Deal has ended, view more credit card bonuses by clicking here.

The Offer

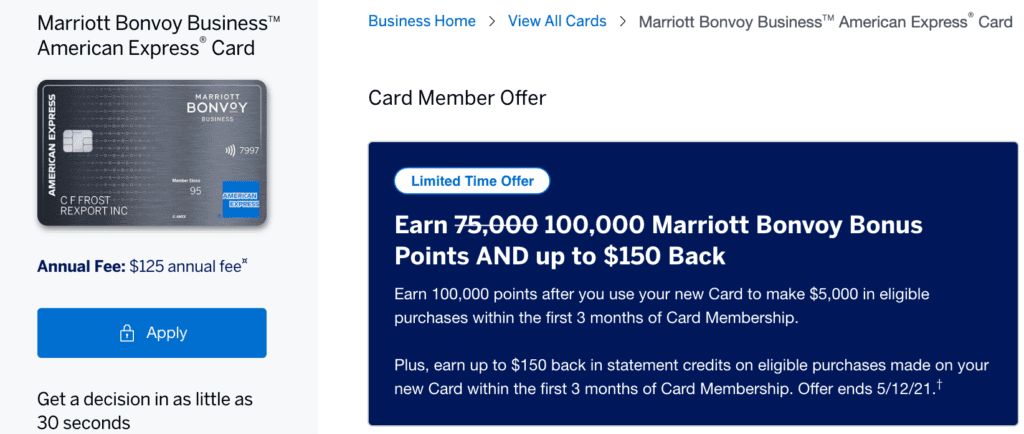

- American Express is offering a sign up bonus of 100,000 points on the Marriott Bonvoy Business Card after spending $5,000 within 3 months.

- You also get a $150 statement credit on eligible purchases made within the first three months.

Signup offer ends on 5/12/21.

Card Details

- Anniversary free night award up to 35,000 points (this is a free night certificated that can be used on properties costing up to 35,000 points)

- $125 annual fee (not waived first year)

- Card earns at the following rates:

- Six Marriott rewards points per dollar spent at participating hotels

- Four Marriott rewards points per dollar spent at U.S. restaurants, U.S. gas stations, wireless telephone services purchased directly from U.S. service providers and on U.S. purchases for shipping

- Two points per dollar spent on all other purchases

- Silver status; earn gold status by making $35,000 in purchases within a calendar year

- Receive 15 nights towards elite status

- Premium in room internet access at participating properties

- No foreign transaction fees

- Can only get the bonus once per lifetime

Our Verdict

Last year we saw a 100,000 point offer + $150 credit + elite status, but the credit required spend on U.S. Advertising in select media. We also saw last month 75,000 points + $150 anywhere. This new offer is the best with 100,000 points + $150 which can be spent anywhere (though this one does not come with elite status). Additionally, this offer is available via referrals, so if you have a friend/spouse to refer you and get a referral bonus the offer is especially nice.

We’ll add this offer to our list of the best credit card bonuses. There’s also a new increased offer on the American Express Bonvoy Brilliant personal card as well.