Deal has expired and is no longer being offered. View more Citi deals by clicking here.

The Offer

No direct link to offer

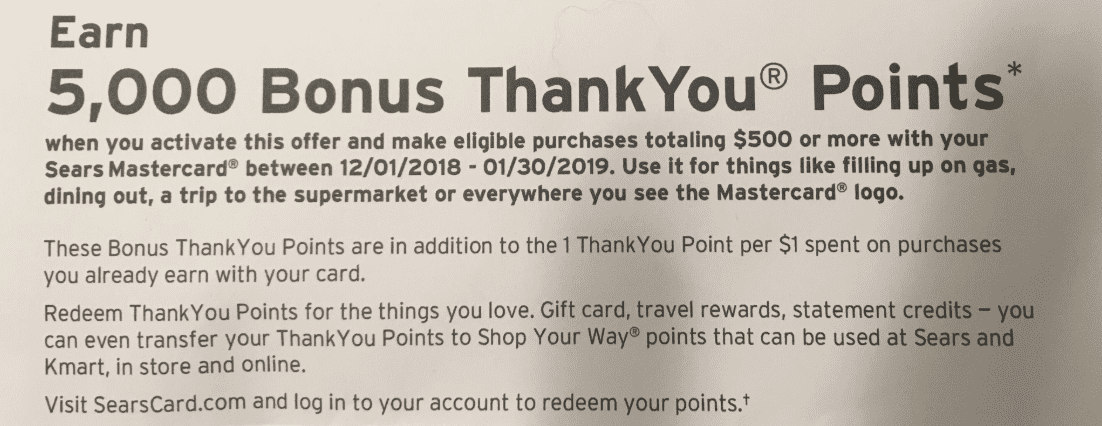

- Citi has sent out some lucrative spending offers to Citi Sears cardholders. Here are some of the offers seen:

- Activate this offer and spend $500 or more with your Sears Mastercard between 12/01 and 01/30

The Fine Print

- Valid from 12/01/2018 until 01/30/2019

- Must activate promotion by end of the promotion period

Our Verdict

These targeted spending offers are the reason this is #1 on our list of store cards. Feel free to share any other variations of this offer you received in the comments. If you don’t have the card currently you can sign up, but the only version available is one that earns SYWR. You can then product change that version to one that earns Citi TYP or cash back (TYP is best as it gets the most offers from what I’ve seen). If you don’t regularly get offers on this card then try putting some spend on it, that seems to trigger offers and usually after receiving your first offer you’ll want to put a lot of spend on the card and that will keep triggering new offers every month/quarter.

Hat tip to reader Luis

Another offer went out. My last 4 offers have each been more lucrative than the one before. I am theorizing that the more you spend, the more they offer. Latest offer is 3 months, 10x, 25K max each month on restaurants, gas, and grocery.

got the same offer. But I wonder if they are going to honor this one at all…in theory they have 2 billing cycles after the promo end date to pay us, which is going to be end of March in this case.

is this offer stackable with previous ones? (i.e. 10x point on restaurants, $50 statement credit on purchase of $600 or more)

Should be if they run over the same time period

Great, thank you William! I will report my datapoint afterwards, too.

Interesting to see this card still going strong even as Sears circles the drain. Do we know (or have any good guesses) what will happen to it once Sears is truly gone?

It’s on my to-apply list for Jan/Feb next year (waiting due to Citi 24-month clock issues), but I’m now waiting to see what happens.

Is it possible to PC from a different Citi card?

When I talked to an agent few months back, it was only SWYR > TYP. He didn’t think other cards can be converted to this, again it was just one front line agent. So I don’t know how accurate he was

In my opinion, this card would not be subject to the 24 month rule. You can’t sign up for the TYP version anyway (you’d have to PC), even if you did, there’s no sign up bonus, right? So I’m not sure what your concerns are regarding 24 months rule. That rule only applies to sign up bonusses. Like DoC mentioned, the true value of this card is ongoing (targeted) spending bonuses.

I am looking for a DP to see how long do people have to wait to PC to TYP version from the regular SYWR version? Hope it’s not like 12 months or so.

I was sent an offer to sign up for a $40 statement credit with $50 for the MSR. They have only had SUB a few times, and they are weak in comparison to others. But the value seems to be from ongoing holding (and using) this.

citi emails such offer or in letters

This has got nothing to do with Sears stores correct. I have $120 in Sears GCs. Don’t want to linger around long to use them. But can’t find useful to buy there…

Correct. It is the Sears co-branded cc issues by Citi. If you haven’t already, product-change from the SYWR-earning card to the TYP-earning one.

Anyone know if utilizing a 0% APR offer on this card interferes with the spend bonuses?