Update 5: Card is now live, full details here.

Update 4: We have another leak. Some additional information:

- There will be NO sign up bonus on this card

- It won’t be possible to product change existing Arrival/Arrival Plus cards to this card initially. They want to see how many people will apply without a sign up bonus/possibility of conversion. If enough people complain/numbers are low enough they will allow conversions. This seems especially strange considering the terms of the Arrival Premier state:

- You may not be eligible for this offer if you currently have or previously had an account with us in the Arrival, Arrival Plus and/or Arrival Premier programs.

- Card will be launched April 2018

Update 3: We now have another leak. This confirms most details we already knew, including the ability to transfer points to travel partners, annual spending bonuses and more. Also confirmation the card earns 2x on all purchases with no caps. Sadly no information on who the transfer partners are or what the sign up bonus will be.

Update 2: Frequent Miler is reporting that transfers to travel partners are confirmed via an unnamed source. Barclaycard currently has co-branded partnerships with the following travel partners:

- American Airlines

- Frontier Airlines

- Hawaiian Airlines

- JetBlue

- Lufthansa

- Wyndham

- Choice hotels

They have also had partnerships with Aer Lingus, China Airlines, and Icelandair in the past. For me the big one will be whether points transfer to American Airlines or not. Citi has been unable to secure American Airlines as a transfer partner for their Citi ThankYou point program largely due to cost so it will be interesting to see if Barclays is able to secure AA or not. I’d love to have Wyndham as a transfer partner as all their properties cost a flat 15,000 points per night.

Hopefully existing Barclaycard Arrival Plus points transfer over to the travel partners and even Uber points too (4x transferable points on dining purchases? Thank you very much).

Update: Multiple customer service representatives are now confirming that this card will be launched. Here’s what some readers have been told so far

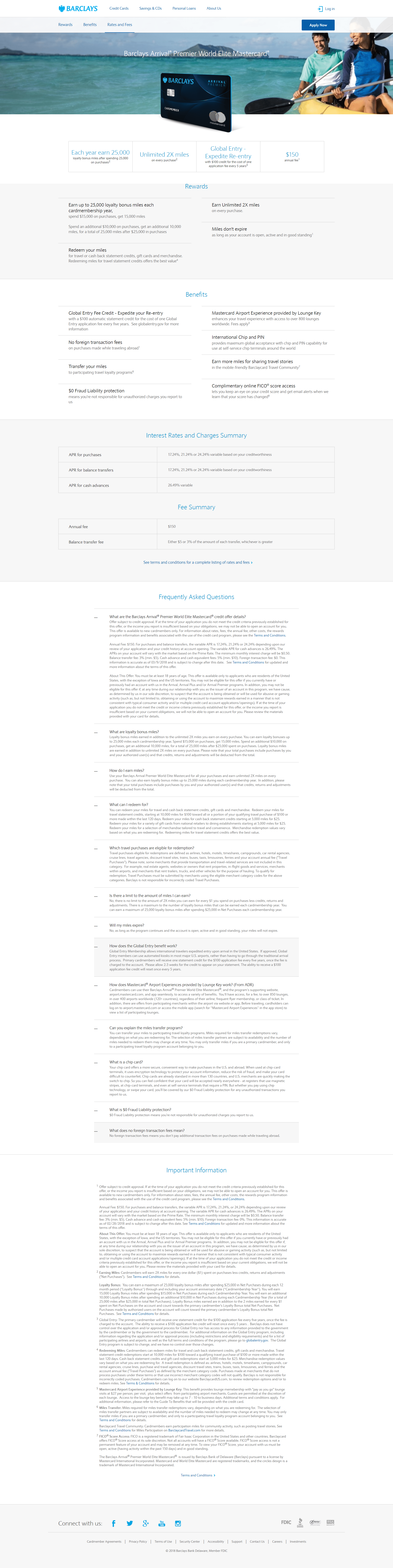

- Annual fee of $150

- Global entry credit

- Annual spend bonuses:

- 15,000 bonus points after $15,000 in spend

- An additional 10,000 bonus points after an additional $10,000 in annual spend

The annual spend bonus is ongoing and is in addition to the sign up bonus (no clue what this is as of yet). If anybody is able to find out any additional information please share it in the comments below.

Original post: File this under highly speculative, but reddit user Joelvis2000 reports calling in to ask about the annual fee on the Barclaycard Arrival Plus. The customer service representative apparently said that there is a new version coming out on April 1st called ‘Barclay Arrival Premiere’, apparently requiring spend of $15,000 for a big bonus before following up with “oops, you don’t need to know that.” Keep in mind two things:

- Barclaycard will rebrand to Barclays in April

- Arrival Plus isn’t currently accepting new applications

Barclaycard also talked about the possibility of airline partners sometime in 2018, originally this was in reference to the Barclaycard Uber card but they also mentioned ‘other card products’. Honestly in recent times Barclaycard’s Arrival Plus product has become largely irrelevant apart from when it was offering an increased sign up bonus whereas in the past it was always one of the top recommended cards.

I love these types of rumors, trying to connect the dots and find out information is probably my favorite thing to blog about. I know some readers hate them and this post in particular is highly speculative and could easily be false/early April fools but hopefully people don’t begrudge me this indulgence too much. If anybody has any information they want to share, please get in touch.