As part of our efforts to give more attention to some of the lesser known card issuers we bring you the “Sun Country Airlines Ufly Rewards Credit Card“. This card is issued by First National Bank of Omaha and it looks like it was first released in June, 2014. Below are the key selling points of the card, along with our verdict.

Contents

Key Selling Points

- Receive a 40,000 points as a sign up bonus when you spend $500 or more within the first three billing cycles

- $69 Annual fee is waived for the first year

- Card earns at the following rates:

- 4 points per $1 spent on qualifying on-board purchases

- 2 points per $1 spent on qualifying Sun Country Airlines products and services, including tickets and upgrades

- 1 point per $1 spent on everything else

- 0% intro APR on purchases for your first 6 billing cycles, then an APR of 14.99% to 18.99% based on your credit worthiness

- 5,000 bonus points each year you put $10,000 or more in spend on your card

About Sun Country Airlines

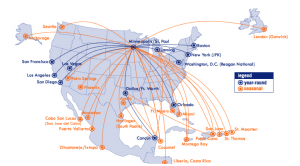

They are based out of Minneapolis/St. Paul. All of their aircraft are currently Boeign 737 Next-Generation airplanes and offer economy and first class cabins.

They have mostly domestic flights, but do also fly to the Carribean, Mexico & Costa Rica. For a short period of time they also offered a seasonal service to London Stansted but they now offer a seasonal flight to London Gatwick instead.

Our Verdict

One thing that is surprising is that it looks like a free FICO score is not offered on this card, this usually comes standard with all FNBO issued cards. This doesn’t really matter though as so many other card issuers offer these scores for free. As the earn rate is low (1x) and there are no category bonuses apart from Sun Country purchases this card really only makes sense in two circumstances:

- You sign up purely for the sign up bonus

- You fly with Sun Country a lot

I’m going to assume that my readers don’t fly with Sun Country at all and just focus on the 40,000 point sign up bonus.

How much are points worth?

Sun Country uses a system similar to Southwest. As long as there are seats available, you can book them using points. Unfortunately there is no fixed value to points and no award chart that I was able to find, you basically just need to do a search and then select “Ufly points” instead of dollars.

Click here to start searching Sun Country using points.

The value seems to vary by quite a lot depending on which flights you select. In some instances we saw a value of 0.8¢ per point and others you’d see value at over 1.2¢ per point. There is also no option to redeem your points for giftcards or merchandise, only flights and upgrades are available.

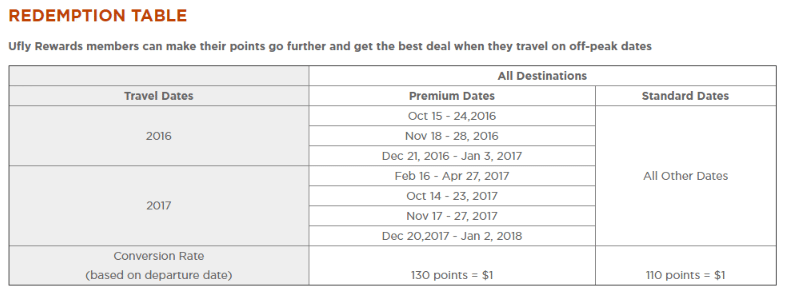

Update: As of June 7th, 2016 points are worth 0.769¢ if you book for premium travel dates and 0.909¢ per point for all other dates. Dates are listed below:

One downside is that if you book award travel within 7 days of departure their is a fixed fee of 5,000 points in addition to what you’d normally pay.

One upside is that they allow you to pool your points with up to 9 other people, this means if you’re just short on points you can get some from a friend or family member. Mom doesn’t care for booking award flights? Use her points and buy her something nice instead! This isn’t as good as being able to transfer points to anybody you like for free, but at least it’s something.

Final Thoughts

The sign up bonus on this card is worth between $363.9-$307.9 depending on the dates you want to fly. It’s not the best bonus ever, but could provide some good value especially if you’re in the Minneapolis area.

If I lived in Minneapolis I might consider this card, but there are other cards I’d be signing up for first. What are your thoughts on this card? Will you sign up for it? What are some other unknown credit cards that are worth taking a look at?

Any word on the viability of being able to churn this card?

No idea, give it a try and let us know.

My husband and I applied for the Sun Country Credit Card on Sunday and received a message that we will hear from you in a few weeks. When doing the application, it didn’t give me an option to add all of our income, just my husbands. Is there a way to add all of our income to the application?

If you pool your incomes, I believe that the entire household income is considered for each of you. So when you fill out an application you can use the pooled amount, and if he fills out an application he can too.

You can put it under your income if it’s household income I believe.

MSP is my home airport so I was really excited for this card when I heard about it.

Data points from applying this summer for this card.

Me

6 hard pulls in last 2 years, 1 in last 3 months – Approved

Wife

8 hard pulls in last 2 years, 2 in last 3 months – Initially pending, Got letter in mail 2 weeks later – Declined for ‘too many inquires’- Didn’t call recon.

We both have credit scores in the 790 range (give or take 10) and a six figure household income. Over a dozen cards later, FNBO is still the only one to deny us. Given that its rare that I have less than 2 HP in a 3 month range I don’t think I will attempt churning this card.

Does anyone know how many times you can apply for this card?

I’d LOVE to get this card. I live in Minneapolis and 40K points would pay for a round trip for 2 to Chicago. But it’s hard to get if you’re a travel hacker. I got an invitation in the mail from Sun Country when the card launched in June. Cheerfully applied and got turned down, despite credit score of about 790. Apparently First Bank is REALLY picky about “too many inquiries.” And they look at HOUSEHOLD inquiries, not just the applicant. And somehow they get a listing of inquiries over all 3 credit agencies, not just the one they do the hard pull on. So, good luck.

I’d love to hear if anybody that reads this type of forum managed to qualify for this card. If I ever find that 3 months has gone by with no credit card applications from my household I might try again.

FNBO isn’t usually that hard to get approved for, it must just be this card that’s difficult. They probably do a soft pull on the other two agencies to see total number of pulls, didn’t realize they did this.

Or maybe they just didn’t like me. 🙁

I was a little surprised to be rejected considering they solicited ME, but I guess that’s not uncommon. I did apply for two cards (me and spouse) simultaneously; and between us we had applied for more than a dozen cards in the previous year. I can see how that could look a little dicey. But it never bothered Chase or Amex.

YMMV. Just have a Plan B in case these cards don’t come through.

What happened when you called reconsideration?

I didn’t call. I’d found comments on another forum indicating that this bank was very sensitive to the “too many inquiries” issue, so I figured it was unlikely to help. I don’t enjoy that type of call, so I just let it go.

Woohoo! I applied again and this time got approved. I waited until 90 days had passed since my last cc application, although I did buy a car in that time period so I had at least one inquiry. Approval was not instant. I just got a messages saying, essentially, “Thanks, we’ll let you know in 2-3 weeks.” But 2 days later I got an approval via email.

Anyway, glad to have the card since they ARE my hometown airline.

I just got approved, but they didn’t tell me the CL right away….wondering if anyone knows what the CL range is on this card? thanks….

This is really interesting. Any idea which bureau this pulls from?

FNBO is usually Experian, occasionally Equifax/TransUnion.

I live near Minneapolis, so I considered this card. Could be nice for a trip to Vegas or Mexico. But I’ve also never flown Sun Country (Delta and Southwest are just as easy and available) and haven’t heard anything impressive about them, so I wasn’t ready to take another credit pull just to get this.