This bonus has now expired, you can view current bonuses by clicking here.

Offer at a glance

- Maximum bonus amount: $150

- Availability: OH or PA only. Some reports of having to live within 20 miles of branch.

- Direct deposit required: Yes, $500+

- Additional requirements: Five debit card transactions

- Hard/soft pull: Soft

- ChexSystems: Yes

- Credit card funding:

Up to $5,000 with a Visa or Mastercard$100 - Monthly fees: None

- Early account termination fee: None

- Expiration date: October 31st, 2016

The Offer

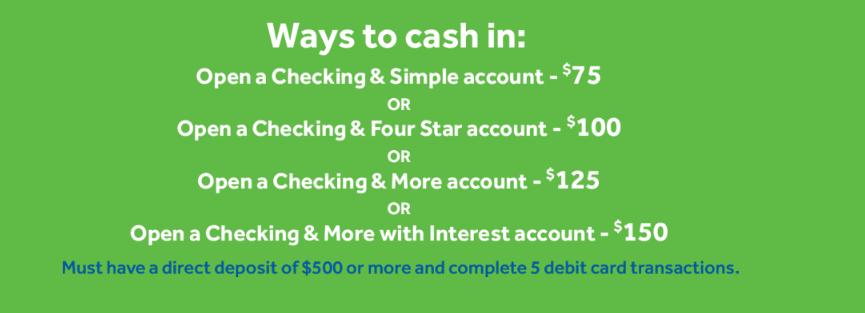

- Open a new checking account with S&T bank, receive a direct deposit of at least $500 and complete 5 debit card transactions (both must be met by December 2nd) and receive a bonus of up to $150. The bonus you receive is dependent on the account you open:

- Checking & Simple: $75

- Checking & Four Star: $100

- Checking & More: $125

- Checking & More with Interest: $150

The Fine Print

- You may earn up to a $150 reward if you open a new S&T checking account. You will only be considered for one reward amount, which is based on the product type you open. The product types available for this promotion are: Checking & Simple accounts will receive their reward of $75, Checking & Four Stars $100 reward, Checking & More $125, and Checking & More with Interest $150.

- To qualify for the reward, the new checking account must be opened between 9/1/2016 and 10/31/2016 and the following conditions must be met by December 2, 2016: (a) qualifying Direct Deposit(s) must be received and (b) at least 5 S&T Bank Visa Debit card purchases (posted and cleared) must be made. Your checking account must remain open and in good standing (a positive balance) in order to receive the reward, which will be credited to the eligible account 12/9/2016. Once all conditions have been met the credit will be identified as “Checking Rewards” on your monthly statement.

- A qualifying Direct Deposit is defined as a recurring Direct Deposit of a paycheck, pension, Social Security or other regular monthly income electronically deposited by an employer or an outside agency into the specific account you opened between 9/1-10/31/2016. The total amount of all qualifying Direct Deposits credited to your checking account must be at least $500. Credit card cash advance transfers, transfers from one account to another or deposits made at a branch or ATM do not qualify as Qualifying Direct Deposits.

- A qualifying debit card purchase is defined as any debit card purchase made at point of sale using your signature or PIN, or a purchase made electronically or online using your debit card number, including recurring payments.

- New accounts will not be eligible for offer if any signer has signing authority on an existing S&T Bank consumer checking account or has closed an account within the past 12 months, or has been paid a promotional premium in the past 12 months. If multiple accounts are opened with the same signers, only one account will be eligible for the premium. For this offer, signing authority will be defined by the customer name(s) and social security number(s) registered on the account. Offer may be extended, modified or discontinued at any time and may vary by market. The value of the reward may be reported on Internal Revenue Service (IRS) Form 1099, and may be considered taxable income to you. Please consult your tax advisor regarding your specific situation.

Avoiding Fees

There was no mention of an early account termination fee in their fee schedule found here. Let’s take a look at the monthly fees and how to waive them on each account:

- Checking & Simple. Need to be signed up for bill pay and pay one bill per month to avoid fee

- Checking & Four Stars. Must be over 50 years of age, not sure if there is any monthly fee

- Checking & More: One of, otherwise $10 fee:

- Minimum daily balance of $1,000

- combined deposit balance and HOME Center outstanding loan balance of $25,000 or more

- Checking & More with Interest. One of, otherwise $15 fee

- Minimum daily balance of $1,000

- Combined deposit balance and HOME Center outstanding loan balance of $50,000 or more

Our Verdict

Previously they offered a $100 bonus that was eligible on any account and didn’t require a direct deposit. This bonus is for an extra $50, but it does require a direct deposit. Some people will prefer the old $100 deal and some will prefer this $150 deal, most likely depends on how easy it is for you to set up a direct deposit. One thing everybody will love is the fact that you can fund $5,000 with a credit card. You’d earn $100 if you funded this account with a 2% cash back card so the bonus a lot more attractive. We will add it to our best bonus list, purely due to the large amount of credit card funding and $150 bonus.

Big thanks to Noah, David who let us know. Please consider sharing bank bonuses with this site so we can make it even better.

Useful posts regarding bank bonuses:

- A Beginners Guide To Bank Account Bonuses

- PSA: Don’t Call The Bank

- Introduction To ChexSystems

- Banks & Credit Unions That Are ChexSystems Inquiry Sensitive

- What Banks & Credit Unions Do/Don’t Pull ChexSystems?

- How To Use Our Direct Deposit Page For Bank Bonuses Page

- Common Bank Bonus Misconceptions + Why You Should Give Them A Go

- How Many Bank Accounts Can I Safely Open Within A Year For Bank Bonus Purposes?

- Affiliate Links & Bank Bonuses – We Won’t Be Using Them

- Complete List Of Ways To Close Bank Accounts At Each Bank

Just opened a Checking & More w/ Interest account. Successfully funded $4000 using Citi DC ; DC cash advance was set at $0. Citi shows the Category as “MORTGAGE COMPANIES-FINANCIAL INSTITUTION”

Boo. Applied and just got denied. I hope that I can still get the HSBC bonus.

Attempted to open account this morning, was instantly declined online.

Called and told that have to be within 15miles of a branch to be able to open an account.

The rep sounds a bit unsure about the actual number of miles of the rule, but it’s definitely affected by the distance to a branch from your home address.

Does anyone have any clue which CC can be used to fund the account without triggering cash advance? Called Fidelity rewards and CapOne venture, CSRs said they can’t lower the cash advance limit. My other options are Chase freedom and BofA Alaska.

Damn I have to move to PA, their bank bonus availability is crazy

I think it’s just because there are more readers in PA actively looking for these bonuses, do the same for your area and I’m sure we will see more of these on the site!

Hahah yea. I live in PA too. Only bad part about it is that I can’t always get in on the bonuses because I max out my inquiries this year pretty much. Opened 11 accounts in last 10 months. Didn’t get bonus for one, not sure why. Opened one and didn’t read requirement right so couldn’t get that right. 2 are in progress. One is Cap1 360 for random DD requirments. I’ve otherwise have gotten $950 on 6 successful accounts so far. Probably spent maybe 10-20 hours on everything. Easiest $47.5-$95 an hour I’ve made! Thanks Doc!

There is a lot of bank mergers and acquisitions in the northeast, which is why we are seeing a lot of bonuses as banks try and lure customers. Key Bank acquiring First Niagara, Northwest Savings from Warren, Pa., invading western New York, M&T Bank feeling threatened all of a sudden, and continued butt-kicking by great credit unions like PSECU in Pennsylvania are making a lot of commercial banks nervous.

Small banks in the Southern Tier of Upstate New York are also expanding into rural northern PA to build market share. Then you have the biggies in southeastern Pa doing their promotions and credit unions trying to grab some share, and you can see some big big bonus offers.

But keep in mind many of these are geographically restricted to within 20-50 miles of a local branch. It doesn’t mean anyone in the state can open an account and expect it to remain open.

Those in the western U.S., don’t worry. Just think about what Wells Fargo is going to have to offer you in bribes to keep doing business with those fraudsters. Just wait….

If I don’t live in any of these area, can I still open a new account just for cc loading?

I’m also very interested in this. Doesn’t seem to stop me from going through with the application. Just opened a few cards so this could be helpful.

Anyone notice that PA has more bonuses than any other state?

How long o I need to live in a state to be a resident?

1 year, for PA

you got that right, and I ain’t complaining. 😉

To waive the fees that is a $1,000 balance OR loan balance…not AND. So if you can tie up $1,000 you can go for the $150 bonus.

Source: https://www.stbank.com/content/personal/checking/checking-more-interest.aspx

Minimum daily balance of $1,000

Combined deposit balance and HOME Center outstanding loan balance of $50,000 or more.

$15 monthly maintenance fee if one of the above balances are not met.

I agree, you can see with this chart:

https://www.stbank.com/Documents/ST_Checking_Chart.pdf

Good point, thanks for catching that! Makes this bonus a lot better, updating now.