of arrogant rascals who collectively work at CHASE……

This is Chase’s policy, and it doesn’t matter if your net worth is $1,000 or $10,000,000. They apply it equally across the board. Other banks have similar policies too. The sooner you realize this the sooner you can understand how to play the game.

And I hope you didn’t have $400,000 just sitting in one of their worthless 0.01% accounts. Even at a paltry 1% that’s $4,000 a year you’re throwing away.

My experience with the 7-10 notice. Got it in branch yesterday (my first day under 5/24 was yesterday). Called recon today and had to verify my income. Was then approved and the card shows up in my account now.

I have a question. I applied for a bunch of cards in March of 2015. So does the 5/24 rule mean that I can safely apply for the CSR card now, or do I have to wait until April? Thanks!

How many cards were opened in the past 24 months? Don’t count Biz cards from non-Chase banks.

Zero

This explains how to calculate it: https://www.doctorofcredit.com/chase-524-rule-explained-detail-need-know/#How_is_24_monthscalculated

today you might have some problems applying in branch.. i did.

they somehow messed up the promotion ending too early.

they had me apply online for the 50k point CSR card, and then they put a bunch of notes in my file saying once i hit the 4k spend they will manually apply the other 50k points.

Bummer. Sounds like you’ may have to call them after you meet the $4k spend to get the full 100k bonus points.

Is anybody else having trouble getting the computer to let you apply for it in branch? The guy is telling me that the csr is greyed out on their options.

what’s the minimum credit score for this?

This is an ultra premium card for Chase, so probably 760+ I’d assume.

I got approved at 759, there are DPs of people being approved with the low 700s though

I got approved at 720, I am a CPC. This is my 5th card during past 6 month, and I also got approved for Marriott at the same day. I think this card do not need a high score.

Two of my friends were approved today with 713 and 737 EX scores.. 737 score was a thin file less than a year of history.

I had a family member get approved with 705. Only got a 10K limit, though.

Not sure how I was approved but I applied for the card back in December since I figured I had nothing to lose. At the time, credit score was 670 and I had just bought a house a month earlier. But the offer was too good to not try and I figured the worst was a 30 pt ding on my score. Went in branch to see if I was pre approved. Teller said I was approved for multiple offers and to meet with banker. Met with a banker and he rattled off 6 different credit card offers of which one was CSR. I applied and was instantly approved for 10k!!! I couldn’t believe it! Called the next day to have my statement date end on the 28th of every month (to double dip the $300 travel credit) and the rep had no issue honoring my request. 6 months later and my limit is 15k. AMAZING CARD AND SERVICE! Wife and I have a wedding anniversary trip planned in the fall, paid for with the sign up bonus. Now, even at 50,000 points offer, there is tremendous value with this card. Good luck to all who apply!

Went into branch on advise of Private Banker to apply for CSR.

I was at 5/25 from the Chase Journey site and told them as much since I did not want a hard inquiry for nothing. Banker said I was good (bad info).

Applied. Denied. Banker called and put me on the phone and they refused to reconsider based on 5/24. Guy who reviewed my file was Greg Carlile. I point his out because it was the worst customer rep I have ever spoken with at Chase… He refused to acknowledge there is a 5/24 rule and referenced cards that were open greater than two years on my report, told me Private Clients status does not matter, refused to move lines of credit or reopen request etc.. Also refused to let me speak to a supervisor. I just gave him back to the Private Banker – who escalated.

Moral – I knew better and should have stayed home 🙂

Happy for those who did make it though.

I’m CPC and got denied for CSR as well for being well over 5/24. Tried reconsider, with CPC banker, and offered to move credit, but no success. I have a feeling when the bonus goes back to 60k for CPC clients vs 50k for regular applicants, then maybe they’ll be more lenient to CPC clients above 5/24, but then the card won’t be as enticing

Sadly, Private Client status means nothing anymore in terms of 5/24. All you can do is wait to drop below 5/24 (unless you get a preapproval).

For now, Chase has really tightened the screws.

Chase reps are hesitant to specifically reference 5/24; they typically just say “too many” cards in 24 months etc.

Went in and applied for the Reserve but was told my application was pending and I would have a decision within a month. Are they trying to let me down easy?

30 days is the ‘good’ pending time. 7-10 is bad. Keep your head up, don’t call until you get anything in the mail.

Why is there a difference?

7-10 means, they’ve auto rejected you and it takes few days to get the official letter mailed to you. anything longer such as 30 days, means you’re likely to be approved.

I just got a 7-10 day notice.. you broke my heart

My experience. Was also 7-10 from yesterday. Called recon just now. Verified my income and was approved. Card shows up in my account as of now.

Were you over 5/24?

What did recon say? Oh yes I see you were declined but we’ll approve you? Or were they like yes, we see its in a 7-10 day status but good news you’re approved!

Also what number did you call? 1-888-270-2127?

Under 5/24 by one day. Didnt mention being denied just said they had to verify a few things then approved me.

Thats the number I called.

Hi Doc,

just want to share about my trageted offer!.

I went to Chase Branch to see if I am pre-qualified for CSR card but I am not. Chase Rep told me that I am pre-qualified for Chase Freedom Unlimited card with 30,000 points offer after spending $500. I accepted it applied for this offer, initially it went to pending and 3 days later it got approved.

$300 bonus for CFU is nice! R you at or over 5/24?

yes. I am over 5/24… I think i am 15/24 (5 of those are chase cards )

I think if I add AU i will get additional $25 after first purchase, i will find it.

Question.

Today I am officially under 5/24. I plan to go to a branch to apply, but know that the Chase system might still count me as over 5/25 because it wont update until the following month. So if I get denied should I call recon in a few days and explain my situation or just wait until 4/1 to call?

MBP – I went under 5/24 on Jan. 9th and applied in branch for the CSR on Jan. 14th. Went to pending and received my card in the mail on Feb. 1st. Based on my experience, you should be good.

Thanks!