Update: We have a more complete post about this rule, found here.

We just posted about changes to Citi churning rules on ThankYou point earning cards, I didn’t think these restrictions were added to co-branded cards but after further checking they are. Basically you can’t get the sign up bonus on a new card if you’ve opened or closed a card within that brand (e.g American Airlines, Expedia, Hilton or Citi ThankYou points) within the past 24 months. Previously you were limited to the specific card not being opened or closed within 24 months (e.g you could get the Citi Prestige and then apply for the Citi Premier two months later and it would be fine).

Contents

AT&T

Bonus ThankYou Points not available if you have had any AT&T Access card or AT&T Access More card opened or closed in the past 24 months

American Airlines Cards

American Airlines AAdvantage® bonus miles not available if you have had any Citi / AAdvantage card (other than a CitiBusiness® / AAdvantage card) opened or closed in the past 24 months.

Expedia Cards

Expedia+ Points Bonus Offer is not available if you have had any Expedia+ or Expedia+ Voyager card opened or closed in the past 24 months.

Hilton

Bonus Hilton HHonors points are not available if you have had any Citi®Hilton HHonors™ card opened or closed in the past 24 months.

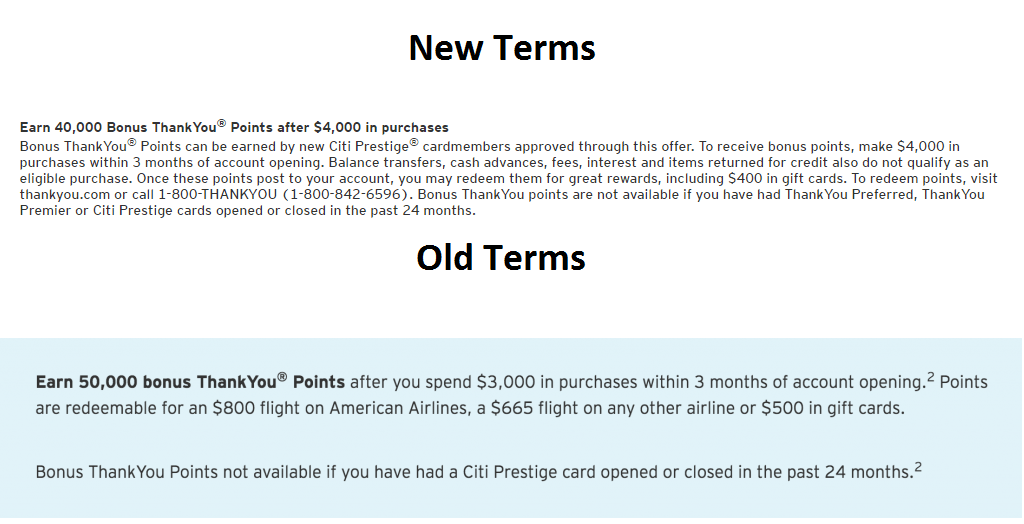

ThankYou Points

Bonus ThankYou points are not available if you have had ThankYou Preferred, ThankYou Premier or Citi Prestige cards opened or closed in the past 24 months.

Business Cards & Personal Cards

The new restrictions treat business cards and personal cards differently. For example, you can get the sign up bonus on the American Airlines business card as long as you haven’t had an open or closed American Airlines business card within the past 24 months, when you last had a personal card does not come into play.

What Happens If I Have A Mail Offer Without This Language?

Honestly, I don’t know. I highly suspect Citi would be enforced to honor the deal though as the language is not included in the mail out.

Our Verdict

Obviously this is a pretty major change by Citi, they have really been cracking down on people chasing sign up bonuses. First they added the rule that you couldn’t receive the sign up bonus if you’d opened or closed the same card within 18 months, then they extended that restriction to 24 months. Now that restriction applies brand wide, rather than being for a specific card.

This rule isn’t as restrictive as the rules from American Express (one bonus per card per lifetime, although this rule is often waived in targeted offers) and Chase’s 5/24 rule (won’t be approved for most cards if you have 5 or more new accounts within past 24 months). We will update our list of churnable cards page and also things you should know about Citi to reflect these changes.

The real question is if this change is being currently enforced, my suspicion is that Citi wouldn’t have added it unless they plan to enforce it. In the past when this sort of language has been added with Citi it’s been enforced immediately although you’ve occasionally been able to find links without the wording and then it wasn’t enforced. If anybody does find these sort of links, feel free to share them in the comments.

This will probably change my churning strategy going into the future, I’ll have a think about my plans and do a dedicated post shortly.

Hat tip to reader Tom