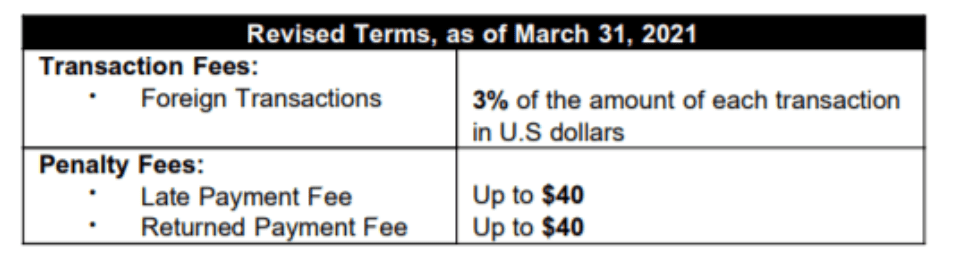

A reader recently noticed that beginning March 31, TD Bank has added a 3% foreign transaction fee to their credit cards, even those that previously did not have any foreign transaction fee. Last year they made a similar change by adding a 3% foreign transaction fee to their debit cards.

Hat tip to reader Alex