Update 5/21/24: This card now includes the possibility to upgrade to the Chase Freedom card. On your first card anniversary an automatic check is done by Chase that looks at:

- The cardmembers’ Freedom Rise account is open, and a purchase has been made on the Rise card within the last 12 months.

- All payments have been made on time to all financial lenders in the past 12 months, and no Chase accounts were suspended.

- They do not have an existing Freedom Unlimited account.

Hat tip to DDG

Update 6/12/23: Card now live at this link. (Officially it’s currently only available in branches. Reportedly, it will become available officially online beginning in early 2024.)

On June 11th is the launch of a brand new Chase Freedom Rise card which is meant to help someone build credit when applying for their first credit card. This is for both students and non-students alike. We previously reported on the new Student Rise card here and here

Contents

Card Details

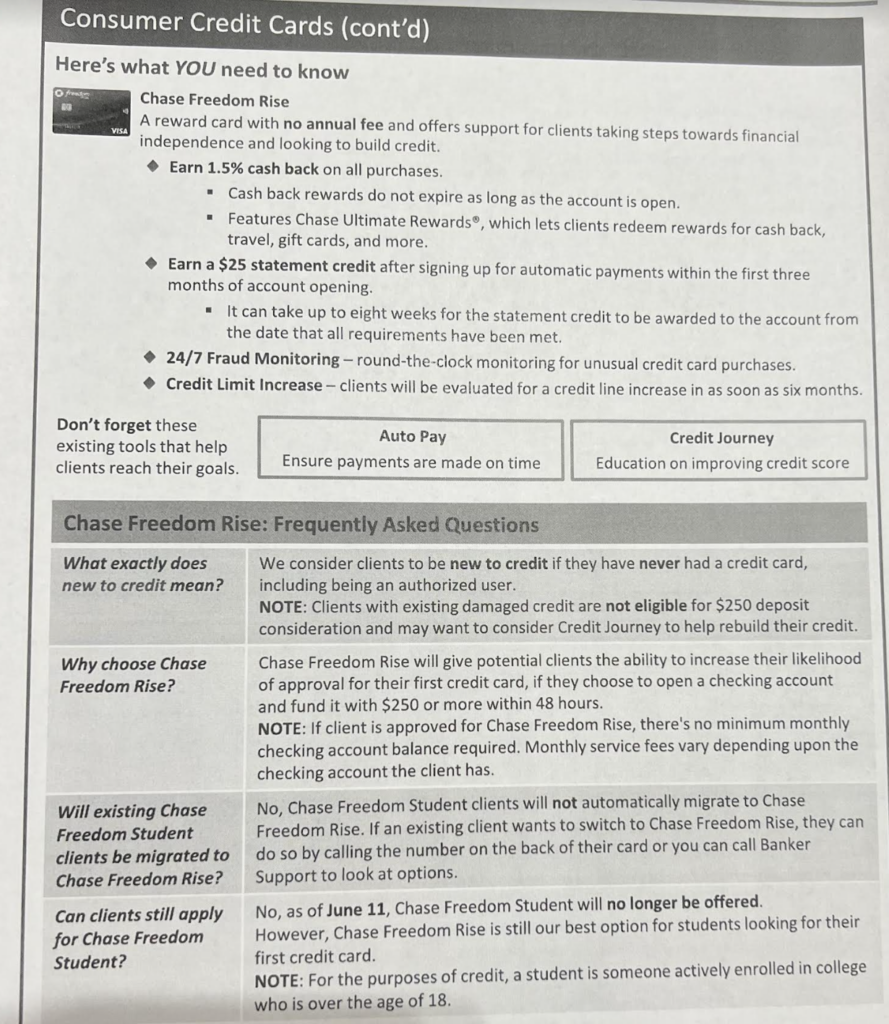

- No annual fee

- Earn 1.5% cash back on all purchases

- The rewards are earned as Ultimate Rewards points which can be redeemed for cashback, travel, gift cards, and more

- Bonus: Earn $25 statement credit after signing up for automatic payments within the first three months of account opening

Other Details:

- Becoming a Chase checking account holder with a checking balance of $250+ will increase your chances of getting approved for the Freedom Rise card (though it is not required). Be sure to open the Chase checking account before applying for the Freedom Rise card. Be sure to add the $250 to your checking account within 48 hours of applying for the card. Existing Chase checking customers can help their approval chances by increasing their balance to $250+ within 48 hours of their Freedom Rise card application.

- The card is meant for those NEW to credit, not for those with damaged credit.

- Cardholders will be evaluated for a credit limit increase in as soon as six months

- The Chase Freedom Student card is being discontinued for new applicants on June 11, 2023 in favor of the new Freedom Rise card. (That card is live right now online, 6/6/23, at this link.) Existing Freedom Student cardholders will continue to be serviced as before, and do not have to transition to the Freedom Rise.

- It’s still unclear if the new Freedom Rise card will be available online or in-branch only.

Our Verdict

The fact that the card earns Ultimate Rewards points makes it a good starter card to advise someone who has no credit, e.g. a student or newbie. The points will then tie into their regular Ultimate Rewards balance when they eventually build up their credit and get the better Chase cards. And 1.5x Ultimate Rewards everywhere is pretty good on its own.

You can always try first applying for a regular Freedom Flex or Freedom Unlimited card and, if denied, try for this starter card instead.

See Chase memo below outlining the change. There’s also a change referencing the Sapphire Preferred card which we covered here.