Deal has ended, view more bank account bonuses by clicking here.

Offer at a glance

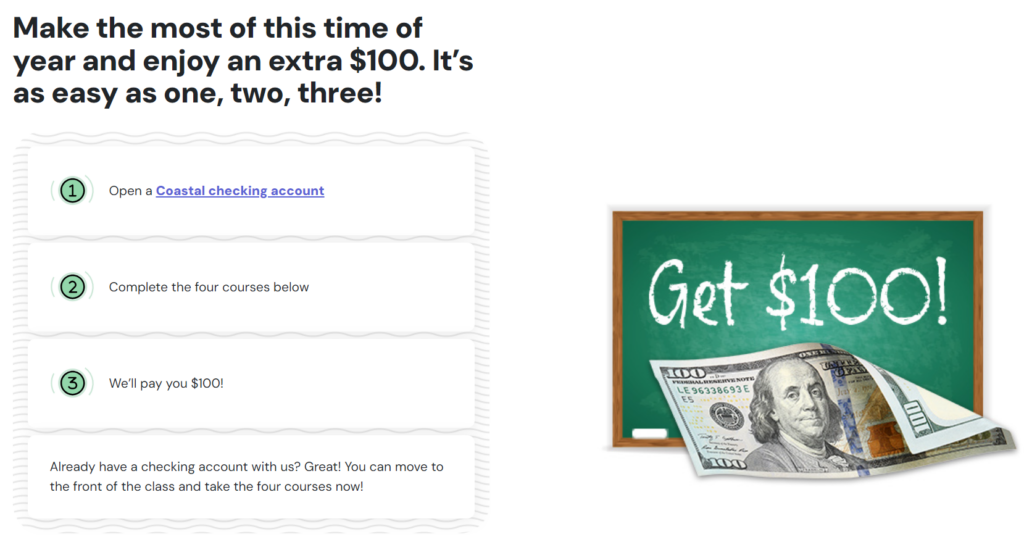

- Maximum bonus amount: $100

- Availability: persons who live and work in the entire cities of Littleton NC, Weldon NC, Aurelian Springs NC, Airlie NC, Halifax NC, Arcola NC, Hollister NC, Brinkleyville NC, Heathsville NC, Tillery NC, Enfield NC, Scotland Neck NC, Whitakers NC, Castalia NC, Red Oak NC, Dortches NC, Leggett NC, Wrendale NC, Speed NC, Nashville NC, Rocky Mount NC, West Edgecombe NC, Woodcrest Park NC, Tarboro NC. Can join out of state with a $18 donation.

- Direct deposit required: No

- Additional requirements: Complete four courses

- Hard/soft pull: Soft pull

- ChexSystems: Mixed DP

- Credit card funding: Up to $1,000

- Monthly fees: None

- Early account termination fee: None

- Household limit: None

- Expiration date:You need to open an account by 10.31.24 and complete the 4 courses by 10.17.24

Contents

The Offer

- Coastal Credit Union is offering a $100 bonus to new and existing customers. To receive the bonus you must finish four courses (watching videos that go for 27 minutes by the looks of it).

The Fine Print

- All bank account bonuses are treated as income/interest and as such you have to pay taxes on them

Avoiding Fees

Monthly Fees

This account has no monthly fees to worry about.

Early Account Termination Fee

Account needs to be open when bonus posts. There is also a $5 inactivity fee after 6 months.

Our Verdict

There was previously a $300 bonus for new users. Nice to see a bonus that works for existing users as well. We will add this to our list of the best bank account bonuses.

Hat tip to Yuri

Useful posts regarding bank bonuses:

- A Beginners Guide To Bank Account Bonuses

- Bank Account Quick Reference Table (Spreadsheet) (very useful for sorting bonuses by different parameters)

- PSA: Don’t Call The Bank

- Introduction To ChexSystems

- Banks & Credit Unions That Are ChexSystems Inquiry Sensitive

- What Banks & Credit Unions Do/Don’t Pull ChexSystems?

- How To Use Our Direct Deposit Page For Bank Bonuses Page

- Common Bank Bonus Misconceptions + Why You Should Give Them A Go

- How Many Bank Accounts Can I Safely Open Within A Year For Bank Bonus Purposes?

- Affiliate Links & Bank Bonuses – We Won’t Be Using Them

- Complete List Of Ways To Close Bank Accounts At Each Bank

- Banks That Allow/Don’t Allow Out Of State Checking Applications

- Bank Bonus Posting Times

Is it expired?

Yes, the deal expired many months ago.

Can you mark the post as “Expired”?

On Coastal, I linked an external bank account. Coastal did only one micro-deposit and one withdrawal – not the usual two small deposits. They left $0.04 in my external account. When I went to confirm, Coastal only had two boxes: one for the deposit amount and one for the withdrawal amount. Confirmation worked. I’ve never seen that before.

Has anyone realized that the Go Green Checking account comes with a 5% APY on balances up to $10k if you have 15 or more debit card transactions per month? I was about to close but I think I’ll keep it now.

Have you tested it out yet? If so, what has worked for the debit card purchases? Does Coastal send out a tracker during the month?

Bank account funding probably doesn’t work for the PIN or signature-based debit card transactions.

I tested it with Langley FCU and they coded PAYMENT DEBIT P2P.

I will never know for sure that those failed because I also made 5 POS transactions >$25. But I wouldn’t rely on anything that codes P2P.

I am 99% sure that you meant to put this in the Wings post rather than the CCU post.

You are 100% correct.

I wrote 99% in case you were to claim that you either meant to test me, you meant to post it in a different post than Wings (ie Langley) or some other excuse. 😉

They closed my account saying they needed a hard pull for equifax when I opened it originally. That’s hard to believe

They softed my EQ.

Lots of CSRs don’t know the difference between soft and hard pulls so maybe that’s what they meant.

If yours was frozen they wouldn’t have been able to soft it unless you were already a member.

Given the deadline to do the courses was earlier this month, no point of signing up for this now it seems?

P1 approved instantly. Already received $100.

Waited out to apply for until P2 to see how P1 experience went.

P2 applied on 10/16, and apparently it was approved the same day but haven’t received a welcome email or any account information. Today 10/17 the initial app funding was taken from external account.

So called the after hours 800 number who confirmed e-mail was correct and the day it was opened but couldn’t give member# or any other information.

Today is the deadline for the $100. Also the terms of the promo make zero sense saying you have until 10/31 to open an account but have to complete the course by 10/17.

Is there a link for app status or some way of getting the member/account # after hours?

Nevermind finally got access to account after several phones call yesterday. I went ahead and did the courses despite the date. The offer was still showing on the link. Guess we’ll see.

P2 completed course on 10/18/2024. Received $100 on 10/21.

I just checked and the PDF still shows that the courses must be completed by 10.17.24. That means 1 of the 2 things below.

#1. They are not enforcing the terms of the offer.

#2. They meant to require sign ups by 10/17 and the course completion by 10/31 but made a mistake on the PDF by switching the dates.

I just logged into my account and saw that the $100 posted to my Savings account today. So it seems like my theory that CCU posts bonuses once a week was correct. 😀

Yep you were right, it showed up for me as well today 🙂

You both might want to check your Savings accounts also for a likely nice surprise. 😀

Nice got it too

I just wanted to tag you also to let you know that we all received the bonus just in case that would push that over the edge to make it worth it for you.

Remember 10.17.24 is the deadline to complete the courses to qualify for the bonus.

Thanks Eric 🔗 but I’ve got enough irons in the fire at the moment.

Eric 🔗 but I’ve got enough irons in the fire at the moment.

Thanks for the heads up. Just checked and saw it was posted to the savings today 🙂

Got it. Thank you

Do you think it is worth trying P2 with donation since i see several rejections even with donation? Do they keep donation even if they reject you?

If I was you, I would certainly try for P2 with the donation option. A friend emailed me today saying that she was approved through the donation option so it seems to still be working.

I’m pretty sure that they only charge for the donation if you are approved as it gets taken from the Savings account.

It did work. Jut have to complete the course for her until 17th

Received $100 campaign reward posted to the savings account.

Yep, $100 rewards showing in savings account too.

Hello,

How to get a Unique Member Code ?

I cannot print a certificate of completion,

You just use your member # in that spot.