The Offer

No direct link, shows up when logged in

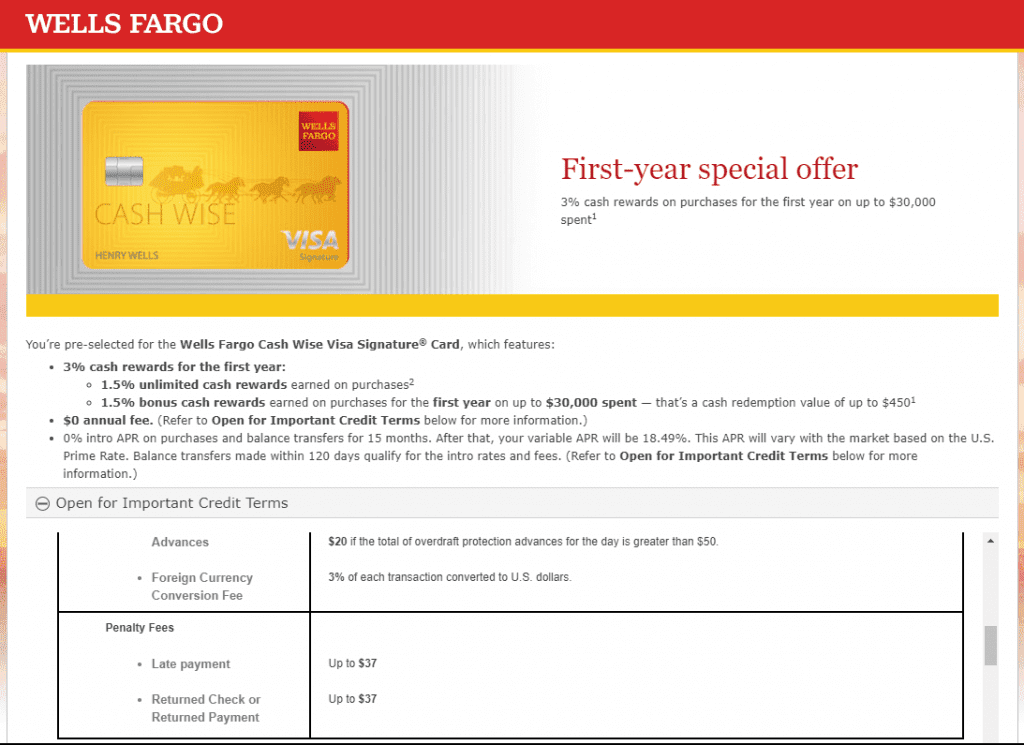

- Wells Fargo is offering some customers 3% cash back in their first year, up to $30,000 in spend

The Fine Print

- Card earns 1.5% cash back on all purchases with no limit

- No annual fee

- 0% Introductory APR for purchases and balance transfers for first 15 months

- Cash back can be redeemed in increments of $25 ($20 for ATM withdrawals)

- Cell Phone Protection insurance, up to $600 with a $25 deductible

Our Verdict

If you spend $30,000 you’d earn a total of $900, on a 2% card you’d earn $600 so basically an extra $300 but obviously huge spend requirement. We’ve seen a similar/the same offer on the Chase Freedom Unlimited before as well.

Hat tip to reader Nick S

Are these “Go Far” rewards? In other words, can they be transferred to the Visa Signature card for 1.5 cpp flight redemptions?

I’m sure most readers already know, but I would note for comparison that the public offer for this is $150 for $500 spend in 3 months – so if you’re not putting more than $5K on this (granted, over 12 months instead of 3), you’re better off with the public offer.

Interesting, but 30k is a lot of spend for $300 gain over the 2% back you get on something like the double cash (which can be more than 2% with the new Thank You points option).

If you are a churner that’s a huge opportunity cost in other sign up bonuses.

I would suggest getting the WF Visa Signature instead of the Cash Wise to get the 1.5x multiplier on flights booked through WF. This can be paired with the Propel Card.

I spaced my signups out by 15 months to get the SUB on both (unintentionally since the propel was a different product a few years ago when I got the signature.) Since I fly a good amount, I count this as an almost cash like 4.5% back on travel/dining.

Don’t forget about the Business Platinum Visa too. I believe that one gets 1.6% when used towards flights (25,000 points for a $400 domestic roundtrip). Personal points can be transferred.

i received this offer. not sure if worth the sign up. what is the best way to MS this offer if i go for it? thanks

The offer I accepted even has an added incentive:

“For transactions made using a qualified mobile wallet during the first 12 months (for example, Apple Pay® or Google Pay™), you will earn an additional 1.8% bonus cash rewards on net purchases for a total of 3.6% cash rewards.”

Where is this?

I only saw that after I opened the account. It was part of the “Disclosures Modal” right next to “Bonus Details” which was in the “Go Far Rewards” liink. Here is the full quote:

During the first 12 months from the date the account is opened, you will earn an additional 1.5% bonus cash rewards above the base earn of 1.5% on net purchases (purchases minus returns/credits) for a total of 3.0% cash rewards. For transactions made using a qualified mobile wallet during the first 12 months (for example, Apple Pay® or Google Pay™), you will earn an additional 1.8% bonus cash rewards on net purchases for a total of 3.6% cash rewards. To review the mobile wallets that qualify for the mobile wallet bonus, go to wellsfargo.com/cashwisemobilewallet. The bonus cash rewards will be earned only on up to $30,000 spent in the first 12 months. If the bonus is earned, it will show as redeemable within 1- 2 billing periods following the end of the 3rd, 6th, 9th, and 12th months after the date the account is opened. Your Wells Fargo Credit Card account must be open, not delinquent, and not in default at the time of fulfillment. Refer to the Go Far® Rewards Program Terms and Conditions and Addendum for the Wells Fargo Cash Wise Visa® Card for further information about which purchases/transactions do not earn cash rewards.

Is there a way to “view offers” in Wells Fargo’s account page?

the real question is can you use google pay at simon?

Samsung pay works