Deal has expired, view more bank account bonuses by clicking here

Offer at a glance

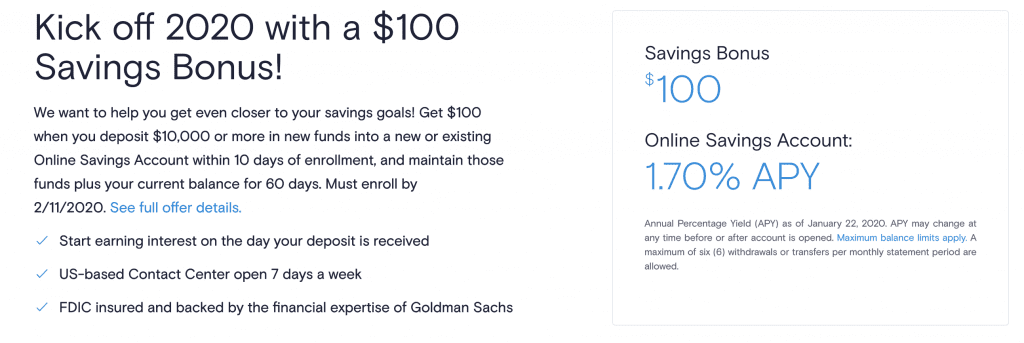

- Max Bonus Amount: $100

- Direct Deposit Required: No

- Additional Requirements: $10,000 deposit (new funds)

- Hard/Soft Pull: Soft pull

- Credit Card Funding: None

- Monthly Fees: None

- Availability: Nationwide, new or existing users

- Expiration Date: enroll by February 11, 2019 and fund within 10 days

- Insured: FDIC

The Offer

- New or existing Marcus by Goldman Sachs customers can enroll to be eligible for $100 bonus when depositing $10,000 in new funds within 10 days of enrollment and maintaining those funds plus your current balance for 60 days. You must enroll first.

The Fine Print

- Offer valid from 1/21/20 to 2/11/20.

- To qualify for the $100 Savings Bonus, you must first enroll in this offer at https://www.marcus.com/us/en/savings/osa-savingsbonus-1 or by calling Marcus at 1-855-730-SAVE (1-855-730-7283) by 11:59 PM EST on 2/11/20. Upon successful enrollment you will receive a confirmation of your enrollment via email or U.S. mail.

- After enrollment, you must deposit $10,000 or more in new funds (internal transfers won’t count) into a Marcus Online Savings Account within 10 days of enrollment and maintain at least $10,000 of those new funds in your account in addition to your account balance at the time of enrollment for 60 consecutive days from the date of reaching the required dollar amount.

- Multiple deposits are allowed to reach the required dollar amount and can be made by joint owners for a joint account.

- Offer available to new and existing customers. Each customer is limited to one bonus offer, which can only be applied to a single account. For eligibility purposes, each joint owner will be treated as a separate customer. For example, if you apply the bonus offer to a joint account, the remaining joint owner(s) may apply this offer to another account they own if they have not done so already.

- The bonus will be deposited into your account within 14 days after fulfilling the above requirements. To receive your bonus, your account must be open and in good standing at the time the bonus is deposited in your account.

- The bonus will be treated as interest for tax reporting purposes.

Our Verdict

Marcus offered a similar deal in March 2019, then they offered a $500 deal in July 2019, and now the $100 deal again. It’s getting more and more worthwhile to hold a Marcus account as the bonuses all seem to be for new or existing customers, and they’ve never run a ‘new customer only’ promotion to wait for, far as I’m aware.

Locking up $10k for 60 days and getting $100 is a APY of roughly 6%, added to their competitive 1.7% regular interest rate (see Best Savings Rates) for a total 7.70% return. Pretty nice offer, especially if you already have a Marcus account open. I’ll probably wait until my Simple bonus finishes, then Enroll in this offer, and then fund Marcus account with the funds from Simple.

Thanks to all those who sent this one in.

Marcus now has a referral program — 0.20% APY boost for 3 months. Additional referrals add 3 additional months. Expires December 31.

Full terms: https://www.marcus.com/us/en/savings/referral-offer-terms

If you are transferring money out of Marcus after the bonus, their wire transfers are free. You can do a wire transfer online but capped at $10k per statement period. Wire transfers above $10k have to be done by phone.

APY is now 1.55%, as per email

I see $100 applied to my account, but the balance only increased by $76?

2/2: Account opened

2/7: $10k push from Ally.

4/6: Bonus criteria satisfied

4/8: $100 bonus deposited.

As others said, very nice that they have a bonus tracker and I will definitely keep this account open for future promos. All my cash is tied up now with Ally, Chase, and CIBC mid-term bonuses but current rate is still 1.7% which is above average as of today.

I’ve always been super impressed with their website and was really impressed with the “Your Offer Status” tracker showing dates of a) enrollment in offer, b) depositing required amount, c) maintaining eligibility for required amount of time, and d) payment received. My $100 was paid on the first business day after meeting the 60-day requirement.

$100 bonus has been paid right on time! This account (as well as Ally and CIT) will be maintained due to occasional promotions just like this one.

My bonus was declined. I enrolled successfully, met all requirements and never made any withdrawals. CSR told me earlier today that it was declined, but she couldn’t get in touch with their back office to figure out why; asked me to call back tomorrow morning. Anybody experience this? I really hope I don’t need to CFPB them.

My bonus ticker disappeared 2 days ago and today is the day for meeting the requirements. I’ll report back if it posts, but I really dont want to call and/or fight this

DP:

01/23 – enrolled for bonus with existing account

01/27 – 10k transfer posted

03/26 – Marcus says eligibility completed

03/28 – $100 bonus posted

Wonder if money from this account should put in a CD or open a high interest checking account ( provided they keep their rate high ) ?