Update: many people are getting denied when applying for this account

The Offer

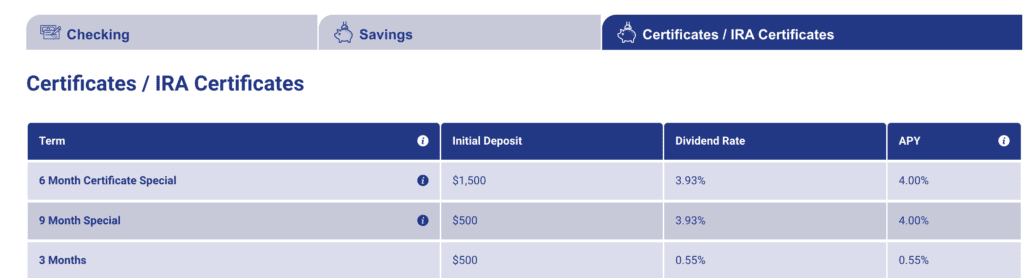

- Sun East federal credit union is offering 4.00% APY on both 6-month and 9-month CDs.

Anyone can join Sun East credit union with a $10 donation to the Sun East Foundation if they don’t meet the local criteria. Some people in Delaware, Pennsylvania, and New Jersey might be eligible without any fee, details here.

The Fine Print

- $1,500 Minimum Deposit Required on 6 month CD and $500 minimum on 9 month CD

- No maximum

Our Verdict

In terms of short deposit length CDs, this is the best available. It seems to be a soft pull to join the credit union. We’ll add this to our List of Best High Yield CD rates.

Hat tip to reader Henry

Looks like it’s gone

Not sure if this is as good as it sounds, since it says it auto renews to a 12 month certificate (effectively around 3.33 18 month or 3.43 21 month)

When the CD matures, you can choose not to renew. You have a window.

Application went to review, got denial email later. Same for P2. Now sure if it’s for OOS or chex sensitive.

Applied from California, with exact same results. Have no idea what the hangup was, as nothing should have raised flags, but obviously this CU is pretty selective. And all over opening a CD! Pffft.

Sorry but what is OOS and chex sensitive? Thank you.

There’s a bunch of branches an hour or less from me, I dunno if I’m close enough, I think they are mostly in Delaware County, PA. I’m in Montgomery. I’m going to give it a try though, that’s a good rate.

Not close enough, it seems. Rejected by location.

wait, were you rejected from when applying online or in-person?

when I went to apply online, I failed their “qualify by location” check, so I didn’t even apply. I didn’t try in person, that might work but I don’t feel like driving an hour each way without some certainty

Doesn’t the $10 donation work in lieu of the location requirement?

I waited several hours today for my call back and had actually given up on it but it did come in. So being in TX I have to join through the foundation. I asked if there had been any problems with this and was told there could be issues with anything as nothing was foolproof. Oook. Asked if there was an option to open the CD (with a set time to fund it) to insure the promotional rate when applying for membership. No. Asked approx. time to get the membership opened and had to listen to the spiel of being approved. Finally got it out that it could take 3 to 5 days. I’m thinking ok, then still need to get my eternal bank set up to ACH money (after I get my acc. #) so there’s a few days for that, I ask, any chance the promotional CD’s might ‘go away’ during this time? She said, they could, they are not guaranteed. I asked about the grace period after the CD matures since I could find nothing on the website about it. I was told they don’t offer a grace period, that I could call them a couple of days before the CD matured and instruct them at that time to deposit the CD funds into my checking or savings account. There is also a fee to close your membership and a account dormant fee (which when I asked abut that she said it could be considered dormant if inactive anywhere from 6 months to a year

Lot of ifs, maybes and could bes and yes, seems to be more fee inclined than I like my FI’s to be. 4% is a good rate and I liked the 6 month since shorter time to tie up the money as there’s going to be a lot of good deals are on the way to take advantage of so I’m going to wait and do the latter.

This is the response I got when I inquired about my eligibility from CA:

Thank you so much for your interest in becoming a member of Sun East Federal Credit Union!

Credit inquiry: We do a soft pull for the membership application.

Foundation donation: Yes, if you are approved for membership and have made a donation to the foundation, your qualification method (the foundation) will last indefinitely.

Proof of membership: If approved, you will receive your member account guide via DocuSign. The advisor that assists you with your membership application can also open your 9 month CD.

$3,000 transfer limit: When you apply online, you only need to transfer $15 ($5 for the membership fee and $10 for the foundation fee). Once your membership is opened, we can provide you instructions on how to fund your CD via wire transfer or check.

Timeline to fund CD: Please ensure funds have been wired or transferred within 10 business days of your membership being established.

Multiple CD’s: At this time we are only allowing one CD per member.

Maturity: Please inform the advisor that you would like to withdraw your funds after 9 months. We can set it up so the CD matures into your checking or savings account versus being rolled into a 12 month CD at the rate being offered at that time. We will then mail you a check of the funds if you choose.

Website security: The website is secure and the information is sent directly to our advisors to review your application and establish your membership.

I do not see a membership application under your name. To apply for membership, please follow the link below and an advisor will contact you via email or phone.

Can anyone please tell me what they mean by $3,000 transfer limit? Does this mean I can only transfer 3k of my money into the CD at a time? This place is starting to make me think it’s not worth it even with the great rate of 4%.

According to the website, you have to live in their field of membership. This is typical for credit unions. However, making a $10 donation to their Foundation first would then qualify you for membership. Awesome rate special, and the penalty mentioned by someone previously is pretty standard.

I knew that “Sun East” sounded familiar. I just searched in my email and I had closed an account with them several years ago.

I signed up yesterday and got a call today with an email that they are doing the micro deposits for my funding account. Im in CA and there does not appear to be any issues.

Please update us when you can. I’m in CA too.

Sounds like this is the only positive DP so far? I hope more is comiing!

Same experience as Kd above. Also in CA. Opened without issue. Only thing is that they wanted the CD funded via wire.

Kd above. Also in CA. Opened without issue. Only thing is that they wanted the CD funded via wire.

Tried to join before, through donation to a Brandywine Foundation that was promoted on site. My ancestors spent about 200 years around Brandywine’s location so there was that incentive. Brandywine Foundation declined all out-of-limited-area applicants. Why bother again now?

“Thank you for your interest in applying for membership at Sun East Federal Credit Union. Unfortunately, your account cannot be opened at this time.”

My rejection is likely because I am out of the 4 state area. I would caution anyone from applying, unless they are fine wasting a Chex pull.

Not necessarily – I’m in the geographic area (there’s a branch less than 10 minutes from my home) and I got the same message.