This is now called UFirst Credit Union

Deal has ended, view more bank account bonuses by clicking here.

Update 7/17/21: Deal is back and available in more counties.

Update 3/9/19: Reposting as it’s confirmed as a soft pull

Offer at a glance

- Maximum bonus amount: $300 + $100 for auto loan

- Availability: Must work, live, go to school, worship or volunteer in Salt Lake County, Utah County, Davis County, Tooele County, Summit County and Wasatch County

- Direct deposit required: Yes, $200 minimum specified

- Additional requirements: 15 debit card transactions per month for 3 months

- Hard/soft pull: Soft pull

- ChexSystems: Unknown

- Credit card funding: Unknown

- Monthly fees: None

- Early account termination fee: Unknown

- Household limit: None listed

- Expiration date: July 31, 2021

Contents

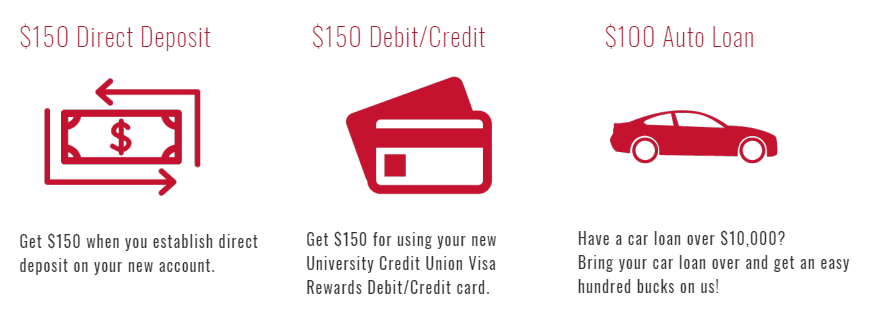

The Offer

- University Federal Credit Union is offering a bonus of up to $300 when you become a member and open a checking account and complete the following requirements:

- Receive $50 per month for 3 months when you set up a qualifying direct deposit (minimum of $200)

- Receive $50 per month for 3 months when you complete 15 debit or credit card transactions per month (Minimum of $2 per transaction)

- You can also get an additional $100 for closing on an auto loan

The Fine Print

- This must be a new account for the Primary SSN.

- They cannot have any other new accounts in the last 12 months.

- New members are to receive $150 for setting up their employer Direct Deposit; $50 per month for 3 months. 30 days after open date, they will receive the first $50.

- This will follow for month 2 & 3.

- $150 for 15 debit or credit card transactions per month. $50 per month for 3 months. 30 days after open date, they will receive the first $50. This will follow for month 2 & 3.

- $100 for an auto loan refinance. $100 for Auto refinance will be deposited at funding. Minimum $10,000 loan amount.

- All bank account bonuses are treated as income/interest and as such you have to pay taxes on them

Avoiding Fees

Monthly Fees

eChecking account has no monthly fees to worry about.

Early Account Termination Fee

I wasn’t able to find a fee schedule so I’m unsure if there is any early account termination fee.

Our Verdict

Seems like it’s a relatively good bonus if it turns out to be a soft pull, shame about the small area. If anybody has any personal experience then please share it in the comments.

Useful posts regarding bank bonuses:

- A Beginners Guide To Bank Account Bonuses

- Bank Account Quick Reference Table (Spreadsheet) (very useful for sorting bonuses by different parameters)

- PSA: Don’t Call The Bank

- Introduction To ChexSystems

- Banks & Credit Unions That Are ChexSystems Inquiry Sensitive

- What Banks & Credit Unions Do/Don’t Pull ChexSystems?

- How To Use Our Direct Deposit Page For Bank Bonuses Page

- Common Bank Bonus Misconceptions + Why You Should Give Them A Go

- How Many Bank Accounts Can I Safely Open Within A Year For Bank Bonus Purposes?

- Affiliate Links & Bank Bonuses – We Won’t Be Using Them

- Complete List Of Ways To Close Bank Accounts At Each Bank

- Banks That Allow/Don’t Allow Out Of State Checking Applications

- Bank Bonus Posting Times

University Federal Credit Union (Utah) now have changed their name to UFirst Credit Union

here are my dps

07/26/2021 Account Opened in branch with $40 Bonus for good grades after I showed my transcript

11/22 Apple Cash Push $501

11/24 15* $20 Apple Cash Deposit with debit card

11/27 $50 DD bonus & $50 Debit Transactions Bonus Posted

12/02 Apple Cash Push $501

11/05 15* $20 Apple Cash Deposit with debit card

12/27 $50 DD bonus & $50 Debit Transactions Bonus Posted

01/07/2022 Apple Cash Push $501

01/10 15* $20 Apple Cash Deposit with debit card

01/27 $50 DD bonus & $50 Debit Transactions Bonus Posted

So I signed up online through the UFCU link. I completed real DD and did 2.05 amazon gift cards to meet the 15 required transactions within my statement cycles for each month but nothing was posting. I reread the T&Cs and saw that it should have posted after each condition was met. Since I did organic DD I at least wanted to see what was going on even if they didn’t give me credit for the debit transactions. I know we’re not supposed to call the bank but I did and the guy I talked to said I did meet all the necessary qualifications to receive the bonus. He put me on hold and checked with another department and came back and told me that I didn’t sign up under the bonus! Before he let me speak though, he said they would honor it and I should see the deposits in my account. I thanked him very much and let him know that I did indeed sign up under the offer because I was called from the bank after signing up to discuss my options for receiving the debit card and I went to the bank to verify when I got the debit card. So Idk what happened but I’m very appreciative that they honored my account.

Don’t waste your time — they require a branch visit even if you open online.

“In order to complete the review process for your application to open a checking and savings we need to verify your identity. This is necessary to safeguard you from identity theft.

Please visit the nearest branch to speak with a loan officer or manager with the following information to finalize the opening of your new account:

o Copy of this letter

o Photo identification (ex: Driver’s License, passport, or any U. S. Government issued ID).

o Secondary identification (ex: Any government issued ID, major credit /debit card, or student ID)”

Are you applying from out of state?

Anyone have DD methods that have worked with this?

DD requirement now $500 per month aggregate per the terms. Also have to open a savings account at minimum, can add echecking as well if you want but savings required. Hard to find any fees that might entail.

This bonus is back for “anyone who lives, works, worships or attends school in Salt Lake County, Utah County, Davis County, Tooele County, Summit County and Wasatch County” through 7/31/21: https://www.ucreditu.com/services-benefits/400-new-member-promo.html

I have opened and closed on last time when this promotion was available, do I qualify again to open an gain the bonus?

“To be eligible for Direct Deposit payouts, member must not have received any promotional payouts for any Direct Deposit promotions from University Federal Credit Union within 5 years prior to account opening.

To be eligible for Transaction payouts, member must not have received any promotional payouts for any Transaction promotions from University Federal Credit Union within 5 years prior to account opening.”

Source:

https://www.ucreditu.com/documents/$400%20New%20Member%20Promotion%20Terms%20and%20Conditions%202021%20v1.3%20(002)%201.docx%20-%20Approved.pdf

Thanks

Everyone in the family including the kids signed up and scored bonus last year. Earlier this year each of us received a 1099-INT but for different amount (e.g., $150, $240), although we all received the same bonus and real interest earned was effectively zero. Then we all received corrected 1099 showing $0 interest. Truly confused here. Anyone else received corrected 1099 for $0 as well? What do you plan to do regarding tax filing?

This bonus has been pulled. Still honoring on applications on or prior to 12/31/19. Unfortunately my app was on 1/1…

Thanks, updated

What methods of DD have worked for this deposit for others who have received the bonus?

This bonus finally completed today. DPs:

6/14/19 – Opened

6/28/19 – Real DD every 2 weeks

Monthly – 15 comcast charges for $2

7/12/19 – $100 monthly for meeting requirements

8/12/19 – $100 monthly for meeting requirements

9/12/19 – $100 monthly for meeting requirements

9/13/19 – drawing balance to $10 and waiting to close. no rush with small balance