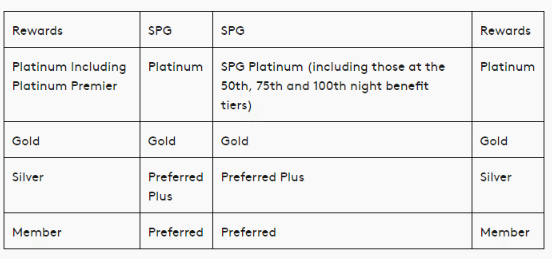

Marriott have just announced the details of their acquisition of SPG. Part of this is the fact that you can now transfer SPG to Marriott points at a rate of 1:3 and conversely you can transfer Marriott to SPG at a rate of 3:1. They’ll also match your status as well, as follows:

Let’s take a look at all of the SPG/Marriott/Ritz-Carlton credit cards and see if there is any hidden value now.

Contents

Ritz-Carlton Credit Card

This card offers three free nights at any tier 1-4 properties and 10,000 Ritz-Carlton points after you add an authorized user and they make their first purchase. It also comes with a heavy $450 annual fee but with $300 in airline incidental credits. It earns at the following rates:

- 5x points on Ritz-Carlton & partner hotel stays

- 2x points on travel & restaurants

- 1x points on all other purchases

It gives you Gold Elite status in the first year and you can maintain this by spending $10,000 on purchases in the first year and each year thereafter. This can be upgraded to Platinum Elite status with $75,000 in spend each account year.

Because the free night credits can’t be transferred to SPG and the earning rates on this card are relatively low (especially when you consider the 3:1 transfer rate) this card isn’t of particular interest. You would get SPG gold or Platinum status, but that isn’t particularly exciting given the high spend requirement.

Marriott Personal

Link to our review/current offer

The current sign up bonus on this card is 80,000 points after $3,000 in spend within the first three months and 7,500 points for adding an authorized user and them making a first purchase also within three months of account opening. This would leave you with 87,500 points (really at least 90,500 after meeting the minimum spend requirement). That would be worth ~30,000 SPG points.

Downside is that the $85 annual fee is not waived the first year, and the earning rates aren’t great.

- Annual fee of $85 is not waived

- Card earns at the following rates:

- 5x points per $1 spent at Marriott & Ritz Carlton locations

- 2x points per $1 spent on airline tickets purchased directly with the Airline, at car rental agencies and at restaurants

- 1x points per $1 spent on all other purchases

- Anniversary bonus of a free night certificate for a category 1-5 property.

- 15 credits towards Elite membership after approval and every year after account anniversary

- 1 elite credit for every $3,000 spent

- This product is available to you if you do not have this card and have not received a new cardmember bonus for this card in the past 24 months

Unfortunately the Chase 5/24 rule also applies to this card!

Chase Marriott Business

Update: According to Flyertalk this link is 70k points with the AF waived, but it’s not mentioned on the application page so YMMV.

This offer is currently pretty similar to the Chase Marriott personal card, big differences are the $99 annual fee and the fact that Chase 5/24 doesn’t apply to this card. Unfortunately there is no authorized user bonus either, so you’d end up with 80,000 points after $3,000 in spend (worth about 26,650 SPG points). Previously they’ve had a 100,000 point offer but that has now expired.

- Annual fee of $99 is not waived

- Card earns at the following rates:

- 5x points per $1 spent at Marriott & Ritz Carlton locations

- 2x points per $1 spent on airline tickets purchased directly with the Airline, at car rental agencies and at restaurants

- 1x points per $1 spent on all other purchases

- Anniversary bonus of a free night certificate for a category 1-5 property.

- 15 credits towards Elite membership after approval and every year after account anniversary

- 1 elite credit for every $3,000 spent

- Marriott gold status after $50,000 in spend

- No foreign transaction fees

SPG Personal

There are currently two offers on this card, you can either get two free nights at any category 1-5 property or 25,000 points after $3,000 in spend by using a referral link (share your referrals here).

Now there are a few big things here, basically this is 75,000 Marriott points with no annual fee (better than the Marriott offers if you ask me). The second is that this card means you can earn 3x Marriott points on all purchases. You’d need to value Marriott points at over 0.67¢ each to get better value than using a 2% card.

SPG Business

Same as personal, there are two different offers. One for two free nights and the other for 25,000 points but both require $5,000 in spend. You can share your referrals here.

- Annual fee of $95 is waived the first year

- No foreign transaction fee

- Boingo internet access for up to four devices

- Premium in room internet at all SPG hotels

- Earn 2x points on all SPG purchases

- Earn 1x points on all other purchases

- Sheraton Club Access

You have the same ability to get 75,000 points and earn 3x on Marriott as with the personal.

Our Verdict

A lot of people will be eyeing the 7 night + miles hotel and flight packages from Marriott. One awesome deal would be 120,000 Southwest miles (these count for the companion pass) and seven nights at a category one to five property. Normally that would set you back 270,000 points but in this case it could be 90,000 SPG points. I’m actually more interested in transferring the other way as I like SPG points quite a lot and have a glut of airline miles. It’s a shame the personal Marriott card is under 5/24 and the business card doesn’t come with the 7,500 authorized user points.

Still that’s a pretty good offer, over 25,000 SPG points but I do eat an annual fee of $99 so will need to think about it some more. Where do you see the value with this new announcement? Let me know in the comments.

Any guesses where we set the ticking down of the Marriott Nights & Flights packages?

Or are folks optimistic in thinking these won’t be axed by, say, January 1?

Does anyone know if Marriott will honor club access for those who have the Amex SPG business card? I wonder how this benefit will carry over. Thanks!

I doubt we will know until the full merger is completed in 2018 at the latest.

Does anyone know if Marriott honor club access for those who have the Amex SPG business card? I wonder how this benefit will carry over. Thanks!

It’s strange that they’re valuing SPG at 3 Marriott points since their own cards only earn 1 Marriott point per non bonus $ spent.

So even if you’re not a Starwood customer, it still makes sense to get the SPG card for everyday spend (if you want to redeem for Marriott stays).

William what do you think will happen to the existing cards since there are two issuers Chase and AmEx?

I think Chase will purchase the backbook from AmEx and create some sort of weird SPG/Marriott card for previous cardholders.

spg has lifetime gold and lifetime platinum. I wonder if marriott will honor

I’d assume so, but we will see.

I have 394 SPG Points left (need min. 1000 to transfer) that expires in 2 months. Can I transfer 2000 MR to SPG which will give me 666 points (666+394=1060 ) and then transfer back to Marriott 1000 SPG points for 3000 MR points? thanks.

Why not? Constipation issues?

Flyer talk listed a 70k business card with no af.

Thanks, added.

No landing page(s) displayed or stated that the 1st yr AF is waived

I’ve got the spy biz and I’m over 5/24. I suppose the right move for me is to grab an SPG personal and a Mariott biz, but I think I’ll hold out for better bonuses on them both.

Goodluck!

One card left before I’m at 5/24…Any opinions on best card to target being Marriott or United?

Not tied to any airline or hotel chain, just an economy traveler looking for value.

Can’t wait to eat every meal at SPG properties using my SPG card – 6 Marriott rewards per dollar, woohoo (*rolleyes*)

You can do two on the same day to get around 5/24 if you’re already under it and get both, although the sign up bonus on the United card isn’t great. Have you got all the Chase branded cards yet?