Update 2/15/24: $300 bonus no longer offered.

Update 4/17/23: APY has been increased to 10% APY (from 5%) and maximum balance now $5,000 (from $2,500). Hat tip to amtrakrailfan

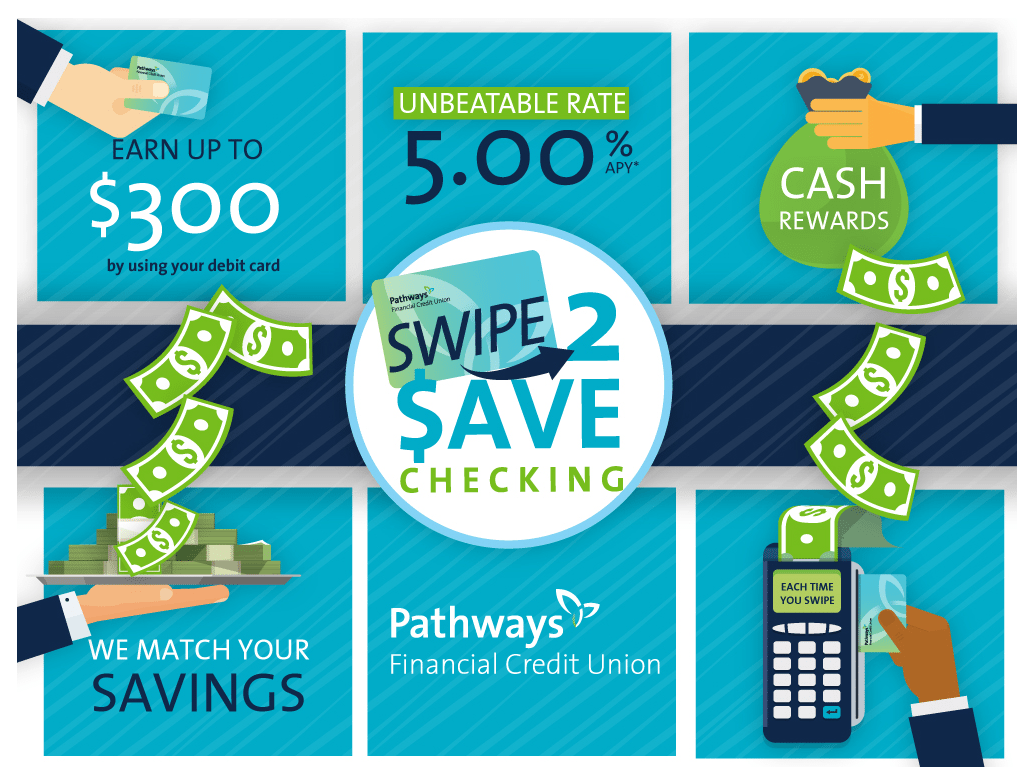

Offer at a glance

- Interest Rate: 5%

- Minimum Balance: None

- Maximum Balance: $5,000

- Availability: You are eligible for membership if you live, work, worship or attend school in Delaware, Franklin, Madison, Licking, Fairfield, Pickaway or Union County, Ohio

- Direct deposit required: No

- Additional requirements: See below

- Hard/soft pull: Mixed datapoints

- ChexSystems: Unknown

- Credit card funding: None

- Monthly fees: None

- Insured: NCUA

The Offer

- Open a new checking account with Pathways Financial Credit Union and they will give you a swipe2save savings account. The way this works is that for every debit card purchase you make they will round it up to the nearest dollar and that amount is depoited into your swipe2save savings account. For example make a purchase of $4.56 and they will round it up to $5 and transfer the extra $0.44 to your swipe2save savings account.

- For the first six months they will match your savings, up to $50 per month. E.g in the above example they will deposit another $0.44.

- Swipe2save savings account earns a 5% APY on all bances up to $2,500

The Fine Print

- Existing checking accounts not eligible for Pathways matching funds, a Swipe2Save Savings Account will be added earning 5.00% APY. APY = Annual Percentage Yield.

- Swipe2Save Secondary Savings Account balances $2,500 and under will earn 5.00% APY compounded and credited quarterly; balances exceeding $2,500 will earn regular Secondary Savings APY.

- Consult the Credit Union’s Account Disclosure Rate Supplement for current APY.

- Six month Credit Union match valid for new checking accounts only.

- Maximum match amount $50 per month for the first six months; match ends six months after checking account opening.

- Round-up deposits will not be made in the instance of a negative checking account balance.

- The only deposits permitted into Swipe2Save Secondary Savings Account are round-up deposits from debit card transactions and applicable credit union match funds.

- PFCU share and checking accounts federally insured for up to $250,000 by the National Credit Union Administration (NCUA). Savings rates subject to change without notice.

- We reserve the right to end or extend this offer at any time.

- All bank account bonuses are treated as income/interest and as such you have to pay taxes on them

Avoiding Fees

Neither account has any monthly fees to worry about.

Our Verdict

It’s a shame that this is a hard pull because according to the comments they aren’t very strict on the debit card transactions you make, so it should be easy to just make a lot of small debit card transactions each month this might be worth it just for the $300 bonus. The 5% APY is less interesting after the matching bonus disappears, but there is nothing stopping you just letting that $600 build up over time. As always if anybody has any experiences please share them. This is an interesting cross between a savings bonus and high interest savings account. I won’t be adding it to either best of list due to the hard pull unfortunately.

Hat tip to reader Adam K