Deal has expired now, view more bank account bonuses by clicking here

Update 4/2/20: Deal has been extended until May 31st, 2020.

Offer at a glance

- Maximum bonus amount: $200

- Availability: Nationwide, can make a donation to surfrider if you’d normally not be eligible

- Direct deposit required: $1,000+ for two consecutive months

- Additional requirements: See below

- Hard/soft pull: Soft pull

- ChexSystems: Unknown, sensitive according to some datapoints but others say not sensitive so YMMV

- Credit card funding: Can fund up to $12,000 with a credit card

- Monthly fees: None

- Early account termination fee: None

- Household limit: None listed

- Expiration date: March 31st, 2020

Contents

The Offer

- SkyOne Federal Credit Union is offering a checking bonus of up to $200 when you meet the following requirements:

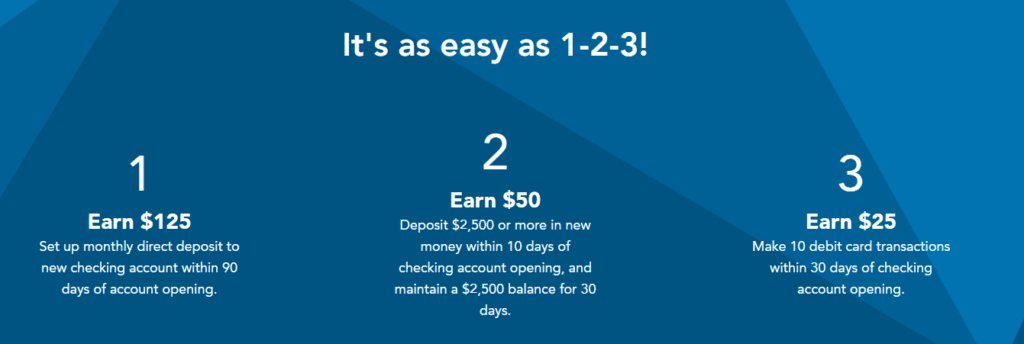

- Earn $125 when you set up monthly direct deposits of $1,000 or more per month for two consecutive months within 90 days of account opening

- Earn $50 when you deposit $2,500 or more in new money within 10 calendar days of opening a new SkyOne checking account and maintain that balance for at least 30 consecutive days

- Earn $25 when you make at least 10 point of sale/debit card transactions within 30 days of account opening

The Fine Print

- Bonus Requirements: Earn $125: You are not eligible for this offer if you are a current owner of a SkyOne checking account and have direct deposit. Open a new, eligible SkyOne checking account by March 31, 2020. Within 90 days of account opening, receive a total of $1,000 or more in qualifying direct deposits per month for two consecutive months in to your new checking account during the qualification period.

- A qualifying direct deposit is a direct deposit of your salary, pension, Social Security, or other regular monthly income, electronically deposited through the Automated Clearing House (ACH) network to this checking account. Transfers from one account to another, mobile deposits, or deposits made at a banking location or ATM do not qualify.

- Earn $50: Deposit $2,500 or more in new money within 10 calendar days of opening a new SkyOne checking account. Maintain a daily balance of $2,500 for 30 consecutive days.

- Earn $25: Within 30 days of account opening make 10 POS (Point-of-Sale) and/or debit card transactions. Bonus Payments: Once the qualification period has elapsed, we will determine if you have met the offer requirements, and will deposit bonus payment into your new checking account within 10 days.

- Additional Terms and Conditions: Offer subject to change without notice and may end at any time.You are responsible for any federal, state, or local taxes due on the bonus and we will report as income to the tax authorities if required by applicable law. Consult your tax advisor.

- Account must be in good standing. Account in good standing is defined as: 1) Your Checking account balance must not be negative for more than 30 calendar days; 2) You must be in good standing, which means no delinquent or charged off loans or charged off share accounts with SkyOne Federal Credit Union; and 3) You do not have a ChexSystems record with monies owed.

- SkyOne reserves the right to terminate this offer at any time.

- All bank account bonuses are treated as income/interest and as such you have to pay taxes on them

Avoiding Fees

Monthly Fees

This account has no monthly fees to worry about

Early Account Termination Fee

There are no early termination fees to worry about

Our Verdict

Downside is that this is ChexSystems sensitive, but the upside is that anybody can open an account/become a member now. I’ll still be adding this to our list of the best checking bonuses, because there are generally not many that are nationwide.

Hat tip to LivingInTheAir

Useful posts regarding bank bonuses:

- A Beginners Guide To Bank Account Bonuses

- Bank Account Quick Reference Table (Spreadsheet) (very useful for sorting bonuses by different parameters)

- PSA: Don’t Call The Bank

- Introduction To ChexSystems

- Banks & Credit Unions That Are ChexSystems Inquiry Sensitive

- What Banks & Credit Unions Do/Don’t Pull ChexSystems?

- How To Use Our Direct Deposit Page For Bank Bonuses Page

- Common Bank Bonus Misconceptions + Why You Should Give Them A Go

- How Many Bank Accounts Can I Safely Open Within A Year For Bank Bonus Purposes?

- Affiliate Links & Bank Bonuses – We Won’t Be Using Them

- Complete List Of Ways To Close Bank Accounts At Each Bank

- Banks That Allow/Don’t Allow Out Of State Checking Applications

- Bank Bonus Posting Times

SkyOne is now offering $100 to sign up for Advantage Checking and by using their direct deposit wizard to sign up for direct deposit. SkyOne has made it easy and fast to sign up for direct deposit. Visit http://www.SkyOne.org/ac-promo to learn more and sign up to earn your $100.

DP 1099-INT? I know they had debit cards within their promotion for referral, but wasnt sure about the bonus? I havent received a 1099 yet.

do they do 1099-INT or 1099-MISC?

I called and asked about any 1099s for my closed account, they said I wouldn’t be getting one since I didn’t earn any interest (BTW, I got the $200 bonus lol).

I got 1099-int just for the interest received. But not for the bonus.

Some time in September my checking was converted to a version that is no longer fee-free. I was assessed a $5 “withdrawal checking fee” on Sep 30th. Fortunately, I got it refunded today.

Your account wasn’t converted. They just changed the rules. You don’t read your monthly statements?

https://www.doctorofcredit.com/skyone-federal-credit-union-200-checking-bonus/#comment-1032684

I went to zero out my account to close it and I was charged a $5 Check fee… WTF

Got the fee adjusted back, but i dont recall getting the email, and I dont follow this thread often. O Well, will attempt to close and possibly keep memebership.

I would strongly advise anyone against opening an account with this bank with a credit card. I opened successfully a secondary savings account with them but it has been a month and a half now and it still is not funded yet. I have contacted them several times and they still have not refunded me the $500 that I spent on credit card funding with my Citi credit card. Finally had to open a dispute with my credit card issuer. Not worth the hassle!

File a CFPB complaint too… which will forward the complaint to the NCUA, since this is a credit union. That will likely increase the speed in which it gets resolved.

Thanks for the tip, I just filed a CFPB complaint with this bank. I hope this can help me. Neither the bank nor my credit card issuer (Citi) seem to want to help me get my $500 back here, and it’s been almost 3 months now.

Well, after you pay the credit card bill… Citi would have little reason to help. One of the 1st rules of a disputed charge is not to pay it, file the dispute, then you make it’s Citi’s problem to find a resolution. They do not charge you interest during the investigation and cannot charge a late fee. You just have to be prepared to pay it in full if they side with the other party.

3 months is crazy… I assume you’re 100% sure the money didn’t go into a different account of yours, or your husband’s account?

I actually have not paid the bill yet. What happened is after a month of seeing the account opened with no funding in it, I contacted the credit union, but they still failed to fund the account. A couple of weeks later still with no funding, I decided to file a dispute with my credit card issuer (Citi) for the $500. A few days later, I see the $500 posted to my secondary savings account finally. It looked like the dispute had been resolved, so I withdrew the dispute. I linked my account to my credit card to pay it, but Citi returned the payment because they said I linked an invalid account. It couldn’t have been the wrong account, because when you connect an account in Citi, you have to log in with your username and password credentials. The account was not frozen or anything as I was able to transfer the $500 directly from my savings to my checking account to try to pay the credit card bill from sky one’s bill pay service. However, transfers even between your own accounts in sky one are not instant, so I had to wait a day or two to be able to use that $500 for a bill payment in the checking account. When I went to check my checking account, I noticed that the $500 was no longer in any of my accounts. I checked my transactions, and noticed that sky one clawed back the $500. The withdrawal had a note on it indicating something about the dispute. I checked my credit card transactions, and see that I am still being charged the $500 on my credit card with no refunds or anything. I checked the status of the dispute, and noticed that Citi updated the status to indicate it had been resolved in the merchant’s favor. I submitted a CFPB complaint, but I got a notice that since it is a credit union, I will have to manually resubmit my complaint to the NCUA, so hopefully they can help me. I live chatted with Citi to see if they could reopen my dispute, and they said that I could, but that I would have to do it over the phone. I called the phone number, and they told me that they would not be able to reopen the dispute. I informed them that I will not be able to pay the $500 until sky one properly funds my savings account. I asked them if there was anything else they could do for me, and they gave me a courtesy credit on my account for $19.19. P2 checked his accounts but the $500 is not there either. I would have been surprised if it was, though stranger things have happened with bank accounts. Andigo actually paid his $250 debit card spend bonus into my account as I received 2 spend bonuses and he did not receive one. In any case, I hope that sky one can resolve this for… Read more »

When I have submitted a CFPB complaint on a credit union the CFPB forwarded it without intervention to the NCUA. I would just verify you have to file it again with the NCUA.

And, actually, you still don’t know if Citi or SkyOne is the problem. I’d file one against Citi too.

That sure sounds like a mess. Never heard of this happening to anyone else, so luckily it’s an isolated incident. It’s not uncommon for CC funding to fail, but when it does, it’s normally done within a week, credited back to the card.

Thanks for your response, Gadget. I did end up having to manually submit another complaint with the NCUA, so I don’t know if credit union CFPB complaints no longer get automatically forwarded to them or not, or if this is just the case with skyone.

So far, all messages to them have gone unanswered, and reps on the phone are giving me the run around. Rep assured me both this week and last week that a full $500 refund was sent to my credit card on 10/13, but it’s been 3 weeks, and no refund has been received yet. Would they have sent this to the wrong customer’s credit card somehow?? I asked the rep if a refund should have taken longer than 3 weeks, and she said that I should have received it by now. Now, it looks like I’ll need to continue my complaints with Citi to see if they have received the refund on their end or not.

My payment is due in 5 days, but I don’t think I should pay it until I receive the money from skyone, because I doubt citi would want to work with me to get my payment back if I pay the $500 from my end. They already said they would not reopen the dispute with skyone, but I still need to get this $500 back somehow. I can’t be out $500 just because of this bank’s incompetence. I understand that mistakes and glitches can happen, but their appalling lack of customer service is inexcusable.

I have received a bonus from this credit union before, and was able to successfully fund my first checking and savings accounts with a large amount of credit card funding, before it was limited to $500 per account. Everything was going smoothly with this bank until now.

There may be some upsides to this bank, especially with all of their bonuses, but I would caution others to not do a large amount of credit card funding with them, and to not leave a lot of money in their accounts. If you end up having a problem with them, good luck on getting it resolved, they are mostly unresponsive to customer complaints.

Well, that’s an unfortunate situation. As I said before, seems like an isolated incident. Even on your own admission, CC funding worked fine for you in the past.

I guess it is possible they sent it to the wrong credit card account.

When banks make errors like that in the customers’ favor, the customer isn’t likely to bring it up. They either leave it to sit, or start spending it. https://www.cnn.com/2019/09/09/us/bank-deposit-error-couple-spending-spree-trnd/index.html

Reversal or credit transactions like that should take no more than a week in my experience. The only time I have had it take longer is if the bank suspected fraud and it’s been placed on hold… U.S. Bank made me wait two months to get a large sum of money back once not too long ago, but it had nothing to do with credit card funding.

I hope it gets resolved soon. Good luck!

Buh-bye SkyOne. Successfully closed via email within two hours of sending picture of hand written request, moist 👀 signature. and ID. Account now locked when trying to log in.

You can close three ways (snail mail, fax, or email), but all require a hand written statement, signature, and ID. Send a SM (responded next day) to close and they will give you the most up to date information on how to close.

Yes, I got the same kind of response – that they want a note with a “wet” signature. Since P2 just got a referral, leaving the credit union open, just in case anyone else used her link.

They will close the checking (but not the share/membership) over SM, and that solves the fee problem.

To close the membership…”In order to process this request, we require a written statement with a physical signature and a copy of your ID. Please be sure to include your account number, date and reason for closure.

You can send the information one of the following ways:

Call Member Services 800-421-7111 option 2

Write us a short letter with the date, address, request to close and your wet signature. This can be sent to us one of three ways.

Fax 310-491-7471

Email [email protected]

Mail Attn: Ops. P O Box 5003 Hawthorne CA 90251-9801″

I specifically left out the steps because it could change so that’s why I said SM first. I was given a different email address in addition to Hawthorne branch.

Yeah, I thought about leaving out the details, but, it also saves some time for people. They took several days to respond to SM, and P2 did not get a notification when they finally responded. I highly doubt they would turn someone away if you contact the “wrong” branch. They probably spilt the internet folks to the different branches, but I would bet money each has the ability to handle the request.

Yeah, I was given both the Hawthorne Branch and what looks like to be a general email address (not branch related)

So you can just hand write the letter, take a photo, and SM it in? yeesh, surprised they didn’t make us contact them via ICQ to start the process

SM wasn’t one of the options. Per Gadget 🕵️ Bank Bonus Geek comment, all accounts but primary savings can be closed via SM. Best to do it with one of my noted options if you plan to close them all so you can do it in one step. Less chance for fock ups.

Gadget 🕵️ Bank Bonus Geek comment, all accounts but primary savings can be closed via SM. Best to do it with one of my noted options if you plan to close them all so you can do it in one step. Less chance for fock ups.

Well, they closed the checking within hours, so you can see right away if they screwed the pooch, since I still have online access. It disappeared without a trace….

I will probably have P2 wait a month or two… just in case some stray referral money comes in.

I think it’s to cover their butts… in case they ever get audited. I bet they keep a paper trail to show they were not creating fantom accounts like with the big WF scandal.

account fee is coming starting this sep. if you have not close the acct, this is the time to close it

Details and source?

On just the checking account or the savings as well?

It’s on the website now as well (September 1).

Remember to turn on eStatements or there is a $2 fee starting from Sep 1 as well.

I’ll be closing my checking account. Savings account is possibly not affected.

https://www.skyone.org/fee-schedule/

Monthly fee waived when enrolled in eStatements.

Monthly fee waived when one or more of the following conditions are met: Be 25 years of age or under. Be 65 years of age or over. Have an active VISA® credit card, or line of credit, including HELOC (activity is defined as carrying a minimum balance of $100 or more or making purchases totaling $100 or more each month). Have a current consumer loan, including mortgage loan (current is defined as the loan is not past due more than 31 days and the loan carries a balance). Have a minimum average daily share balance of $2,500. Have monthly aggregate deposits of $1,000 or more. Make a minimum of 10 debit card transactions.

Thanks!

The last time I SMed to close my account, they wanted me to mail in a hand written letter with signature and a copy of my ID lol. If anyone has had success closing the accounts otherwise, please share your DP.

Really glad you posted this — it would have caught me unaware!

Finally received the referral bonus for P1 and P2 after contacting customer service. They credited it to my account instead.

they have a new referral promotion where referrer and referee get $50

Tell a friend about SkyOne, and you’ll BOTH get a $50 Visa® Gift Card* when they open a new account. Here’s how:

Share with friends via Facebook, Twitter, or email.

Your friend will receive a $50 gift card when they open an account and deposit the minimum opening balance amount of $5.

You’ll get your $50 gift card when they become a member!

was about to apply for membership so if someone has a referral link

If you are still looking for a referral you can email me at mel41333 at hotmail dot com

Can someone report the card funding max for us please. I know a few months ago they put a cap on it.

Credit card funding max is still $500.

email intarray at gmail and i can help. I wont post my referral link in here though

Received a VGC in email for SO Referral. She also received a $25 vgc in email and both received bonuses.

can you share a link. I’m going to be applying for membership