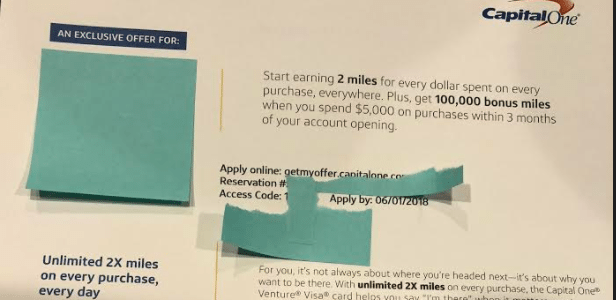

Update: Some people got even bigger offers for up to 100,000 points.

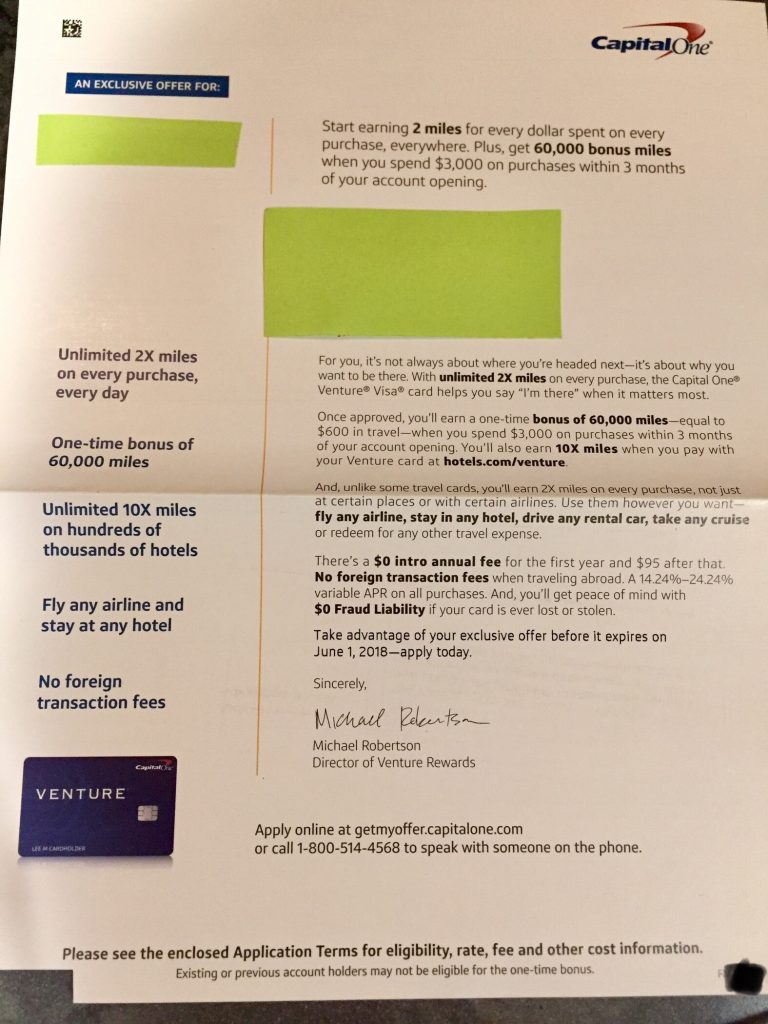

The Offer

No direct link, sent out via snail mail

- Capital One has sent out a targeted offer for 60,000 points after $3,000 in spend within the first three months from card opening on the Capital One Venture card.

Card Details

- $95 annual fee; fee is waived the first year

- Card earns 2x points everywhere (the equivalent of 2% everywhere)

- No foreign transaction fees

- Visa Signature benefits

Our Verdict

The standard bonus on this card is 40,000 miles. There is currently a public offer of 50,000 miles. Points are worth 1¢ each when redeeming to offset travel costs or in gift card redemption (e.g. Amazon). The downside to this bonus is the card is issued by Capital One and they do a hard pull on all three credit bureaus. Keep in mind, you can freeze your Experian or Transunion and limit the pulls to just two, plus a lot of us don’t care about hard pulls much anymore.

Hat tip to reader Ryan

I got 60K offer, but misplaced it. Is there anyway I can get that offer? I do not even remember it is 4K or 3K spend.

You can try calling in

Thanks William 1

4 months after this post and just got a 60k in the mail

I was going to apply for the Public 50k offer. But reading this post, it looks like I should hold on. Ideas on how to increases chances of getting targeted for 60k or 100k offers? I have been getting their mailers for $150 equivalent bonus cards. Have no existing relationship with Capital One.

Received a pathetic 20,000 Miles on $1,000 spend mailer.

My wife just got the offer for 75k miles w/ $5k spend. The only thing we have with CapOne is my Venture card that I opened in October and an old Sony card I’ve had for years. She is not an AU on either. She is 0/24 (probably 0/60+) because she has no interest in this game. I couldn’t even get her to take the 100k MR Amex Plat offer she had before they raised the AF. She doesn’t work outside the home so she has no direct income. I have often wondered if she would even be approved for these offers by just listing household income and occupation as something like domestic engineer. Her only credit cards are a department store card and AU on my Freedom, Everyday and Discover cards (all over 10 years old).

FWIW, my wife is a stay-at-home mom, and we just got her the Venture card. It took a lot of phone calls to the reconsideration line as well as additional information (basically proving that she has full access to my income and we have a shared bank account), … but eventually she got approved.

My gf is the same way. Can’t get her to apply for anything. So I feel your pain on this. Envious of those in 2-player mode.

My wife got a 100,000 with 5K spend today. We have no banking relationshipwith them. I need to do 2 Chase cards to get her back to 5/24 and then I’ll do this Cap One!

Highly disappointing: got the prescreened 75k offer in mail, have a 815+ score but still got declined … this is really bad since they did do 3 agency pull just for declining the application.

Stay Away.

Reason given by the bank in letter:

1. no checking or savings account at the bank

2. you pay off your balance in credit cards too early and maintain low average balance …

this is disappointing.

Wow those reasons seem stupid. Will think again about applying for this card

‘We will give you a card, but only if you maintain big balances and pay us juicy interest’

I was just approved for this card last month for the 50k point bonus. Is it possible for them to match the bonus?

Chatted with Cap One to see if they can find an offer for me. No dice. I’ve had a Quicksilver with them for a while and find zero use for it. Oh well. $1,000 would be sweet though.

100k offers!? My wife has been getting the 50k offers (before it was public) and just received the 60k offer. Zero relationship with Cap1. I was going to jump on it but now I wonder if we should hold out.