Via r/churning, Chase is surveying select customers about a premium relationship product they are considering. It might be called Chase Reserve Banking or Chase Sapphire Banking.

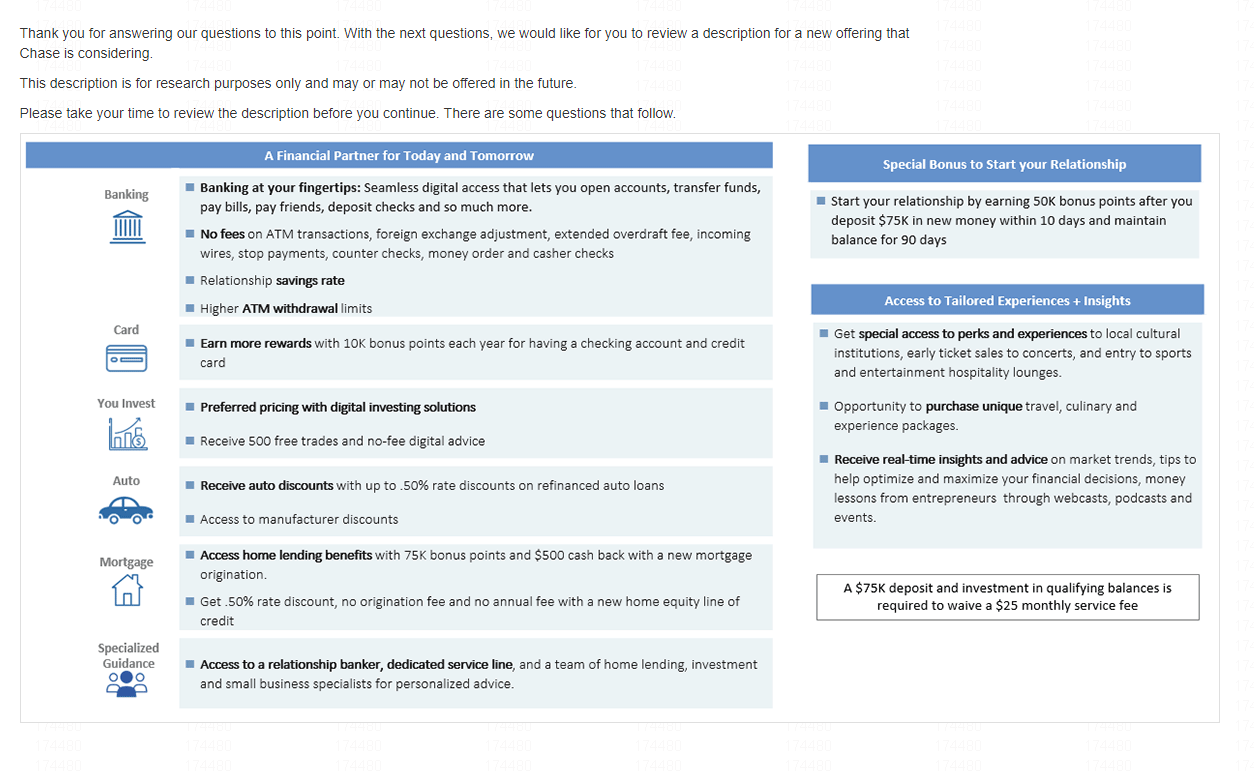

List of benefits:

- 50,000 points signup bonus (Ultimate Rewards, presumably) when depositing $75k for 90 days

- 10,000 points annual bonus when holding a checking account and credit card

- 75,000 points bonus + $500 back when taking out a Chase mortgage

- .50% discount on some home equity and car loans

- 500 free trades

- No ATM fees

- No foreign exchange fees

- Various other benefits and perks

The cost to be part of this Chase relationship? Two options:

- Either hold $75,000 with Chase

- Or pay $25 per month

Sounds like investments will count toward the $75k requirement; hopefully we can figure out how to passive-invest with Chase.

Or you can just pay the $25 monthly fee. Obviously, the first few months is a no-brainer due to the 50,000 points bonus. Beyond that, a case can be made to pay the fee and get 10,000 points bonus (maybe tax-free) with a host of other benefits. It’ll ultimately depend what other value you’re getting out of the premium product. Some of the benefits like no-fee ATM and no foreign transaction fees can be had with other institutions such as Schwab. Free trades can be had if you are part of Bank of America Preferred Rewards (though they don’t offer as many free trades).

Our Verdict

Overall, it does sounds like it could provide solid value for the right person. Relationship customer might also get better credit card offers, as Private Clients often do. Personally, I’m afraid to bank with Chase, but that’s for another time.

This push to deepen relationships was also evident in their recent investor’s update which emphasized a push toward “deeper engagement with Card customers across CCB.” As evidenced from the potential name ‘Chase Reserve Banking’, CSR customers are their clear target. They’re hoping a lot of CSR customers can become Chase lifers for banking, trading, and loans.

Lots of banks have some sort of relationship banking program which often crosses over to credit cards too, including Bank of America’s Preferred Rewards program and the CitiGold program.

Chase themselves have their Private Client program. My feeling is that this new banking product would be a way of institutionalizing the Private Client since currently that program is a bit enigmatic – other banks make it clearer how to qualify and what the benefits are, and this might be a move from Chase in that direction. They may discontinue Private Client or make it somewhat more elite.

Of course this is all just a survey and I’m sure it won’t turn out exactly this way in the final product. Certainly interesting to see where they are headed.

Yes, please Chase…

I fear they set amazing terms just to see interest levels. This sounds too good to be true. Move my stocks over there and get all these perks for nothing? It’s a no brainer.

i guess pple are loving the deposit accnt issued UR points. i pass. i dont do citi, chase, or any other other 1099 MISC point rewards that are taxed. those points are categorized in a totally different bucket. citi already does this.

furthermore, chase already has a 75k level. i mean, nobody in this group should care. if ur moving investment funds of 75k to 250k to chase, it is a very deliberate move to take advantage of certain options. it wont be just for 50k UR. some of the discussion going on reddit about this simple survey is really just sad. SMH.

this survey just makes it super clear what chase is trying to do and have been doing successfully. i.e. converting n00b and wanna-be point gamer millennials to the chase banking ecosystem offering “potential UR vacation experiences” as that cohort already got locked in with the CSR and are now buying homes and raising a family. now chase is saying “why not just move your 401k and IRA or anything over 75k to chase. keep everything in one place!”. smart move chase. i wont fall for ur shit tho.

If they could match or even come close to BoA at high asset levels, I would do it. So give me a special Chase Private Freedom Unlimited with 2 UR on everything, and give me a free CSP or Ink Plus (with the equivalent $95 discount off a CSR). I’d jump off BoA in a heartbeat, since 2 UR is the equivalent of 3 cents of value with CSR on travel through the portal. The stock trading interface could be garbage (like Vanguard is) and I would go for it since I wouldn’t be trading in that account anyway. Instead of competing with BoA Preferred Rewards they are competing with Citi Priority, which is so bad that I can’t get DoC to write about them. This is not Citigold with the free lounges, although I could do without the “personal wealth management” that charges a nice 0.20% or higher AUM fee.

yup exactly. chase could match BofA at 100k level benefits and would cause serious competition. u really cant beat BofA at 100k level esp if u also use MEdge. otherwise no way. people should put 50k into citi priority before they do chase 75k for the $350 Prestige AF, but thats about it. otherwise, its useless vs BofA. but i am interested in the chase 75k for the 500 free trades. if thats monthly, i want to check it out and see. but i dont expect anything to really change from the current 75k and if u have 250k for CPC, i would go Citi Gold first with their $200k for the lounges and overall banking perks like waived fees and etc but its still $4.95 per trade.

Any idea what the $75K banking relationship would be defined? Robo-advising? and also what would the management fee be? I know their private wealth is over 1% whereas other robo advisors are around 0.25%

Bank bonuses are usually taxable, so what value do they assign for 50,000 UR?

I recently opened a Chase business checking account in response to a mailed offer for 30,000 UR points. I asked the banker how the points would be valued for 1099 purposes, and he stated at 1 cent each. Who knows if this is right, but he was a Chase Private Client banker for whatever comfort that gives.

yea. thats pretty accurate.

i thought for a long time Chase already had a 75k deposit+investment tier? not complaining that they are considering adding benefits but looking at their current list:

Total Checking

Premier Plus at 15k

Premier Platinum at 75k

Chase Private Client at 250k

$75k @ 3%apy is $187.50/mo, or $562.50 for 90 days. High interest bank accounts may be better if you haven’t maxed them out. Depending on how you value UR

Where are you getting 3% apy?

My I-bond is yielding 3.5% wait til the next rate reset and the base should be higher than currently.

Current I-bond rate actually is 2.58%

Unless you bought I-Bonds 10+ years ago when the fixed rate was fairly high.

They better do, coz CPC SUCKS…….as a CPC account holder i have not gotten shit from Chase so far……no preferential credit card approvals or anything.

Bottomline, i just moved my $300k Plus to other banks for better rates/perks/bonuses and investment deals.

Agree with you and am in the same boat but haven’t moved any assets yet. Curious if you would share where you moved to, so that I might follow.

Cannot reveal all details but getting between 10-15% back, investment in Hotels/Real estate management with a similar bigger group of people i know. F..k Chase

Bankwise, PNC worked out much better than MF’er Chase

Lol, so I won’t tell you where he moved just how good of a deal he’s getting. Perfect.

I seems like Chase is trying to create a one stop asset shop much like what BoA and Merrill Lynch did with UR points as a way for people to overlook its shortcomings with a non competitive mortgage rate, inferior fund selection (unless you’re buying company shares or Vanguard/Schwab/Fidelity index funds), and the free ATM reimbursements/no forex fees.

I’d rather use multiple shops and save more money/have higher investment returns compared to the UR points offered.

I’d like to see them offer a cash out of UR points at better than 1 cent/pt – just like you can cash out Amex MR points to Schwab for 1.25 cents/pt.

I’d also like to see the ability to redeem UR points against travel charges at 1.5 cents/pt like I can with the Altitude Reserve.

Did you want to redeem for travel charges after the transaction posts like how Arrival+ or CapOne Venture work? I’m sure you’re aware, but you can “redeem” URs for 1.5 cents/pt only with the Sapphire Reserve through the Chase Travel Portal currently but the redemption and the booking transaction happen concurrently instead of after the fact.

I wonder what term would fit better for “redemptions” pre- or post-transaction?

Yes – I’d like to use the points after the fact. I figured this post was a wish list of new things we wanted from Chase. 😉

I often find that prices are a little higher thru the Chase Travel Portal so the redemption rate is effectively less than 1.5 cents/pt. Plus you likely won’t get loyalty points for travel booked thru Chase.

2nd this.. Especially the cash out part

I like Chase a lot for their banking service. Their rep is always on top of their job. However, I can’t see the benefit of having bank account with them. If I open and close the accounts I can get $500 every year. But if I open and keep the account I get nothing. For Citi at least they hand out free TYP to keep the accounts. It doesn’t make sense now to keep Chase account open, hopefully the newer program will help to change.