Update 4/4/22: Back up to 5% APY. Might be nationwide with 25.00 donation to Leader Dogs for the Blind. Looks like not nationwide based on the comments.

Offer at a glance

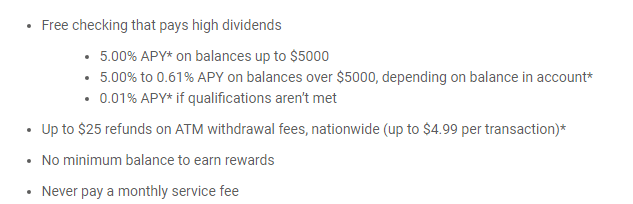

- Interest Rate: 5% APY

- Minimum Balance: None listed

- Maximum Balance: $5,000

- Availability:MI only?

- Direct deposit required: No

- Additional requirements: See below

- Hard/soft pull: Unknown

- ChexSystems: Unknown

- Credit card funding: None

- Monthly fees: None

- Insured: NCUA

The Offer

- Chief Financial Credit Union is offering 5% APY on balances up to $5,000 when the following requirements are met each monthly qualification cycle:

- Have at least 12 debit card purchases post and settle

- Be enrolled in and agree to receive eStatements

- Be enrolled in and log into online banking

The Fine Print

- Qualification Information: Account transactions and activities may take one or more days to post and settle to the account and all must do so during the Monthly Qualification Cycle in order to qualify for the account’s rewards.

- The following activities do not count toward earning account rewards: ATM-processed transactions, transfers between accounts, debit card purchases processed by merchants and received by our credit union as ATM transactions, non-retail payment transactions and purchases made with debit cards not issued by our credit union.

- Transactions bundled together by merchants and received by our institution as a single transaction count as a single transaction for the purpose of earning account rewards.

- “Monthly Qualification Cycle” means a period beginning one (1) day prior to the first day of the current statement cycle through one (1) day prior to the last day of the current statement cycle.

- Reward Information: When your Kasasa Cash account qualifications are met during a Monthly Qualification Cycle, daily balances up to and including $5000 in your Kasasa Cash account earn a dividend rate of 4.98% resulting in an APY of 5.00%; and daily balances over $5000 earn a dividend rate of .39% on the portion of the daily balance over $5000, resulting in a range from 5.00% to .61% APY depending on the account’s daily balance.

- Limit of 1 account(s) per social security number.

- All bank account bonuses are treated as income/interest and as such you have to pay taxes on them

Avoiding Fees

There are no recurring monthly maintenance charges or fees to open or close this account.

Our Verdict

All of the requirements are relatively easy to meet and there is no monthly fee to worry about. It’s gotten harder to get a 5% APY account with the loss of Insight accounts so I suspect some readers are still looking for a replacement. We still need to know if it’s a hard or soft pull, if you can fund with a credit card and if it’s actually state restricted or not. As always please share your data points in the comments below. You can view a full list of high yield savings accounts here.

Hat tip to reader Spartan24

PSA Cash App no longer works. I had this account for over a year and used CashApp to make the required debit card transactions.

Received email saying: “Please be aware that your account is being reviewed for inappropriate qualification transactions. These are transactions that do not meet the qualification requirements outlined in the account disclosure. ”

Appears the jig is up. Time to move on.

I received the same email. After they blocked CashApp I was using Amazon reloads. Interestingly they have CDs available for the same interest rate so why not just give us the interest rate in savings rather than making people play these stupid games? I’m going to move the money to an Ally 5% CD, which is longer in time and Ally has given me very little trouble over the years.

Other penny charge methods done manually do not work. It appears they have gotten very strict and is no longer a viable Credit Union.

Can confirm Paypal subscriptions no longer works. Need to find a new automation method.

I had paypal auto subscription of $0.01, been getting interest every month, but didnt post for July. They changed something.

PSA: Check you your Chief account for a fraud charge on Jul 30 titled as HC* HC_CHARGE. I got hit with about 4 transactions worth $300.

Just opened my account. Any data points yet on minimum debit card transaction? There is none stated in the terms that I saw.

Was it a hard pull?

Tried in nearby state: must open either in-branch or have MI state ID.

anyone actually try OOS?

Anybody know if there is a debit tracker? I don’t like doing these without a tracker to confirm I have met the requirements.

I signed up and chatted with a CSR and was told I will receive an email when approved with how to log in.

Thanks frank