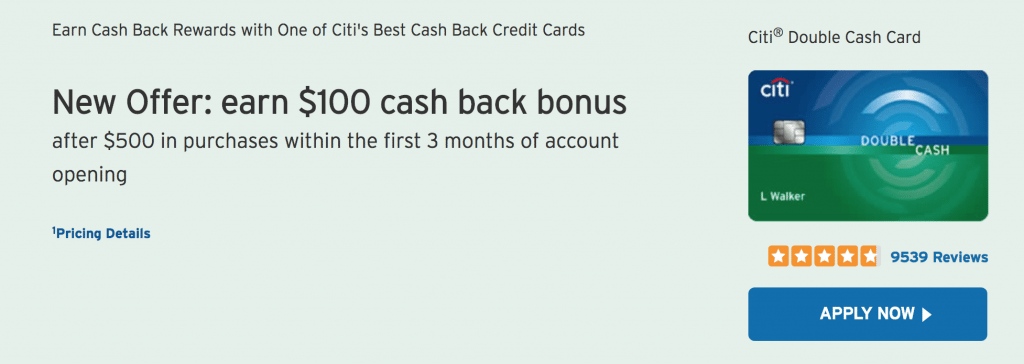

The Offer

Citi is finally offering a public signup bonus on the Citi Double Cash card:

- Signup for the card and get $100 statement credit when you spend $500 within three months

Card Details

- Earn 2% back on all spend: 1% with the purchase and another 1% at time of payment; no caps or category restrictions

- No annual fee

- 3% foreign transaction fee

Our Verdict

We wrote about how this $100 offer might be coming – great to see that it’s been released as a publicly available offer. 2% is the minimum you should be getting on every purchase (either that or an equivalent value from a points currency). There are some potentially better cards like the Alliant 2.5% card, but if you’ve been denied from that one like I was or if it’s not worth the annual fee based on your spend, a 2% card is a basic staple to have.

Other options to the Double Cash include the Fidelity Elan card and the Paypal 2% card. There are other similar offerings as well like Barclay Arrival Plus, Capital One Spark, and then there’s Blue Business Plus. See Best Card for Everyday Purchases for more options.

$100 isn’t much, but it’s an easy spend threshold and a nice little bonus for a card you’d be interested in regardless. That said, for a lot of people it would make more sense to go for a different Citi bonus and instead product change an older unused Citi card to become a Double Cash. Also check out these Things to Know about Citi Cards before applying.

Hat tip to reader Sammy

FYI just got an email saying if you paid the double cash with citi accelerated savings you get a bonus of .5% till 1/31/21.

That brings you up to a total of 2.5% cash back and your accelerated savings gives you 2.3 apy

The 2% on Citi’s card is nice, but customer service is pretty weak. Well, insulting. When you have a question that the automaton can’t find an answer to in the script binder, they suggest a manager call you back within 48 hours. I’m not joking. You see, all of the customer service managers are in meeting each time you call. Fancy that. So very busy. They’ll perhaps ring you if available on their own timeline, say, in about two days.

I applied using this offer and citi is refusing to give me the $100 because there isn’t a code. I’m putting a complaint in with the cfpb, has anyone else not gotten this bonus?

DP: Applied for this card in march with the sign-up bonus at a 764 score and was approved. They pulled Equifax for me.

Can someone tell me what the $ redemption increment levels are? For example discover has none, wells fargo cash wise is $25.

It is any amount with minimum of $25.

Is being an authorized user on a Double Cash make this offer void if I apply for the card directly?

Is being an authorized user on a Double Cash make this offer void if I apply for the card directly?

Can we have more than one Citi Double at a time?

Does Citi allow you to hold multiple Double Cash cards (like how Chase lets you have multiple Freedoms)? If so, I don’t see the downside in applying here and PC’ing other cards to the DC later.

What’s the point of multiple double cash cards?

The only point would be to avoid the annual fee on the card you’re PC’ing away from (like a TY Preferred or AA Plat/Gold). I understand there’s no added benefit to getting a second double cash – I just don’t understand the logic behind why you would completely ignore the $100 signup bonus in the hopes of in the future downgrading a card with an AF to the Double Cash, since taking this bonus doesn’t preclude that option. It feels like turning down free money for no added benefit.

score 784, at 7/12. approved. excited for the timing as I’ve been meaning to get this card, also recently got the uber Barclaycard 4% back at restaurants that had the same sign up bonus. awesome!