Deal has ended, view more bank account bonuses by clicking here.

Update 10/3/25: Deal is back until 11/30/25 and found under special deals & offers.

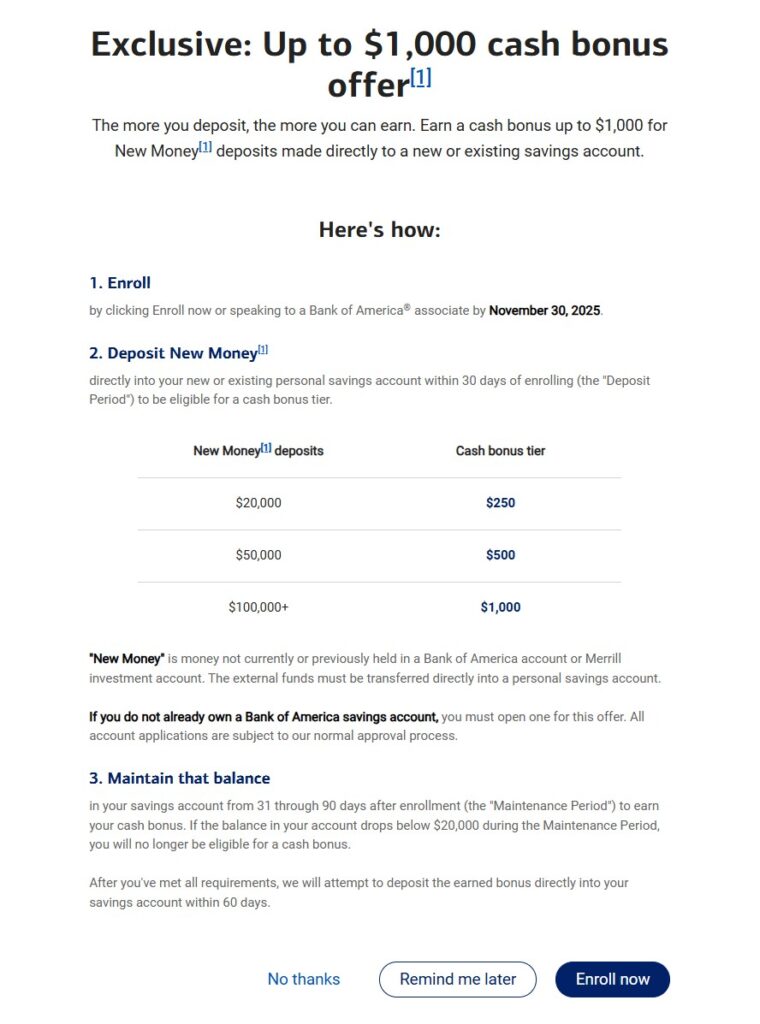

Update 3/20/25: New variation: $250 bonus for $20,000 deposit, $500 for $50,000 deposit, and $1,000 for $100,000 deposit. Hat tip to RM

Offer at a glance

- Maximum bonus amount: $750

- Availability: Nationwide

- APY: 0.01%

- Deposit required: $20,000 – $100,000

- Hard/soft pull: Soft

- ChexSystems: Unknown

- Credit card funding: None, but can fund with a debit card up to $300

- Monthly fees: None

- Early account termination fee: None

- Household limit: None listed

- Expiration date: September 30, 2024

Contents

The Offer

- Bank of America is offering a savings bonus of up to $750.

- Open a Bank of America Savings account if you don’t have one already

- Enroll in this bonus

- Within 30 days of enrollment deposit new money

- Deposit $20,000, $250 bonus tier

- Deposit $50,000, $500 bonus tier

- Deposit $100,000, $750 bonus tier

- Maintain that balance in your savings account from 31 through 90 days after enrollment

The Fine Print

- Offer is limited to individuals who receive the offer via a direct communication from Bank of America.

- Fiduciary accounts (e.g., trusts), business accounts, Certificates of Deposit (CDs), and Individual Retirement Accounts (IRAs) are not eligible for this offer.

- Offer cannot be combined with any other savings bonus offer and is limited to one bonus per account and per customer.

- Offer expires on September 15, 2024.

- Bank of America may change or discontinue this offer at any time before this date without notice.

- Enroll in this offer through a Bank of America associate or by clicking the enrollment button or link in a direct communication from Bank of America by September 15, 2024.

- Deposit New Money directly into your new or existing personal savings account within thirty (30) days of enrolling (the “Deposit Period”)

- All bank account bonuses are treated as income/interest and as such you have to pay taxes on them

Avoiding Fees

Monthly Fees

This account has no monthly fees to worry about.

Early Account Termination Fee

There is no early account termination fee.

Our Verdict

This account earns 0.01% APY. At minimum you’ll need to maintain the balance on this account for about 61 days (deposit on last day of the 30 day period and then hold until 90th day) but I think it’s safer to assume a 90 day hold period when all is said and done. The $250 bonus is the best return and that works out to be an annualized return of 5%, as the bonuses increased that progressively gets worse (4% and then 3%). Given the current high interest rates available this isn’t worth considering and we won’t be adding this to our best savings bonuses.

Useful posts regarding bank bonuses:

- A Beginners Guide To Bank Account Bonuses

- Bank Account Quick Reference Table (Spreadsheet) (very useful for sorting bonuses by different parameters)

- PSA: Don’t Call The Bank

- Introduction To ChexSystems

- Banks & Credit Unions That Are ChexSystems Inquiry Sensitive

- What Banks & Credit Unions Do/Don’t Pull ChexSystems?

- How To Use Our Direct Deposit Page For Bank Bonuses Page

- Common Bank Bonus Misconceptions + Why You Should Give Them A Go

- How Many Bank Accounts Can I Safely Open Within A Year For Bank Bonus Purposes?

- Affiliate Links & Bank Bonuses – We Won’t Be Using Them

- Complete List Of Ways To Close Bank Accounts At Each Bank

- Banks That Allow/Don’t Allow Out Of State Checking Applications

- Bank Bonus Posting Times