[Update 10/13/19: Now publicly available at the links below. Update 5/6/20: It appears to be by invitation only again.]

Sallie Mae has launched three new credit cards. They are currently only available by invitation. You can also add yourself to the waitlist.

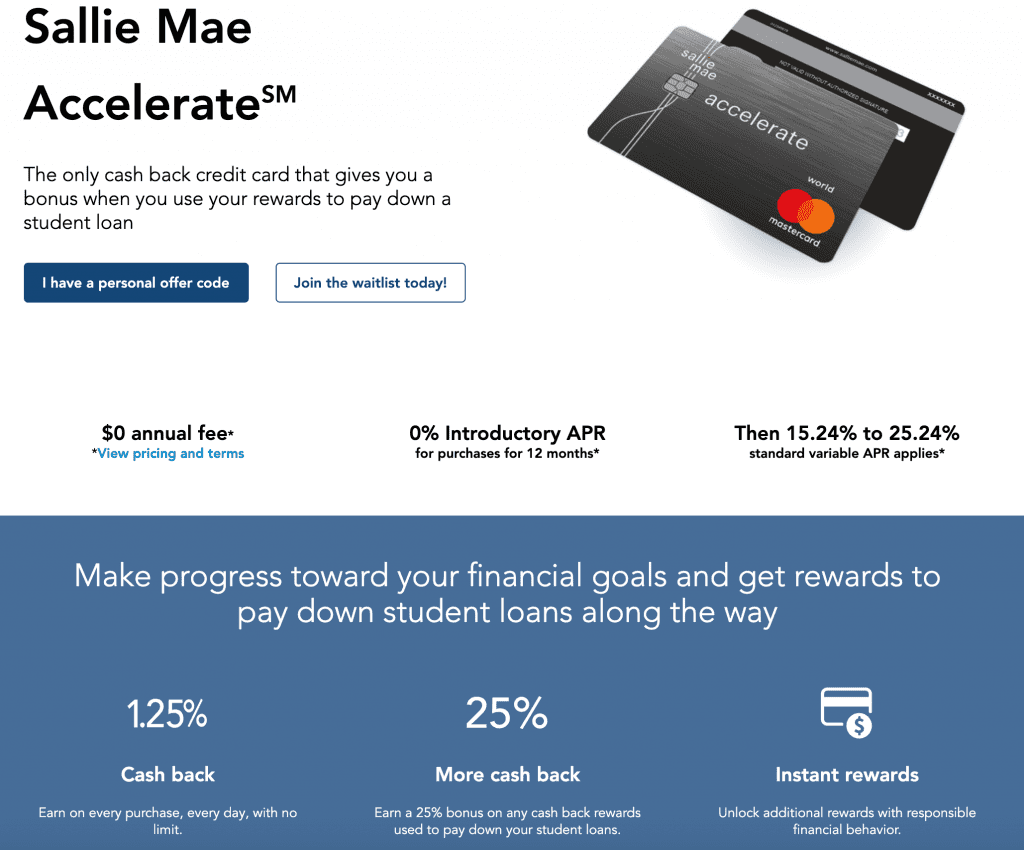

- Salle Mae Accelerate This card earns 1.25% everywhere with no limit. It also gives a 25% bonus on any cash back rewards used to pay down all student loans

- Sallie Mae Evolve This card earns 1.25% everywhere with no limit. It also gives a 25% bonus on cash back rewards earned from your top two purchase categories each month.

- Salllie Mae Ignite This card is meant for students. It earns 1% back on all purchases, and gets a bonus 25% after making six consecutive on-time payments.

Other card features:

- All 3 cards have no annual fee

- All have an introductory 0% APR of either 6 months or 12 months

- All come with $600 Mastercard cell phone insurance

- All come with free FICO score

- All cards offer the ability to pause/lock your card temporarily

Nothing too interesting here from what we see so far as you should be earning a minimum 2% cashback on all your purchases.

Hat tip to reader S.

The Accelerate and Evolve cards are currently offering $200 cash back rewards after you spend $1,000 in the first 3 months. The Ignite card offers a $50 cash back reward after you spend $250 in the first 3 months.

Received a targeted mailer for the Accelerate for 2.5% (1.25+1.25) on all purchases for the first 12 months. Also 0% APR for 15 months on purchases + BT. Max is $20,000 “net annual spend” for the bonus though, and that 1.25% bonus only pays out after 12 months. No signup bonus. Was excited until I saw the cap.

i never know that you can pay student loan with credit card.

More college debt.

Interesting. I see the mention of Sallie Mae, but not Barclaycard/Barclays, issuer of the previous UPromise MC. I wonder if this is a sign that the UPromise card days are numbered.

Barclays isn’t backing these, Deserve is

How many undergrads have even heard of DoC?

Sound off if you’re in college right now.

I paid 1% for student loans to fund checking bonuses and a 4% savings thanks to DoC. Good times!

Can you explain what you mean by this? I’m paying on student loans and wondering the best method to get cash back on payments.

Lots of examples on here of folks taking 0% BT offers to fund bank promos, then pay back, and profit. Stafford loan was subsidised, which allowed for arbitrage. But needn’t stop there. Rather than make direct payments to loan, make payment to a credit card w/ MSR that earns 5.3% or CCs that get 5-6% back at supermarkets, use CCs to buy GoC from my local supermarket, then use GoC less 1.2% fee to pay loan, and profit 4%. Bonus round if SECURE Act becomes law. Instead use GoC to fund 529 bonuses, then use 529 to pay loan, and profit!

👋 We exist.

I think I will pass on this one. Anything under 2% just isn’t worth it.

My brainstem rejected these. I didn’t have to consciously think.

future product names: Barrier, Cleanse, Exhaust, Flash,Ghost…

Never forget the 5%

RIP.

What no sign-up bonus.