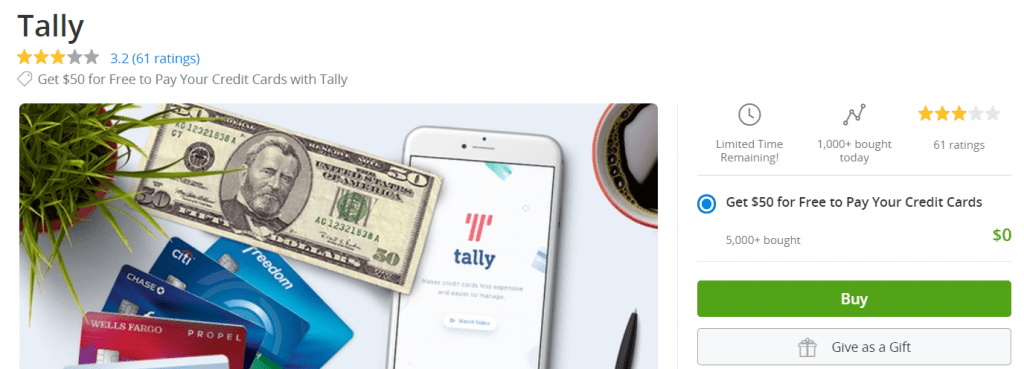

The Offer

- Groupon is offering a $50 credit for Tally. Tally is a service that offers a line of credit that is used to pay off your credit card bills, you then pay Tally. You need to add at least one card and have a minimum interesting-bearing balance of $1,000 across all credit cards.

The Fine Print

- Soft pull

- This offer is only available to new Tally customers. To be a Tally customer, you must pass a soft credit check, have a FICO Score of 660 or higher and qualify for and accept a line of credit with Tally. (Note: Soft credit check will NOT impact customer’s credit score. Scroll down to see what Tally charges.)

- To utilize the offer, customer must register at least one credit credit card with Tally and have a minimum interest-bearing balance of $1,000 across all credit cards. As long as customer’s Tally account is current, Tally will pay $50 toward customer’s debt within 60 business days of activation.

- Promotional value expires 180 days after purchase. Amount paid never expires. Valid only for residents in the following states: AR, CA, CO, CT, DC, FL, GA, IA, ID, IL, LA, MA, MD, MI, MN, MO, NJ, NM, NY, OH, OK, OR, PA, SC, SD, TX, UT, WA, and WI.

- Allow up to 60 business days from time of activation for application of voucher.

Our Verdict

Tally charges an interest rate of 7.9% – 19.9%, that’s pretty in line with what most credit card issuers charge so I’m not sure how it’s actually cheaper. In terms of this offer itself it seems like you need an interest bearing balance of at least $1,000, so I assume balances that are under the grace period you’re not paying interest on won’t qualify. Because of that I don’t think this offer is worth considering, getting in the habit of not paying your balances in full is not a habit you want to get into and personally I don’t think it’s worth the hassle or bad habit for $50 in savings.

Hat tip to readers Bob S & JJ